Resources Top 5: Bayan Mining and Minerals joins REE throng gathering around Mountain Pass

Bayan Mining and Minerals is a new player in the critical minerals rich Mojave Desert in southeast California. Pic: Getty Images

- BMM is expanding its strategic footprint into one of the world’s most prospective rare earth districts

- BPM has entered an option agreement to acquire the Forelands gold project in WA

- SRZ has extended a drilling program at the Heemskirk tin project in Tasmania

Your standout small cap resources stocks for Monday, July 7, 2025

Bayan Mining and Minerals (ASX:BMM)

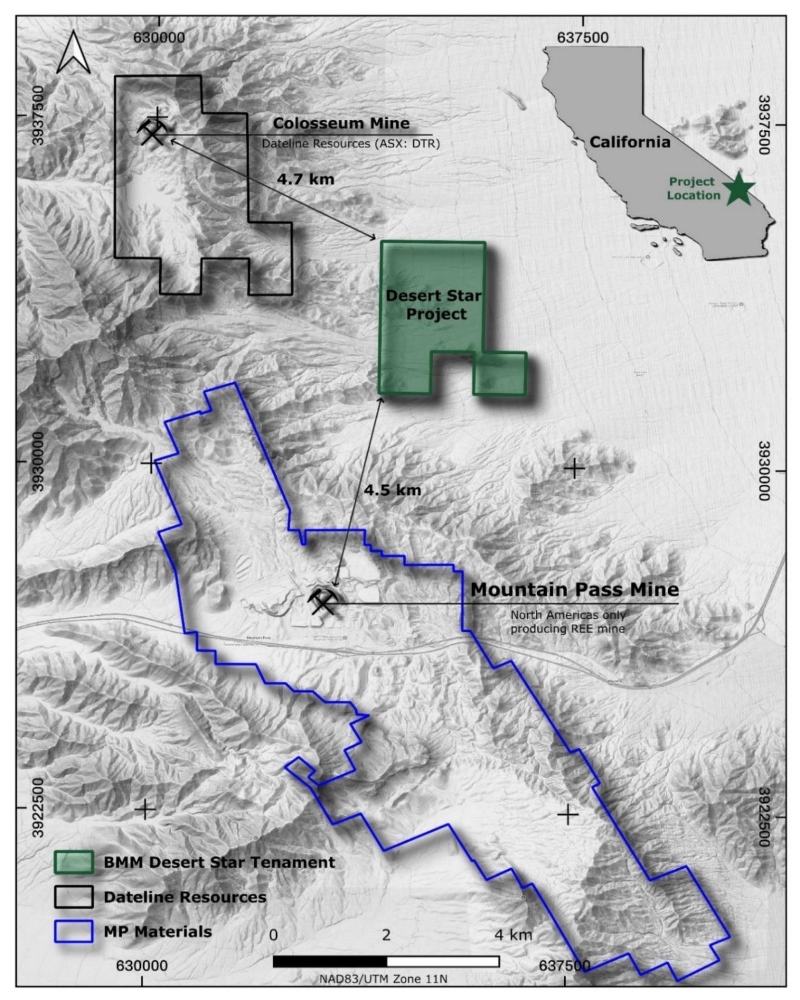

The list of players milling around the USA’s only rare earths producing mine – Mountain Pass in southeast California – is growing and now includes ASX-listed Bayan Mining and Minerals, which joins the critical minerals gathering hoping for success.

The new player in the Mojave Desert, a Tier-1 area for critical minerals with rare earths and antimony, has staked 72 lode claims covering 6km2 to form the Desert Star REE project and doubled to a daily high of 7c with 46m shares changing hands.

The project is 4.5km from MP Materials’ Mountain Pass mine, which supplied 15.8% of global rare earth production in 2020, and in proximity to the Mojave antimony and REE project of Locksley Resources (ASX:LKY) and the Colosseum REE and gold project of Dateline Resources (ASX:DTR).

