Resources Top 5: Forget farm to table, this tungsten dealer wants to go mine to market

Investors are dining out on these small cap ressie stocks today. Pic: Getty Images

- EQ Resources to become mine to market ferrotungsten producer via $13.5 million Vietnam plant deal

- VRX Silica progresses environmental approval at Arrowsmith North

- Silex Systems the biggest beneficiary of Russian enriched uranium protest

Your standout small cap resources stocks for Monday, November 18.

EQ RESOURCES (ASX:EQR)

After a couple stabs navigating a weak IPO market, Tungsten Metals Group has found its way to the ASX in the form of a merger with EQ Resources, owner of tungsten mines in Queensland and Spain.

This excites us because we have written about the process previously last year.

TMG and its partner George Chen own a 4000tpa ferrotungsten plant in Vinh Bao in Vietnam’s Haiphong Province, one of the largest facilities of its kind outside China.

Built in 2011, the plant is almost a form of modern-day alchemy given the extraordinary temperature at which tungsten – used among other things for plating bullets and missiles, radiation shielding and in light bulb filament – melts.

It’s so high tungsten itself is used to line the kiln and experienced process technicians need to assess the heat of the furnace by eye.

That IP is, apparently, worth $13.5 million to EQ, which will issue 170 million fully paid shares and $2.5m in cash plus take on liabilities for the 60% and 40% stakes in the ferrotungsten plant held by TMG and Chen respectively.

“EQR is pleased to announce the execution of a Heads of Agreement for the 100% acquisition of the TMG Group. This Transaction aligns with EQR’s strategic initiatives to be the preeminent western tungsten producer,” EQR CEO Kevin MacNeill said.

“Upon completion of the transaction, EQR will have achieved a strategic diversification of products, customers and geography, and be proud 100% owner and operator of critical western tungsten operations on three continents.

“Additionally, EQR will have achieved vertical integration of our upstream operations, leveraging our substantial resource base and existing production output, throughout the tungsten supply chain.”

TMG exec chair Tony Adcock said the scheme of arrangement represented a “compelling investment case”.

“The TMG Board believes there are significant synergies that can be realised following this potential transaction, with the enlarged EQR positioned very well to benefit from the tailwinds in the tungsten and ferrotungsten markets globally,” he said.

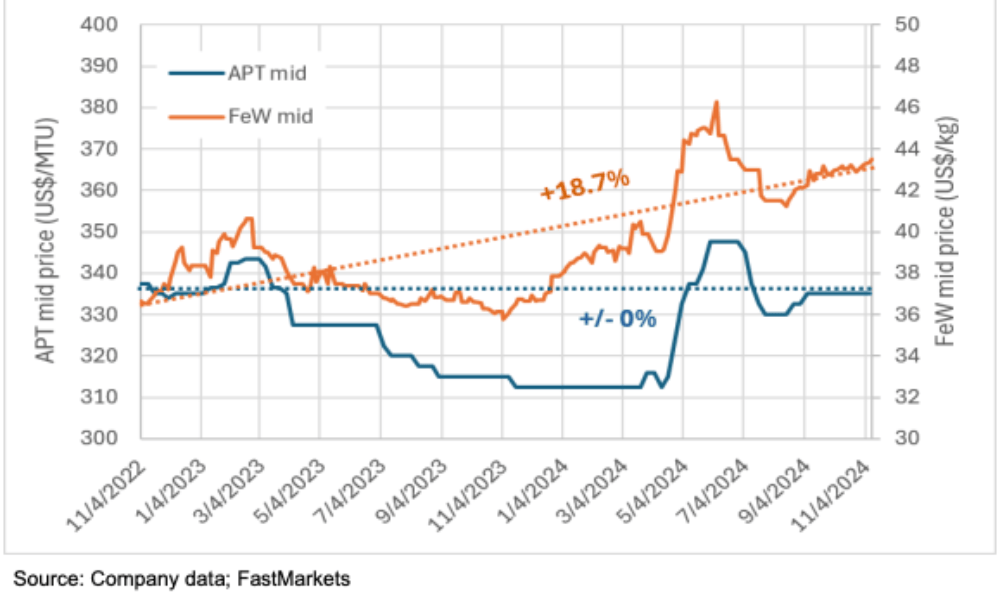

According to EQR, tungsten is among the metals that will not be able to be sourced from outside China for US arms post-2026. The Vinh Bao plant represents over 80% of the installed ferrotungsten capacity outside China and Russia, with prices up 18.7% since 2022 at the same time as concentrate prices have flatlined.

VRX SILICA (ASX:VRX)

It hasn’t been the happiest few years for shareholders in VRX Silica, who have seen their shares tumble from a pandemic era high of 38c in 2021 to 5.2c today.

The company has been in the weeds working through the approvals for a silica sands mine north of Perth in WA’s Mid West.

But some news today will give those shareholders hope a pathway to development is emerging.

