Resources Top 5: Gains coming hot and fast for niobium and antimony juniors

Investors appear to be calling for hot WA-based ASX stocks today. Pic: Getty Images

- Caprice snaps up Rio tenure in West Arunta

- Miramar soars off new Chain Pool acquisition

- Surefire lands port deal on back of EPC contract for Victory Bore

Here are the biggest small cap resources winners in morning trade, Tuesday, August 27. Prices accurate at time of writing.

Caprice Resources (ASX:CRS)

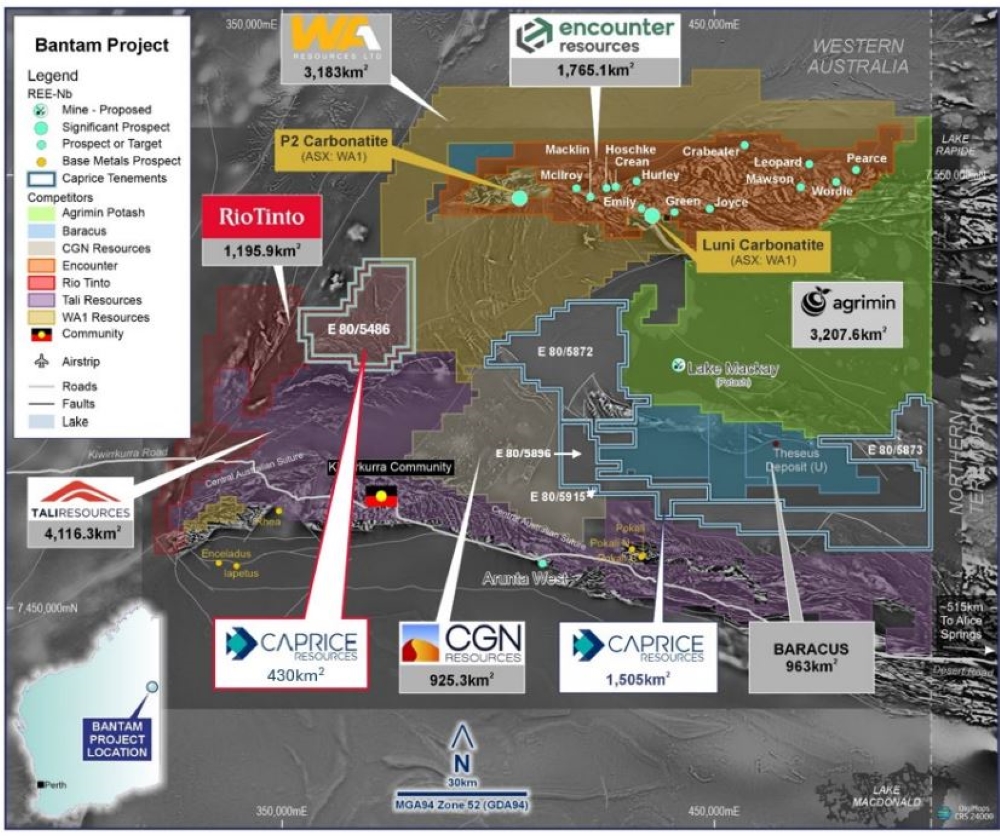

The niobium heater is real as CRS has entered into a binding agreement to acquire an additional 430km2 of strategic exploration tenure in WA’s West Arunta region from Rio Tinto’s (ASX:RIO) exploration arm – right next to its Bantam project.

The large landholding acquisition now makes Caprice the third largest ASX-listed explorer in the highly prospective West Arunta.

The burgeoning mining district, in northeast WA, has ignited exploration for the critical mineral around the world after WA1 Resources’ (ASX:WA1) Luni deposit discovery last year – especially for ASX ressies in Brazil, where 90% of current production takes place, largely through privately-owned CBMM.

Demand for diversification away from that main supply route means that exploration is still focused in West Arunta, which has been pegged to become the world’s second production hub of the metal.

CRS’ newly acquired ground is interpreted as a fertile host for mineralised carbonatites – as discovered by WA1 and Encounter Resources (ASX:ENR), on ground immediately northeast of the tenements.

A desktop review completed by consultants indicates IOCG prospectivity, along with multiple targets demonstrating similarities to the mineralised carbonatites at WA1’s and ENR’s respective projects.

“This acquisition secures Caprice a commanding land position, the third largest ASX-listed exposure, in this highly fertile and very underexplored region which is being proven to host world-class discoveries,” CRS CEO Luke Cox said.

The explorer noted that the area has relied heavily on targeting geophysical features derived from a combination of magnetic and gravity surveys and aims to follow a similar path utilising magnetics and gravity to refine high-priority targets for upcoming ground truthing and drill testing.

Shares in the junior have shot up 15.4% on the news and are up 50% in a week, trading at 3c.

