Resources Top 5: Energy from water, lithium deals and wedding ring grades of gold top ASX stocks

Pic: Getty Images

- Strategic Elements soars on piloting its water to energy tech

- Lithium stocks lift on Rio-Arcadium takeover while approval for Ewoyaa sends Piedmont pumping

- Artemis encounters wedding ring-grades of gold at Titan prospect

Here are the biggest small cap resources winners in morning trade, Thursday, October 10. Prices accurate at time of writing.

Strategic Elements (ASX:SOR)

It’s not quite a ressie but SOR’s energy innovation is super cool and worth a shout.

That’s because there’s rocketing interest from investors on the bourse for SOR today as it announced the launch of large-scale prototypes of its Energy Ink tech which extracts energy from moisture.

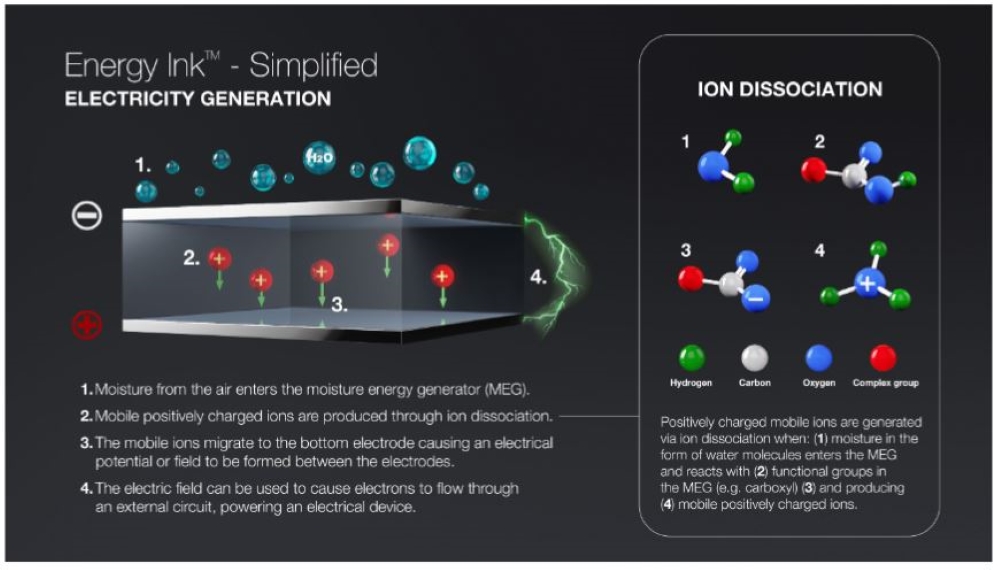

How does this tech work exactly? Glad you asked. Here’s a snazzy image that lays down the process:

SOR MD Charles Murphy says as Energy Ink is a pioneering technology, much work was required to design the ‘Cell to Sheet’ program and prepare modified ink and materials for trial in automated machinery.

“While much of this foundational work has not been externally visible, achieving this progress in such a brief time is a credit to the entire team,” Murphy said.

“The next phase could revolutionise our ability to generate energy from moisture and enable us to attract global collaborators.”

Shares in SOR are up 36% after heavy morning trades, swapping at 4.9c.

Piedmont Lithium (ASX:PLL)

News is coming hot and fast both directly and indirectly for PLL, this time it’s mine operating approval for its Ewoyaa lithium project which it shares in a JV with Atlantic Lithium (ASX:A11).

The development still hinges on the outcome of the mining lease ratification by the Ghanaian Parliament and ongoing design works, both of which are looking promising.

PLL is working across its NAL and Ghanaian lithium projects, recently expanding the NAL mineral resource by 51% to 87.9Mt at 1.13% Li2O in late August and has locked in an environmental permit for Ewoyaa.

Piedmont rose 12.2% to trade at 20.75c a share.

It’s also worth mentioning the enormous elephant in the room, Rio Tinto’s (ASX:RIO) $10bn takeover deal for Arcadium Lithium (ASX:LTM), which has investors clamouring over themselves to pick the lithium bottom on the back of the ‘counter-cyclical’ deal.

It sits firmly in the large-cap realm but Arcadium itself is actually sitting on gains of over 39% after the premium Rio cash offer was approved by its board after trade yesterday. You can check out the expert analysis on the deal from an early emergency edition of Monsters of Rock below.

READ MORE: Experts weigh in on Rio’s $10bn Arcadium Lithium deal

Artemis Resources (ASX:ARV)

ARV’s return to the Pilbara is looking promising early doors, as rock chip samples (which are preliminary signs that there’s a decent orebody underneath the ground) have turned up some bonanza grades of gold, with assays showing up to a whopping 692,579g/t and silver of up to 3000g/t.

Those may seem like the sort of grades you’d get if someone dropped their wedding ring in the fire assay machine, but they’re not.

The samples were taken from the explorer’s Titan prospect, with results suggesting mineralisation is linked to quartz-iron veining that covers 63 hectares – reinforcing the potential for more exploration in the region.

The distribution of significant surface rock chip gold assays (>0.5g/t Au) across a broad area at Titan (potentially up to 2km x 400m) and across differing structural trends, is of “considerable interest” and could suggest a larger mineralised system than previously thought.

The ARV stock price shot up 23% in early trade on the back of the news, swapping for 1.6c per share, but came back to 1.4c (+7.7%) around 2pm.

Lithium Energy (ASX:LEL)

(Up on no news)

It’s been months since LEL sold its 90% interest in the Solaroz lithium brine project in Argentina for $97m.

The explorer sold the asset to China’s CNGR Advanced Material in May at 86.5 per share, a 79% premium to its, at the time, one month VWAP and a shiny reflection of the progress it’s made since its IPO at 20c a share three years earlier.

LEL’s Solaroz asset, adjacent to the soon to be Rio owned Olaroz, was scoped out to get into production at a run rate of either 20Ktpa or 40ktpa using conventional evap ponds processing methods.

The explorer has now moved to spin out a new company, Axon Graphite, in a merger with Novonix to explore the Burke, Corella and Mt Dromedary graphite assets.

The 12.7Mt Mt Dromedary has a 14.5% Total Graphitic Carbon (TGC) grade for a total of 1.83Mt contained graphite (at a 5% TGC cut-off grade) and adjoins the Burke tenement.

Shares in the junior are up 13.9% today and 30% over the past month, trading at 41c a share.

Viking Mines (ASX:VKA)

A review of VKA’s First Hit gold mine has uncovered substantial, historical and unmined drill intercepts that show some bonanza grades of up to 77.6g/t gold.

The explorer says the hits reflect the narrow vein, high-grade style of mineralisation present in the area and is mulling over getting the drill bit out to test the targets.

Hits include:

- 4m at 26.1 g/t Au from 58m at hole BFH005

- 3m at 77.6 g/t Au from 224m at hole BFH030; and

- and 4.9m at 64.8 g/t Au from 62.1m FHU045

Project is situated along the prolific Ida Fault and Zuleika shear, which have substantial gold endowment.

It’s also adjacent to Ora Banda’s (ASX:OBM) Riverina deposit and 40km from the Davyhurst mill.

At the core of the tenement holding is a 25km strike length fully encompassing the Zuleika shear, which has seen very little modern exploration and limited bedrock drill testing.

Shares in the minnow are up 37.5% to trade at 1.1c at time of writing.

At Stockhead we tell it like it is. While Lithium Energy is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.