Resources Top 5: Dreadnought blasts up on nickel-copper find; Meteoric hits more REE action in Brazil

Pic via Getty Images

- Dreadnought further firms as a critical minerals player with notable nickel-copper find

- Meteoric announces ‘outstanding’ ionic clay REE results in Brazil

- Riversgold dives deeper for lithium in Canada’s James Bay with major acquisition

- 29Metals shareholders give the copper miner’s ailing Capricorn project a $122m assist

Here are the biggest small cap resources winners in early trade, Thursday August 31.

DREADNOUGHT RESOURCES (ASX:DRE)

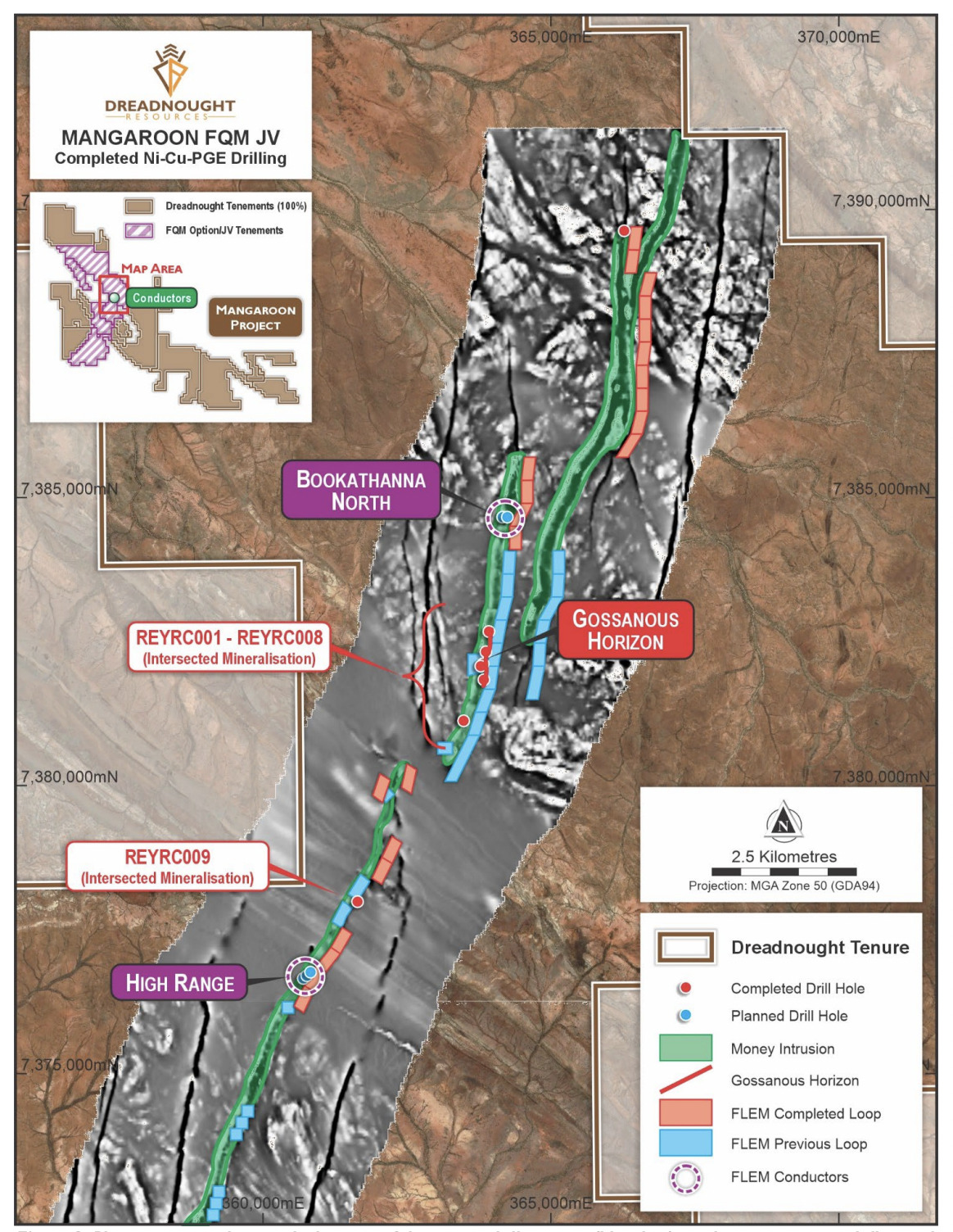

WA-focused exploration company Dreadnought Resources is surging this morning on the back of an announcement regarding “massive and disseminated” nickel-copper sulphide intersections from RC drilling at the Bookathanna North prospect.

