Resources Top 5: Gold and silver discovery adds to gallium potential for G50 at Golconda

G50 has had a Eureka moment at the Golconda project in Arizona with a gold and silver discovery. Pic: Getty Images

- Gold and silver stand to boost Golconda project

- High-grade copper concentrates with strong recoveries produced at Prospect’s Mumbezhi project

- IXR lauds government support in Brazil

Your standout small cap resources stocks for Thursday, July 17, 2025.

G50 Corp (ASX:G50)

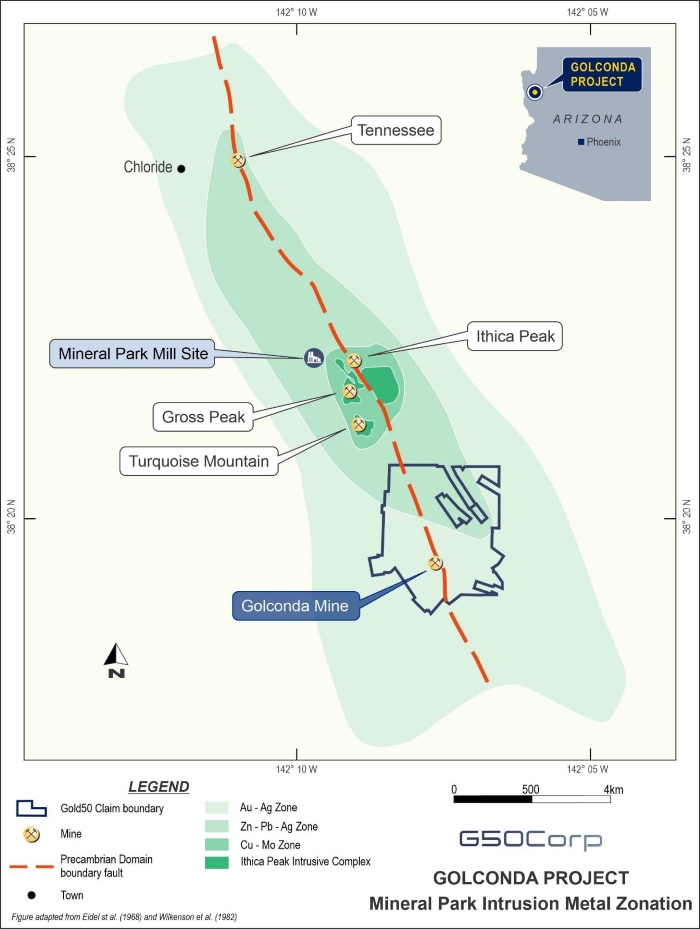

A Eureka moment has provided G50 Corp (ASX:G50) with a potential major gold and silver boost to its Golconda project in Arizona adding to the gallium recently identified.

High-grade results from a second RC drilling program has confirmed a new and significant gold-silver discovery and has seen shares jump 42.2% to a three-year high of 27c.

Golconda was the site of the state’s largest zinc-lead mine more than 100 years ago but is now back in the spotlight due to its potential gold, silver and gallium riches.

A high-grade gallium halo identified by G50 at the flagship asset has brought the project into focus since China initiated export controls on the critical mineral back in 2023 and led to discussions over the strategic nature of the asset with the US Government.

And now returns of up to 47.2m at 2.00 g/t Au, 40.2g/t Ag and 0.29% zinc from 191m to the end of hole in the first ever drill program to target the central portion of the Tub Zone below the depth of oxidation increase G50’s optimism.

The intersection also included 16.8m at 5.19g/t Au, 100.2g/t Ag and 0.57% Zn from 198m while other results were 77.7m at 0.76g/t Au and 11g/t Ag from 184m to EOH, and 97.5m at 0.27g/t Au, 4.8g/t Ag and 0.7% Zn from 149.4m at the base of historic mine workings to EOH.

Twenty-six RC holes were completed and assays have been returned for 14 holes, four of which ended in mineralisation.

Results confirm the Tub Zone is a laterally and vertically continuous, wide, well defined mineralised discovery that remains open along strike and at depth.

Phase 2 RC drilling also tested the high-priority gallium halo with all holes returning consistent shallow intercepts including 216m at 18.4g/t Ga from 4.6m, 209m at 17.7g/t from 4.6m and 204m at 21.7g/t from surface.

Every RC hole hit consistent widths and grade of gallium underpinning management’s view that the halo could be a valuable source of the strategic minerals for domestic supply.

“Today’s results confirm we have a new and significant gold-silver discovery at Golconda in Arizona,” G50 Corp’s managing director Mark Wallace said.

Prospect Resources (ASX:PSC)

Positive results continue to emanate from Prospect Resources (ASX:PSC) at Mumbezhi in Zambia with metallurgical testwork showing that the copper project has a conventional processing profile that can be treated using low-cost methods.