TechGen Metals (ASX:TG1)

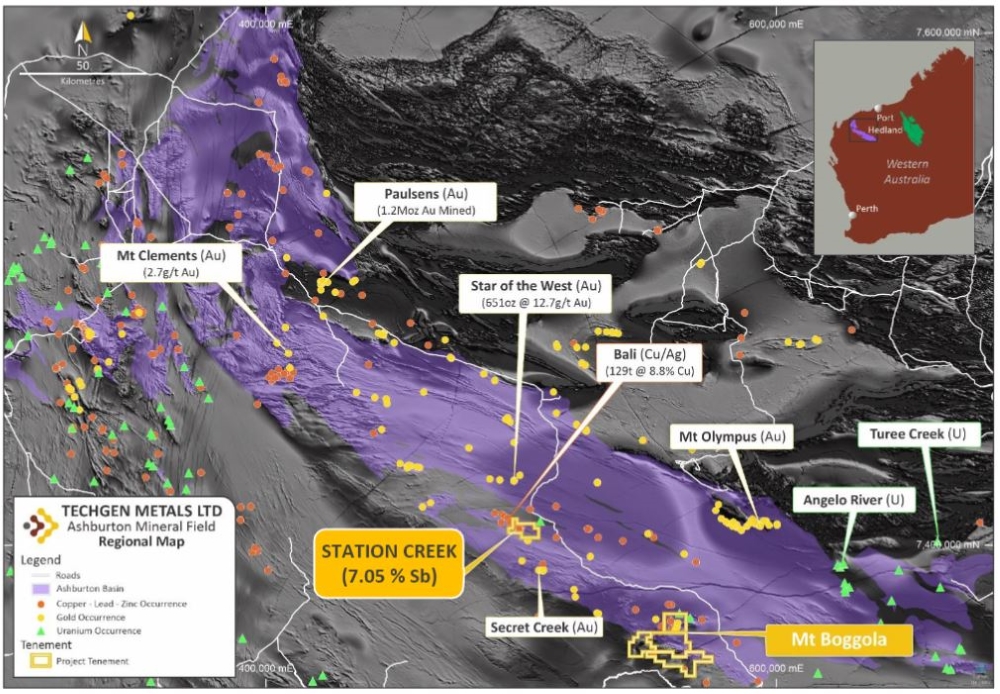

TG1 has zoomed up the charts today with high grades of up to 7.05% antimony (Sb) hits at its Station Creek project in WA’s Pilbara.

The company went to ground sampling rock chips on the back of 1980s data that the project area was perhaps prospective for antimony, yet was only explored for uranium base metals and gold in the past.

On review of the antimony anomalism found within Station Creek, TG1 is planning further work to assess the project’s potential.

Shares in the 5m explorer have punched up almost 26% to swap for 3.9c.

Miramar Resources (ASX:M2R)

M2R has now been granted an exploration licence over the highly prospective Joy Helen copper-silver-lead prospect, part of its Chain Pool project in WA’s Gascoyne region.

That means it can get out the drill bit after collecting rock chip samples during maiden reconnaissance that showed up to 5.49% copper, 42% lead and 73.48g/t silver.

M2R exec chair Allan Kelly noted that Chain Pool is also prospective for multiple other styles of mineralisation alongside the copper, lead and silver seen at Joy Helen.

“The western half of the project is dominated by a Durlacher Supersuite granite, which is the same unit that hosts the Yangibana and YIN REE deposits, and there are several later dolerite dykes cross-cutting the project, which are the same unit that hosts the Mangaroon Ni-Cu-PGE prospect further south,” Kelly said.

M2R is also focused on an ongoing maiden drill program at the Mount Vernon and Trouble Bore projects, part of the overarching Bangemal nickel-copper-cobalt-PGE portfolio nearby, as well as its Gidji JV north of Kalgoorlie.

The junior is up 44% on the news and 84% in the last month, swapping files for 1.3c a share.

Surefire Resources (ASX:SRN)

SRN has made a surefire agreement with the Mid West Ports Authority (MWPA) towards a solution for export of its vanadium-titanium-magnetite concentrate from Victory Bore through the Port of Geraldton.

The Joint Cooperation Agreement (JCA) aims to secure contractual arrangements for the provision of facilities by MWPA for export by Surefire, of ~1.25mtpa of product Under the JCA, with SRN and MWPA to negotiate port access, capacity reservations and ship loading, as well as port services and product export contracts.

The move comes on the back of an EPC deal with DRA Global (ASX:DRA) to progress the project into production.

Concentrate is expected to be shipped to Saudi Arabia for processing into high-value products such as vanadium pentoxide, ferro-vanadium, pig iron, iron oxide, and titanium slag.

Shares in the now $14m market-capped junior are up 40%, trading at 7c.

Queensland Pacific Metals (ASX:QPM)

QPM has agreed commercial terms with the Townsville Power Station (TPS) and North QLD Gas Pipeline – deals the company considers a transformational de-risking of its vertically integrated energy supply chain.

The pact lays out the potential for new contracts covering dispatch rights of the total capacity of TPS’ 160-megawatt gas turbine generation unit and NQGP’s gas storage and transport services.

The company reckons it will result in a significant reduction in fixed operating charges, ensuring its ability to accelerate ambitions of increased gas production.

Gas shortfalls were already expected to hit Australia’s east coast by 2027 and get worse through 2028 as southern gas production declines.

The forecasts had already led QPM to further commit to accelerating development of Moranbah to help meet demands of an eastern energy market

While an impact of the contracts won’t be reflected until FY2026, the terms would have benefited QPM’s 2024 operating costs by >$30m.

“This achievement caps 12 months of hard work by the team and is a key milestone marking the successful reinvigoration of the operational and commercial foundations of the business,” QPM CEO David Wrench said.

Shares in the $93m market-capped QPM are up 23.3% on the news to trade at 3.7c.

At Stockhead we tell it like it is. While Miramar Resources and Queensland Pacific Metals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.