Resources Top 5: Diggers starts to lift ASX juniors in the Goldfields amidst US recession fears

Pic: Getty Images.

- Ardea primed to fill BHP’s abandonment of Goldfields’ nickel production

- Horizon rides gold bulls with low-risk production from Boorara set for September quarter

- Killi rises once again on drill targets for Mt Rawdon West

Here are the biggest small cap resources winners in morning trade, Monday, August 5. Prices accurate at time of writing.

As stock markets around the world get slammed on the back of US recession fears, at least there’s a few ressies lighting green candles today as the annual Diggers & Dealers conference in Kalgoorlie kicks off. Check them out:

Ardea Resources (ASX:ARL)

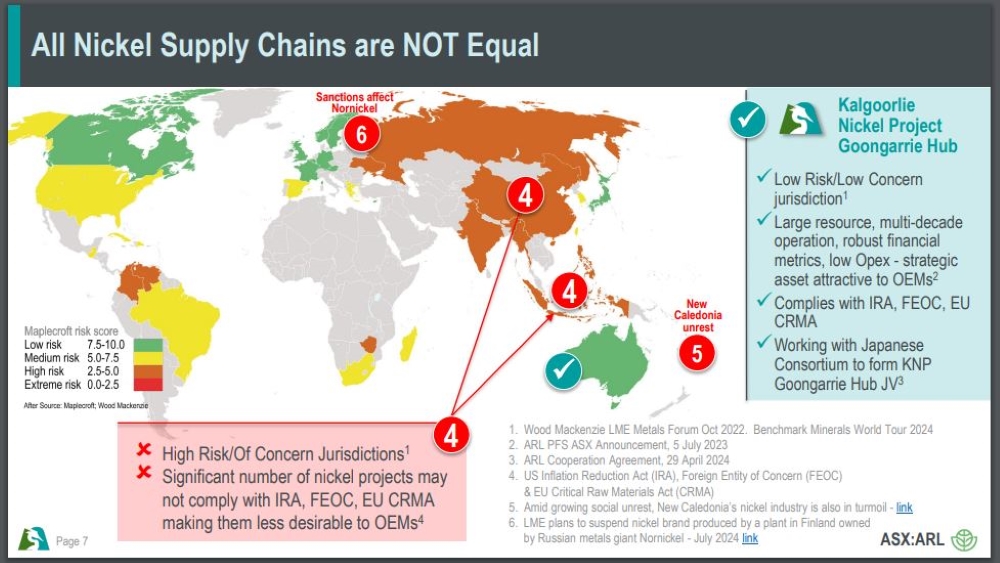

One of the first cabs off the rank to pull ahead from its Day 1 presentation at the Diggers & Dealers conference in Kalgoorlie, ARL has pushed the supply chain diversification narrative to sell its 50:50 4Mt KNP Goongarrie Nickel Hub JV.

ARL warns of mounting concerns from OEM’s about buying product from the environmentally non-compliant and high-risk jurisdictions of China and Indonesia – two of the world’s largest nickel producers.

It’s signed on Japanese majors Sumitomo and Mitsubishi, which will fully fund a DFS for up to $98.5m and jointly farm-in to a 50% share of the project.

The two companies will have access to 75% of the offtake on commercial terms, with Sumitomo’s technical expertise in nickel-laterite mining and refining to come to the fore during development.

A preliminary study outlined KNP Goongarrie as a 194.1Mt at 0.70% Ni and 0.05% Co for 1.36Mt of nickel and 99,000t of cobalt as a low-cost operation comparable with Indonesia’s globally dominant pig iron opex.

Perhaps ARL sees an opportunity with BHP’s shuttering of its WA nickel operations and subsequent pivot to copper.

In any case, shares were up >10% on the news, before settling to just a 5.56% rise to 47.5c.