The $32 million minnow has had its response to public submissions on Arrowsmith North accepted and published on the WA EPA website.

It’s a major step for the firm’s public environmental review, with the company to attend the EPA’s next board meeting on Thursday, where it will be discussed.

A recommendation on approving the project to the minister for environment is likely to take around 12 weeks based on statutory timelines, VRX said.

“The Response to Submissions is a vital component of the EPA assessment process and now, having been accepted and published, is a confirmation that the EPA will be completing its assessment of the Arrowsmith North Silica Sand Project,” VRX MD Bruce Maluish said.

“This work is the culmination of an extensive series of studies that have been undertaken for the Project, and these are included in the RtS and the Environmental Review Document that has previously been published on the EPA website.

“Acceptance of the RtS is a significant milestone in what has been a lengthy approvals process for Arrowsmith North. We are pleased that this process is now entering its final stages. We thank shareholders for their continued patience as we work through this.”

Located around 270km north of Perth on WA’s coast, Arrowsmith North contains a proved and probable reserve of 221Mt at 99.6% SiO2, with a potential mine life of more than a century.

A BFS earlier this year suggested it would cost $66.8 million to build at a scale of 2Mtpa, generating $650m in cash flow after finance and tax over an initial 25-year life.

That study suggested it would take 4.4 years for the initial capex to be repaid, after tax, with a post tax NPV10 of $166.7m and IRR of 35%. Silica sand use has been increased worldwide due to clean tech, with the flat glass market growing to service solar PV and e-glass installations.

Less than 1% of the output from the global sand mining industry has the correct properties to go into these high end industries.

SIERRA NEVADA GOLD (ASX:SNX)

(Up on no news)

Dubbed the cheapest silver explorer on the ASX by our very own profiler extraordinaire Kristie Batten.

That’s handy, because it means we already have the latest on the Nevada silver and gold explorer here:

READ: Kristie Batten: The cheapest silver explorer on the ASX

Its Blackhawk project has gone unheralded since old-timers mined the eyes out of it in the 1920s.

As is often the case, the now ~$8.5m mine hunter is betting on the adage that the best place to find a new gold (or in this case silver) mine is under an old one.

A 1500m drill program targeting the most prospective areas of the Endowment Mine at Blackhawk, where hits of 1270g/t silver have been seen in the past.

A weak US economy and technical limits on processing sulphide ore, both factors that have been overcome, saw the mine which delivered 70,000oz gold equivalent from ~1860 halted in its last phase of production in the 1920s.

SILEX SYSTEMS (ASX:SLX)

A little dispatch from the larger end of town and uranium stocks are moving sharply upwards today after a statement on Friday from Russia’s Government over Telegram that it would restrict enriched uranium exports to customers in the United States.

That comes ahead of a now legislated post-2028 ban supported by both normally highly adversarial sides of US politics in response to Putin’s invasion of Ukraine. Having outsourced much of its commodity needs for decades, onshoring became a serious imperative under the outgoing Democrat Joe Biden, whose signature industrial policies like the Inflation Reduction Act largely focused on subsidising local supplies of critical materials.

A number of large caps, including Boss Energy (ASX:BOE) and Deep Yellow (ASX:DYL) moved higher on the ASX on Monday. But Silex Systems was, without doubt, the prime ASX beneficiary of the trade spat.

Silex boasts a JV to deliver US enriched uranium called Global Laser Enrichment in cahoots with the West’s biggest uranium producer Cameco.

It made a submission earlier this year to a request for proposal from the US Department of Energy, which has US$2.7 billion to throw around to incentivise domestic uranium enrichers.

Russia produces just 14% of the world’s uranium and converts 22% but has an outsized 44% of its enrichment capacity. That makes countries like the US uncomfortably reliant on a nation with which is has become increasingly unfriendly.

Silex owns 51% of GLE, but big bro Cameco has the right to acquire an additional 26% and take the majority 75% share in the company. Euroz estimated the value of that option at $300 million last year.

PIONEER LITHIUM (ASX:PLN)

(Up on no news)

The name’s a misnomer, with most of this explorer’s recent news flow coming from Brazil, where it recently completed a 32-hole, 300m auger campaign exploring its 73,061 hectare Verde Valor rare earth project.

Results included hits close to surface of up to 4m at over 2300ppm.

That comes as the explorer, from the stable of Robert Martin whose enthusiasm for Canadian hard rock lithium brought a number of new explorers to the ASX in 2023, progresses planning for a maiden exploration drilling campaign at its Root Lake project in Ontario, Canada.

Located near Green Technology Metals’ (ASX:GT1) more advanced McCombe and Root Bay fields – collectively hosting economic lithium resources of ~15Mt at over 1% Li2O – Pioneer executed an early exploration agreement in June with the Slate Falls First Nations group.

That early exploration included a kilometre of trenching looking for potential extensions to GT1’s neighbouring fields.

At Stockhead, we tell it like it is. While Sierra Nevada Gold is a Stockhead advertiser, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.