Resources Top 5: Crucial court wins, near-term miners, and a besieged lithium play on the mend

Pic: Tyler Stableford / Stone via Getty Images

- NZ coking coal miner Bathurst wins key court battle

- Alara picks up more ground, scores crucial approvals at advanced ‘Wash-hi Al Majaza’ copper-gold project in Oman

- Infinity continues to claw back losses suffered when its San Jose lithium project permit application was cancelled in May

Here are the biggest small cap resources winners in early trade, Wednesday July 14.

BATHURST RESOURCES (ASX:BRL)

A long court battle has come to an end, with New Zealand coking coal producer Bathurst emerging the victor.

The Supreme Court ruled that Bathurst did not have to pay a $40m ‘performance payment’ to L&M Coal, an issue Bathurst management believed was weighing on the company’s share price. Until now.

The ruling — coupled with a recent positive production and coking coal price outlook — has sparked a 110% share price gain over the past month.

ALARA RESOURCES (ASX:AUQ)

The $18m market cap explorer has picked up more ground and scored crucial approvals at its advanced 51%-owned ‘Wash-hi Al Majaza’ copper-gold project in the little-known jurisdiction of Oman.

The Omani Ministry of Housing (MoH) granted additional land around the mining licence and permission to build the processing plant — agreements which pave the way to kickstart early construction.

Commercial production is pencilled in for March 2022.

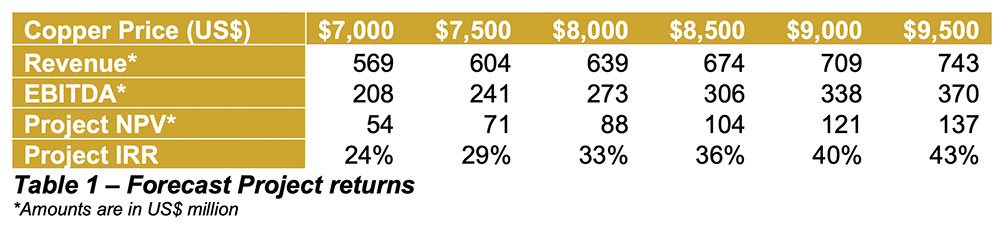

A booming copper price will be great for the project’s bottom line, Alara says. Just check out these returns under various copper price scenarios:

INFINITY LITHIUM (ASX:INF)

The beleaguered stock has clawed back a large portion of the massive losses suffered when its San Jose lithium project permit application in Spain was cancelled in May.

The company is naturally appealing the decision.

Despite this, the company went on to sign an MoU with global leading lithium-ion battery producer LG Energy Solutions for the potential long-term supply of battery grade lithium hydroxide.

Today, it drew attention to Spain’s newly announced €4.3 billion recovery plan to integrate the national EV value chain.

“San José is ideally positioned to cornerstone Spain’s lithium-ion battery value chain with the country’s largest JORC compliant lithium resource and commercially advanced integrated lithium chemicals project,” Infinity says.

KIN MINING (ASX:KIN)

In the June quarter, WA gold project developer Kin updated its Cardinia project resources to 1.23 million ounces.

A $12.8 million capital raising completed last quarter means the company has been able to maintain an impressive pace of exploration results and resource development activity, managing director Andrew Munckton says.

“We are now working towards the next resource update for the CGP scheduled for the September quarter, which will include the impressive results generated from in-fill and extensional drilling at our developing Cardinia Hill deposit,” he says.

The $110m market cap stock is down 17% year-to-date.

COKAL (ASX:CKA)

The project developer has locked in $US20m to develop its 60% owned 266mt Bumi Barito Mineral (BBM) coking coal project in Indonesia.

Cokal says the attractive financing structure avoids any dilution for shareholders.

The funding of the project and additional working capital support “place the company in a tremendous position to commence mining and production at BBM”, chairman Domenic Martino says.

The $67m market cap stock is down 10% in 2021.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.