High-grade copper concentrates with strong recoveries have been produced from several tested mineralised zones, exceeding industry standards.

The company is also buoyed by gold indicators and a gold assessment will extend licence-wide as part of phase 2 exploration work with potential for a high-value byproduct at a time of near-record gold prices.

Progress from Zambia has resulted in shares hitting a 12-month high of 20c, an increase of 8.11% on the previous close.

Testwork on transition samples from Nyungu Central deposit and fresh samples from Kabikupa deposit provides indications that Mumbezhi can deliver strong economic returns.

Fresh composite from Kabikupa achieved a copper concentrate of 27.5% Cu and 310ppm cobalt at 95.3% Cu recovery after one cleaning stage, while fresh composite from Nyungu Central delivered a copper concentrate of 24.6% Cu and 0.9% Co at 96.2% Cu recovery after single cleaning.

Nyungu Central transition composite also returned strong results with a copper concentrate of 32.1% Cu and 9.1% Co at 81.4% Cu recovery after two cleaning stages.

The standard flotation process worked effectively for Nyungu Central and Kabikupa, supporting the use of one simple centralised processing plant.

“These results show that Mumbezhi mineralisation has a conventional processing profile, with copper ores that can be treated using simple, low-cost processing methods as implemented at both Lumwana and Sentinel mines,” managing director and CEO Sam Hosack said.

“The potential for gold at Nyungu Central also adds value, and a broader gold assessment across the licence is underway.

“Recent Nyungu Central testwork, covering fresh and transition materials, has delivered much better results than those achieved by the previous operator, Argonaut,” he added.

The test results come on the heels of additional exploration success at Nyungu Central including phase 2 drilling which returned 49m at 0.52% copper from 314m as well as 12.3m at 0.79% from 331m.

Mumbezhi, which is in northwest Zambia in proximity to several major mines in similar geological settings, hosts an indicated and inferred resource of 107.2Mt at 0.5% Cu for 514,600t of copper.

Ionic Rare Earths (ASX:IXR)

Significant support from government at various levels is being received by Ionic Rare Earths to establish a Brazilian rare earths supply chain and this is welcomed by investors with shares hitting a 12-month high of 2.1c, a 16.67% improvement on the July 16 close.

The latest show of support for Viridion Rare Earth Technologies, the 50/50 Brazilian JV of IonicRE and Viridis Mining and Minerals (ASX:VMM), comes in the grant of 2,071m2 of land by the Municipality of Poços de Caldas, Minas Gerais.

This land in an industrial district will be used to construct the Centre for Rare Earth Refining, Recycling and Innovation.

Viridion is seeking funding from Brazilian federal authorities to support the centre’s establishment and technical team, with definition of the funding package expected in coming weeks.

“We are extremely appreciative to the Municipality of Poços de Caldas, the state of Minas Gerais, Brazilian federal authorities and all local stakeholders for their magnificent support as we build South America’s first rare earth refining, recycling and innovation centre in Minas Gerais,” IonicRE MD Tim Harrison said.

Resolution Minerals (ASX:RML)

Initial phase 1 drilling is expected to begin in August at the Golden Gate target area of Resolution Minerals’ Horse Heaven gold, antimony and tungsten asset in Idaho’s historic Stibnite mining district.

This follows approval being granted by the US Forest Service with the upcoming program to include up to 20 drill holes for around 20,000 feet.

It is part of RML’s Plan of Operations that comprises 57 holes from 19 drill sites along an existing road network in Valley County.

Several past drilling programs targeted shallow oxide gold, returning 36.6m at 1.51g/t gold and 71.6m at 1.37g/t but overlooked antimony and tungsten.

RML plans to confirm the presence of a gold resource, expand known mineralisation and potentially identify the presence of tungsten and antimony.

Shares hit a new two-year high of 6.6c, a lift of 20% on the previous close.

Green Critical Minerals (ASX:GCM)

With first revenue in sight for its Very High Density (VHD) graphite tech for thermal management across a range of sectors, Green Critical Minerals increased 17.9% to 3.3c, a new high of almost five years, and volume of more than 98m.

The VHD tech has applications from global electronics, semiconductor and microchip manufacturers, to data centre operators and thermal solution providers.

It can be used in any industry where thermal management is vital, with sample testing being expanded to customers in aerospace, automotive, electronics, medical and industrial sectors through machining and distribution partners in North America and Europe.

GCM is advancing commercialisation of the tech and its product distribution strategy, with new sales channels in development, including online retailers and machine shop networks, along with existing collaboration deals such as with Australia’s leading data centre provider GreenSquareDC2.

Discussions are ongoing with data centre operators in North America, Europe and Asia, focused on the evaluation and integration of VHD graphite into advanced computing infrastructure.

At Stockhead, we tell it like it is. While Prospect Resources and Green Critical Minerals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent financial advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.