Resources Top 5: Dazzling gold hits, a popular lithium pivot, and juniors cement lucrative Hancock deal

Pic: iStock / Getty Images Plus

- Monger Gold to acquire the large ‘Scotty’ sediment-hosted lithium project in Nevada

- JV partners Legacy and Hawthorn cement deal with subsidiary of billionaire Gina Rinehart’s Hancock Prospecting

- Metalstech hits 173.2m grading 3.27g/t gold and 11.8g/t silver from surface at ‘Sturec’

Here are the biggest small cap resources winners in early trade, Tuesday May 3.

MONGER GOLD (ASX:MMG)

Another lithium pivot well received by investors.

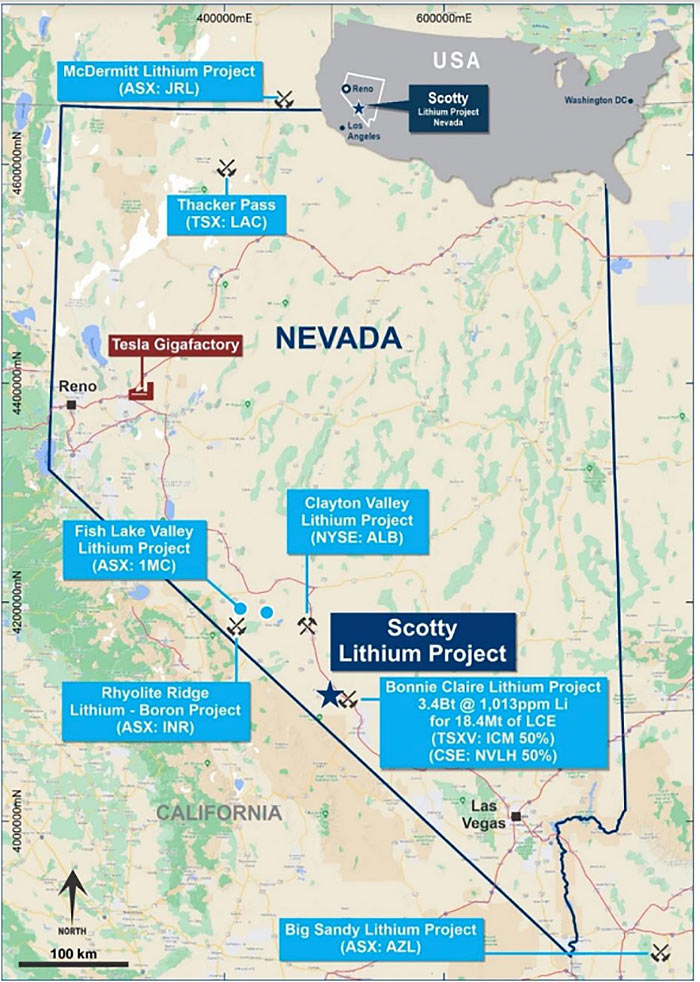

Torian Resources (ASX:TNR) spin-off MMG will acquire the large ‘Scotty’ sediment-hosted lithium project in Nevada for $2m.

This is a good neighbourhood. The 14,000-acre project surrounds the ‘Bonnie Claire’ project (host to one of North America’s largest lithium resources at 18.3Mt LCE), is 70km from Albermarle’s ‘Clayton Valley’ mine (the only producing lithium mine in the US) and 330km from Tesla’s Gigafactory.

Historical soil sampling returned grades of up to 300ppm lithium, representing similar grades to soil sampling over Clayton Valley.

Scotty also likely covers identical geological sequences to those that host ‘Bonnie Claire’, MMG says.

A soil sampling program will kick off in June, to be followed by drilling in Q3.

“The electric revolution is just getting started, with increased demand for lithium to be a feature of the world’s economy for many years to come,” MMG chairman Peretz Schapiro says.

“Through development of the Scotty Lithium Project as well as continuing to seek out additional accretive acquisitions, MMG intends to become a significant player in the lithium market.”