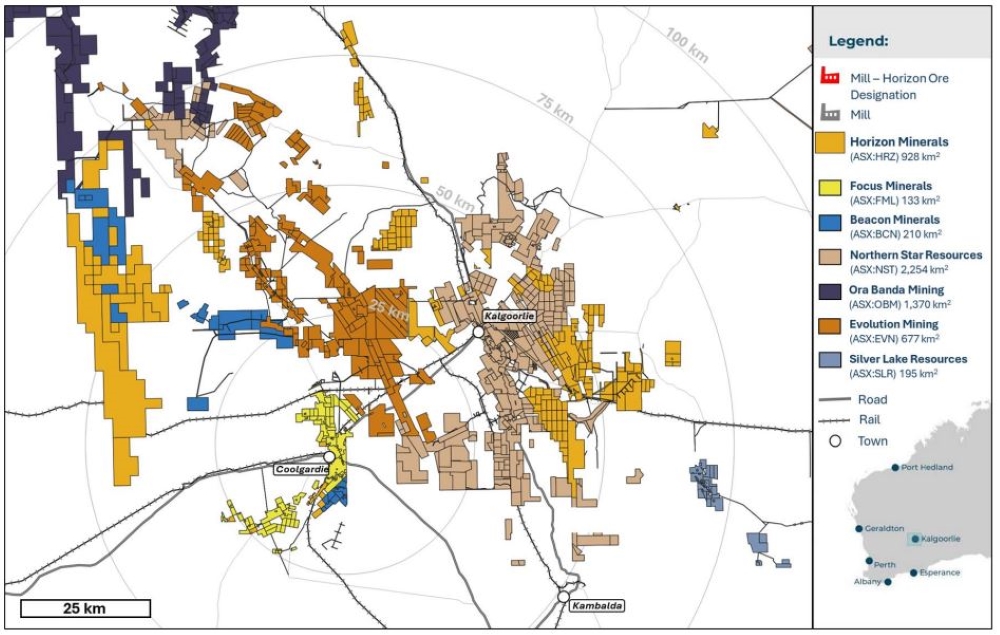

Horizon Minerals (ASX:HRZ)

Another winner from Day 1 at Diggers, Grant Haywood-led HRZ has geared itself to start production and gold sales from its 1.8Moz Goldfields assets, with the 428,000oz Boorara to kick off in the September quarter and 54,570oz Phillips Find during the following.

It has a 1.24Mt ore sale agreement with Norton Gold Fields in place and a toll agreement through FMR Investments’ 1Mtpa Greenfields mill.

There’s also its cornerstone Burbanks asset which has a growing >460,000oz resource, which was last topped up from 10,000m of drilling that added 188,000oz.

Shares in HRZ climbed 12.8% today to be swapping at 4.4c at time of writing.

Killi Resources (ASX:KLI)

Ever since it tripped over 8oz of gold on some exposed land at its Mt Rawdon West gold-copper project in QLD near Evolution Mining (ASX:EVN) 70,000ozpa Mt Rawdon mining operation, trade on KLI has been quite significant.

The explorer is holding court on the ASX once again today, after confirming gold and copper drill targets from ground IP surveying across the Kaa prospect at Mt Rawdon West which intercepted some bonkers gold grades up to 238g/t gold and 5.2% copper.

Those grades were found via IP line 3600N, a trend that’s sub-parallel to the recently mapped 1.8km-long high-grade copper-gold trend at surface.

“Mapping saw us understand the region has seen significant structural deformation, and the gossans and veins at surface returned high-grade assays, which is not a common occurrence in outcrop,” CEO Kathryn Cutler says.

“You normally have to drill a hole to hit a high-grade result like this.”

KLI says it’ll kick off a 1000m drilling campaign in the coming weeks to test targets beneath the high-grade copper and gold surface results.

A 3c company by the end of April this year, shares in KLI are now up almost 400% and currently bouncing around the 11-12c mark, which was boosted by a 25% rise in early trade.

Metal Hawk (ASX:MHK)

High-grade gold has been discovered from rock chip and soil samples across the Siberian Tiger prospect, part of MHK’s Leinster South gold project, also in the Goldfields.

The prospect area is just 15km from the 4.5Moz Lawlers mining centre and assayed results showed up to 20.2g/t gold from 16 >1g/t samples.

“We could not have wished for a better start to exploration at Leinster South and we are thrilled with these outstanding results of up to 20g/t gold at Siberian Tiger,” MHK MD Will Belbin says.

“It is rare these days to find new discoveries of outcropping gold in the northeast goldfields, let alone only 15km from a mature, world class mining camp such as Agnew-Lawlers.”

The explorer is continuing geological mapping and sampling as it looks to define drill targets across Leinster South.

The $6m market-capped MHK’s shares pumped 32.1% today to trade at 7c per share.

Oceana Lithium (ASX:OCN)

(Up on no news)

It looks like news of OCN CEO Caue Araujo resigning last week has been welcomed by investors, as its pivot to uranium and rare earths have not yielded any substantial results to-date.

Last year it was looking at proving up its Monaro project in James Bay, yet recent activities has had its focus on U3O8 and REE prospectivity at Napperby in the NT.

OCN is investigating a 4.5km-long uranium anomaly which it hopes to prove up.

Shares in the minnow are up 17.7% to trade at 4c per share.

At Stockhead we tell it like it is. While Metal Hawk is a Stockhead advertiser, it did not sponsor this article. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.