That’s a site along the 45km long Money Intrusion in the Mangaroon Ni-Cu-PGE project in the Gascoyne region of Western Australia.

Dreadnought has recently made a pivot in the nickel, copper and gold-hunting direction, teaming up with A$20 billion Toronto-listed First Quantum Minerals at Mangaroon.

And this new focus comes alongside the company’s completion of its rare earths exploration for the year, notes its managing director, Dean Tuck.

The significant sulphides find came in a campaign that planned a 5-hole drill for ~1,000m followed by down hole electromagnetic exploration.

The first hole (REYRC013, for 153m) provided the main highlight, intersecting ~14m of Ni-Cu sulphide mineralisation from 37m.

That included 2m of massive sulphides and 12m of disseminated sulphides. The massive sulphides, the company notes, appear to be high tenor, comprised of 40-50% combined pentlandite and chalcopyrite in equal proportions.

“The intersection of shallow, high tenor massive sulphides in the first hole of this program is truly exciting and a great way to set the tone for the remainder of 2023,” said Tuck.

Additionally, Dreadnought has provided updated First Quantum Minerals earn-in details:

“First Quantum Minerals can earn an initial 51% interest by funding $12m of expenditure by 1 March 2026,” notes DRE, adding: “First Quantum Minerals may withdraw at any time during the earn-in phase with 0% interest.”

Upon reaching the $12m funding target, though, the two companies will form an official joint venture, with First Quantum then potentially increasing its interest to 70% and funding further exploration.

DRE share price

METEORIC RESOURCES (ASX:MEI)

Meteoric, a currently $421 million market-capped rare earths success story focused on ionic clay REE drilling in Brazil, has announced what it’s describing as “outstanding results” from its latest activities just outside the Caldeira project mineral resource.

That’s a Brazilian project the company regards as the world’s highest grade ionic clay REE resource.

Hole CVSDD001, located just outside Caldeira, has returned “the widest, highest-grade ionic clay REE drill intercept reported this year” at the project, says Meteoric.

And more precisely, that’s an intercept of “149.5m @ 8,912 ppm TREO1 mineralised from surface to EOH with 1,417 ppm MREO2 with 52m @ 12,692 pm TREO with 2,710ppm MREO from 61m.”

We're pleased to announce outstanding REE drill results outside of the Caldeira Resource.

CVSDD001, located outside of the Caldeira MRE, has returned the widest, highest-grade ionic clay REE drill intercept reported this year at the project.

Read more: https://t.co/7CRtFylrtS pic.twitter.com/id4AqEzD2c

— Meteoric Resources (@ASX_MEI) August 31, 2023

Executive Chairman Dr Andrew Tunks made a few comments:

“The Caldeira Project continues to deliver truly amazing results that even a month ago, we could not have predicted. The extensions of REE mineralisation below the Mineral Resource Estimate have now clearly been proven.

“Our diamond drilling now conclusively shows that the depth of mineralised clays is far greater than 10m and that REE mineralisation is developed throughout the entire regolith profile.

“Hole CVSD001, which is outside the resource area, is simply remarkable. It contains the best intercept we have yet seen at Caldeira and ended in strongly mineralised clay.”

The jury is out on ionic clays outside China in general, but experts remain bullish on Caldeira thanks to its stonking grades. See below for your records.

Read: MoneyTalks: Four tier 1 rare earths projects primed to ride the cycles

MEI share price

RIVERSGOLD (ASX:RGL)

Another early jumper this morning, this former goldie revealed it’s been shopping in Canada and has acquired seven project blocks located between the Whabouchi and Rose lithium deposits in the James Bay district of Quebec.

