Resources Top 5: Copper stock wins go to Infinity, and beyond!

Pic via Getty Images

- Infinity shares rocket up on Cangai purchase

- White Cliff on a heater with super high-grade and large-scale copper finds at Rae

- Frontier bounces back with strategy update for McGowan-backed Waroona renewables project

Here are the biggest small cap resources winners in morning trade, Friday, October 4. Prices accurate at time of writing.

Infinity Mining (ASX:IMI)

(Up on yesterday’s news)

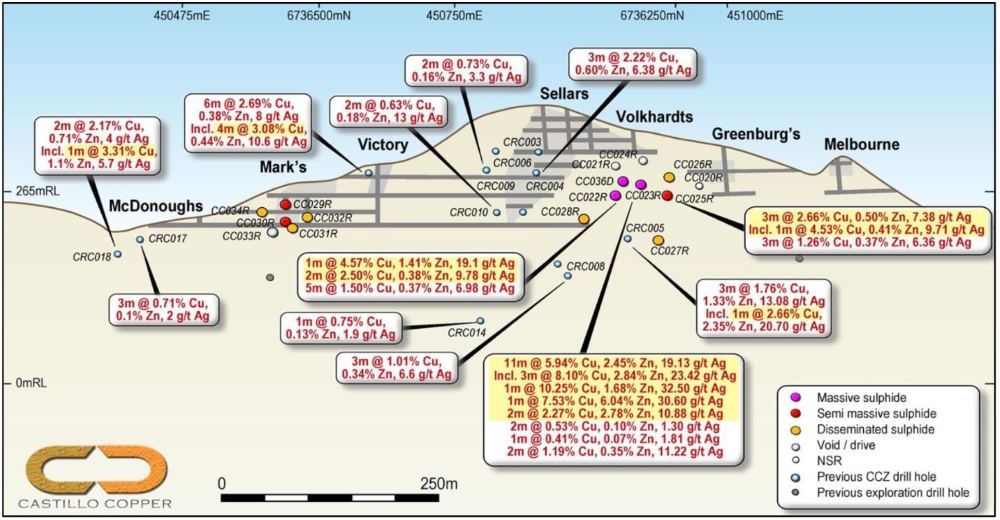

Rumours were put to bed yesterday as IMI signed a binding agreement to acquire the renowned Cangai copper mine and surrounding tenements in northwest NSW from Castillo Copper (ASX:CCZ).

Cangai historically produced some super high grades of copper ore in the past, ranging from about 7-10% with silver and gold credits to boot back in the early 1900s.

Diamond drilling by CCZ from 2018 returned up to 14.45% copper, 5.93% zinc and 40.1g/t Ag, including a best intersection of 4.39m at 5.06% Cu, 2.56% Zn and 20.1 g/t Ag from 49.9m.

With a modern arsenal of exploration and development tools, the explorer is set to hit the ground running at Cangai’s 114,000t of copper metal JORC resource after a due diligence period.

IMI is set to kick off an extensive exploration program at the Cangai site, focusing on un-mined sections and the high-grade supergene copper zone.

This will include soil sampling, drone topographic surveys, and a two-stage drilling program to target both the known orebody and new, deeper conductor anomalies identified through advanced geophysical techniques.

IMI’s buy is set to take advantage of burgeoning copper prices, which was laid out yesterday by our very own Sarah Hughan, breaking down IMI’s acquisition and the red metal market.

WATCH: Break it Down: Infinity acquires Cangai copper

Shares in the minnow are up over 50%, swapping for 4.7c.

White Cliff Minerals (ASX:WCN)