LEGACY IRON ORE (ASX:LCY) and HAWTHORN RESOURCES (ASX:HAW)

JV partners LCY and HAW cemented a deal with a subsidiary of billionaire Gina Rinehart’s Hancock Prospecting, which shelled out an initial $9m to earn into the ‘Mt Bevan’ iron ore project in WA.

Mt Bevan hosts a 1,170 million tonne magnetite resource @ 34.9% iron, 250km north of Kalgoorlie in WA.

While magnetite iron ore resources are lower grade than hematite in the ground, they can be concentrated into a higher-grade product which fetch higher prices.

This initial investment of $9m gives Hancock a 30% interest in Mt Bevan, with $8m cash being paid to LCY and HAW in proportion to their interest in the project (Legacy $4.8m and Hawthorn $3.2m).

The remaining $1m will be working capital.

LCY will hold 42% and HAW will hold 28% upon completion of the initial investment.

Hancock can earn an additional 21% by funding the completion of a pre-feasibility study (PFS), a detailed look at whether the project is economic to build.

On Thursday 14th April 2022, the first JV committee meeting was held during which the key objectives of the Mt Bevan PFS were agreed, LCY says.

The meeting also approved an initial budget for the PFS and the commencement of work, which is forecast to conclude in Q1 2024.

LCY ($200m market cap) and HAW ($63m market cap) are up 240% and 280% respectively since the deal was first unveiled November last year.

METALSTECH (ASX:MTC)

Latest infill drilling results out of the 1.5Moz gold, 10.93Moz silver ‘Sturec’ mine in Slovakia include 173.2m grading 3.27g/t gold and 11.8g/t silver from surface.

This intersection is not true thickness, the company says, which is always the width of the vein/orebody etc at its narrowest point.

Resource modelling suggests the true thickness on mineralisation in this area is about 55m. Still excellent.

This ongoing drilling program was designed to increase confidence in the existing resource (infill drilling), as well as extended mineralisation to the south (extensional drilling).

MTC has an exploration target of between 2.2Moz and 5.1Moz of gold eq, which is in addition to the existing resource.

“The orebody at Sturec continues to deliver impressive zones of gold mineralisation,” MTC director Gino D’Anna says.

“Our drilling has grown the confidence of the existing Sturec mineral resource and demonstrated that the mineralisation extends further to the south along strike of the existing resource and remains open down dip/plunge.”

A scoping study – the first proper look at the economics of building a project — is due out this quarter.

MTC plans to use a cyanide-free gold recovery process at Sturec.

Cyanide leaching — toxic and environmentally unfriendly for obvious reasons — remains the industry standard because it is a proven, cheap method which delivers maximum gold recovery from low-grade and some refractory (ultra-fine gold particles) ores.

Slovakia implemented a gold cyanidation ban in 2014, which discouraged the previous owners of Sturec from developing the project further, MTC says.

The $51m market cap stock is flat year-to-date. It had $3.3m in the bank at the end of March.

AGUIA RESOURCES (ASX:AGR)

(Up on no news)

AGR is currently trying to get its Três Estradas Phosphate Project (‘TEPP’) and Andrade Copper Project (‘Andrade’) into production.

The two projects are near each other in the Southernmost Brazilian state of Rio Grande do Sul.

First results from an ongoing drilling program at Andrade to improve confidence in, and potentially expand, the copper resource is due any day now.

In March 2021, an early-stage project study and updated resource shows “positive economics” for development.

Results show an impressive 67.1 per cent internal rate of return (IRR) on a 1mtpa copper sulphate (salt) operation over 14 years.

Average earnings before tax would be almost $20m a year – and it would cost just $10m to build the thing.

Meanwhile, the TEPP – considered a project of importance by the Brazilian government — is expected to produce 306,000tpa over 18 years following a three-year ramp up.

It will cost just $8m to build.

AGR’s natural phosphate fertiliser products, Pampafos and Lavrato have now been tested on the following Brazilian crops; soybean, rice, corn (maize), oats and wheat, “with all tests returning excellent results”, the company said early Feb.

“Domestic interest in Aguia’s Direct Application Natural Phosphate continues to grow with more offtake agreements anticipated,” it says.

The $423m market cap stock is up 12% year-to-date. It had $4.7m in the bank at the end of March.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.