This essentially means the lithium-pivoting company is now set to acquire 100% of the Abigail lithium project, which comprises the seven blocks.

It’s a strategic acquisition that places RGL firmly between Critical Element’s (TSX.V:CRE) Rose lithium deposit with a probable reserve of 26.3Mt (million tonnes) at 0.87% Li2O, and Nemaska Lithium’s Whabouchi deposit: 36.6Mt at 1.3% Li2O.

David Lenigas, chairman of RGL, said: “The Abigail Lithium Project in Quebec is blessed with year-round access for exploration and the current exploration program, planned to commence in two weeks, will be managed by the same exploration team who identified the project’s potential lithium anomalies back in 2016/17.”

Riversgold Limited has successfully finalised a deal to acquire the Abigail #Lithium Project, situated in the highly prospective James Bay district in Quebec, Canada.

View more: https://t.co/yORSKPBvzl #JamesBay #QuebecMining @DavidLenigas pic.twitter.com/DRL4r0PUhz

— Riversgold Limited (@Riversgold_Ltd) August 30, 2023

RGL says it intends to undertake a due diligence field exploration program in September 2023, carried out by the team that did the LCT targeting program in 2016 and 2017.

RGL share price

29METALS (ASX:29M)

29Metals is one of the top-performing ASX resources stocks this morning after completing an institutional entitlement offer to raise $122 million in support of its Capricorn copper recovery plan.

It’s welcome news for the recently hammered copper miner, which had to suspend operations at the waterlogged Queensland Capricorn project after it copped a record seven-metre flooding in March.

The offer reportedly received very strong support, with eligible existing institutional shareholders subscribing for approximately 97% of their entitlements (in the aggregate).

The offer price of $0.690 per share represented a 5.6% discount to TERP of $0.731 based on the last closing price on August 29, 2023; and 8.0% discount to the last closing price of $0.750 on August 29.

“We are very pleased with the level of support shown by our existing shareholders,” said 29Metals managing director and chief executive officer Peter Albert, adding:

“Proceeds from the offer will strengthen 29Metals’ financial position, ensure that the ongoing Capricorn copper recovery plan is fully funded, de-risk the balance sheet and position the company to progress near-term growth initiatives.”

Documents lodged with the ASX yesterday showed major ~44% shareholder EMR Capital, led by big time resources investor Owen Hegarty, was taking up its full allotment of $67.8m.

29M share price

POWER MINERALS (ASX:PNN)

Power Minerals is a South Australian-based exploration company aiming for a diverse portfolio of demand-driven commodities. And yep, that naturally includes battery metal du jour, lithium.

The company’s share price is rising this morning after Power announced it’s received a $2.6m strategic investment from the the lithium-sector investor Mingjin New Energy Development Co.

The funds will be used to accelerate the development of Power’s lithium assets in the Argentinian section of the “Lithium Triangle” (which comprises Argentina, Bolivia and Chile) – the world’s leading lithium-brine region.

And specifically, that means the development and exploration of the company’s Salta lithium project in the north-west part of the country. The project consists of five salt lakes that sit within seven mining leases, over a total project area of 147.07km².

We've received $2.6M strategic investment from #lithium sector investor, Mingjin New Energy Development Co. The funds will be used to expedite the development of our lithium assets in Argentina. Mingjin subscribed for 6.5M $PNN shares at $0.40 per share.

📄https://t.co/EmfObeM7oj pic.twitter.com/1daw5CNgRb— Power Minerals Limited (ASX:PNN) (@PowerMin_PNN) August 30, 2023

Mingjin has subscribed for 6.5m Power shares at $0.40 per share via a placement to raise $2.6m before costs.

The investor also has existing “cornerstone” equity investments in Octava Minerals (ASX:OCT) and Patagonia Lithium (ASX:PL3).

PNN share price

At Stockhead we tell it like it is. While Riversgold and Power Minerals are Stockhead advertisers at the time of writing, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.