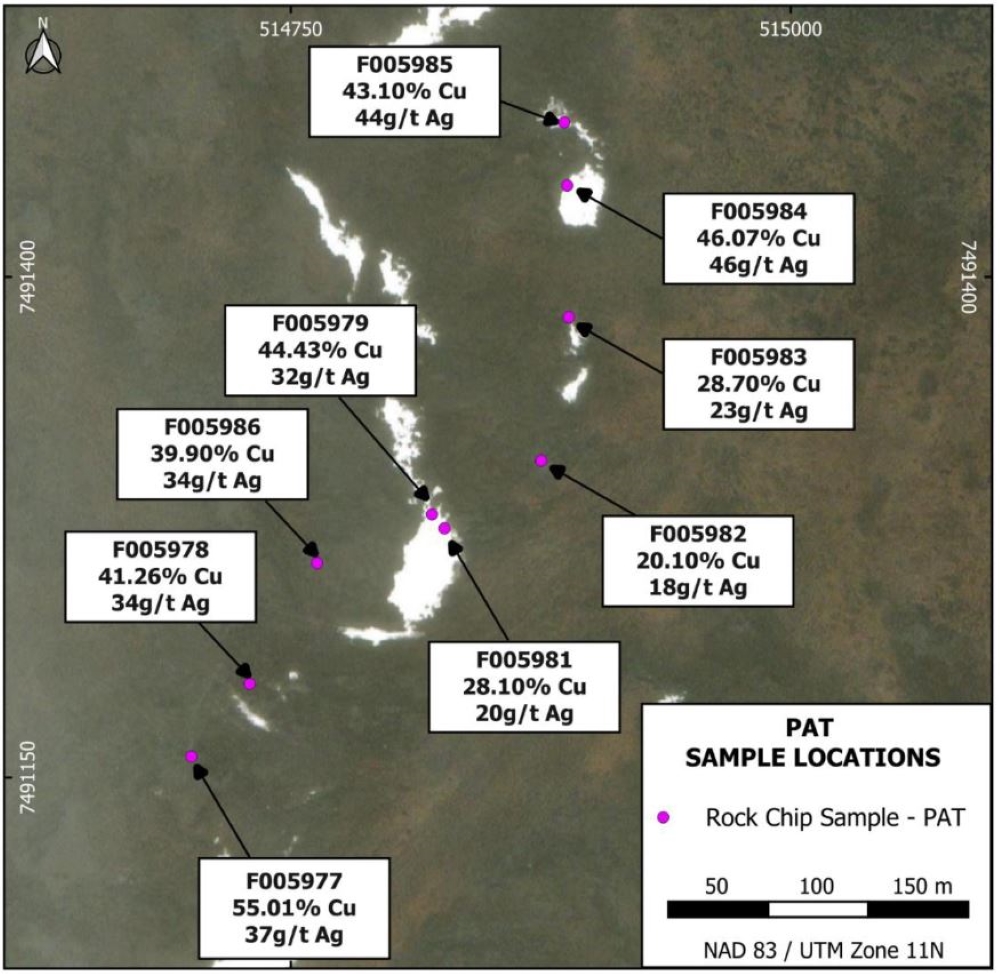

Nothing like an extraordinarily large-scale copper discovery to end the week, which WCN now knows all about, after finding some super high veins of the red metal at its Rae project in Nunavut, Canada.

Grades of rock chips across a long stretch of the project area have been assayed and reveal up to 64.02% copper at Rae’s Don and Pat prospects.

“White Cliff’s Great Bear Lake project potentially holds the mantle of the highest ever recorded representative Silver rock sample assay result of 7.54% Ag, and now the Rae project can lay claim to the highest ever recorded representative copper rock sample assays,” WCN MD Troy Whittaker said.

“The results also demonstrate the deep plumbing, copper-rich fluids and fertile nature of the host rocks of basal part of the Rae sedimentary sequence and provide longer-term opportunities for not just bulk tonne sedimentary-hosted copper, but potential for direct shipping of a high-grade copper concentrate using a mine and ship approach from these newly identified chalcocite veins.”

Over the next months the company expects to receive MobileMT geophysical results, which will sharpen the resolution of the previous groundwork, confirming drilling targets for the upcoming campaign.

First cab off the rank will be the high-priority Hulk prospect; a very large, green at surface, 16km by 4km target within the reactive subsurface basal units (siltstones and mudstones) of the Rae Sedimentary Basin.

Shares in the junior are up over 90% in the past 12 months, including 9.5% on today’s news, trading at 2.3c.

Tambourah Metals (ASX:TMB)

TMB reckons there’s enough grade data to announce potential extensions to the lode gold system at Tambourah King, with results from the latest RC drilling showing significant highlights of:

5m at 2.02g/t Au from 53m, including 1m at 3.35g/t Au from 54m in TBRC042 and 6m at 2.05g/t Au from 18m, including 1m at 4.61 g/t Au from 23m in TBRC043.

11 holes total were drilled and from the RC drilling, and TMB has scored into a 150m strike extending the known gold system.

TMB shares rose >15% on the news to trade for 4c at time of writing.

Frontier Energy (ASX:FHE)

A couple of hiccups recently saw ex-WA Premier Mark McGowan-backed FHE’s share price in the doldrums, but is now back on the rise after updating its finance strategy for Stage One of its Waroona renewable energy project.

After just ditching a $23m equity raise that sent prices plummeting, it’s now looking at non-dilutive funding options to progress Waroona, a project that combines a 120MWdc (megawatts of direct current) solar facility with an integrated 4.5-hour duration 80MW/360MWh lithium-ion phosphate battery to supply clean electricity into the South West Interconnected System.

It’s on track to reveal an updated definitive feasibility study (DFS) which is expected to demonstrate several key capital cost reductions compared to the original DFS, is on track for delivery in Q4 this year and is key to progressing discussions for the project.

“Delivering a non-dilutionary funding solution for the Waroona project development is our highest priority and we are now accelerating engagement on a range of these options,” FHE CEO Adam Kiley said.

“We had previously investigated a number of these options, however, did not pursue these due to existing debt proposals from traditional banks requiring a five-year fixed reserve capacity price.

“These options are excellent alternatives compared to the original strategy, with some potential benefits in terms of flexibility and leverage.”

Western Gold Resources (ASX:WGR)

(Up on no news)

WGR is having another bounce after releasing a ridonculous 617% internal rate of return on the development of its Gold Duke project in the north-eastern Goldfields of WA in late September.

While nothing has been heard from the company since a September 26 annual report, it’s definitely getting traded up and down since the news broke. Today, it’s up.

The explorer’s Gold Duke contains a current 230,000oz resource which it reckons can inject early cash of $38m with a capex of 6-$7.2m over a 12-month mine life according to the recent scoping study.

“The Scoping Study has demonstrated the attractive value and potential cash generation of the Gold Duke project over a broad range of gold prices. Importantly there is significant further upside as the study only includes 51% of the published resource of the Project,” WGR MD Warren Thorne said in September.

“The mine development has been optimised to minimise up-front capital costs, utilising operational cash flow to self-fund mining generating open pit ore feed to nearby processing facilities.

“The mine plan has been designed to minimise risks associated with ramp up and deliver a profitable gold producer in WA with significant upside to expand on the production profile and mine life.”

WGR soared 11.5% today and shares are currently trading at 2.9c.

At Stockhead we tell it like it is. While White Cliff Minerals, Frontier Energy and Tambourah Metals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.