Desert Star is in the same Precambrian terrane that hosts Mountain Pass and the project area features potassic alkaline intrusives, similar to those associated with REE mineralisation at that operation.

The area is also considered prospective for gold and antimony.

As well as being easily accessible via well-maintained paved and gravel roads, the project also benefits from proximity to infrastructure, including high voltage transmission lines servicing Mountain Pass and a Union Pacific rail line passes within 25km.

A desktop geological review is underway with field reconnaissance and rock chip sampling to begin shortly.

Binding commitments have been received to raise $250,000 in a placement at 4c per share to existing and new sophisticated and professional investors with funds to accelerate exploration across existing BMM assets and new targets at Desert Star.

“The filing of staking application of Desert Star project claims represents a significant milestone for Bayan Mining and Minerals as we expand our strategic footprint into one of the world’s most prospective rare earth districts,” executive director Fadi Diab said.

“Securing ground just kilometres from the globally significant Mountain Pass Mine positions Bayan at the heart of a proven REE corridor with potential opportunity.”

BPM Minerals (ASX:BPM)

After entering an option agreement to acquire the Forelands gold project that hosts high-grade, near-surface, visible gold, BPM Minerals (ASX:BPM) increased 72.42% to a daily high of 5c.

The district-scale project of 630km2 is in world-class gold terrain about 150km east of Kalgoorlie on the Yilgarn Craton-Albany Fraser Orogen margin – a tectonic setting analogous to the >8Moz Tropicana gold deposit – and is close to a number of mills.

Beachcomber prospect is a highly attractive, near-term resource conversion opportunity that is open in all directions and at which historical drilling returned up to:

- 3m at 65.8g/t gold from 25m;

- 9.7m at 4.5g/t Au from 88.8m; and

- 3m at 13.5 g/t Au from 90m.

“The Forelands project represents an exciting opportunity to unlock a high-grade, district-scale gold system in one of Western Australia’s most prospective but underexplored frontiers,” BPM CEO Oliver Judd said.

“With a newly consolidated ~630 km2 tenement package covering over 75km of confirmed mineralised strike, stacked quartz lodes at Beachcomber returning bonanza intercepts, 3m at 65.8 g/t gold, and multiple walk-up drill targets across granted and recent tenement applications, we’re hitting the ground running.

“We see significant growth potential through extensional and near-term resource conversion drilling on defined prospects geologically analogous to Tropicana, one of Australia’s most significant gold discoveries.

“With our technical team already on board and approvals in motion for high-impact drilling, Forelands has the potential to deliver significant gold resources in a buoyant precious metals market.”

Historical drilling by AngloGold/IGO primarily targeted auger anomalies, with RC programs following up on aircore intercepts.

A recent prospectivity review highlighted upside potential, particularly for first-pass drilling along key structural corridors, many of which remain untested due to shallow alluvial cover that rendered auger sampling ineffective.

A heritage agreement with the Native Title group is set to be executed in coming months and RC drilling at Beachcomber is planned to start this quarter aimed at converting known mineralisation to a maiden JORC-compliant resource.

Project vendors Dr Ross Chandler and Luke Blais have joined BPM as technical advisor and

exploration manager respectively, to assist with advancing the project.

They have a strong discovery record, including receiving AMEC’s 2023 Prospector Award for their roles in the Yin REE deposit discovery while at Dreadnought Resources (ASX:DRE).

Stellar Resources (ASX:SRZ)

Success of a 24-hole diamond drilling campaign for about 9500m at Heemskirk tin project in northwest Tasmania has prompted Stellar Resources to extend the program and saw shares jump 25% to 2c.

The planned program focused on infill and extensions to the 2023 resource estimate of 7.48Mt at 1.04% tin containing 77,870t is nearing completion.

Results up to 17m at 1.79% Sn from 203.8m, including 7.9m at 2.74%, and 6.3m at 2.22% from 369m at Queen Hill deposit and 20.9m at 1.97% Sn from 431m at Severn prompted the board to approve an additional five diamond holes and wedges for 2,500m to begin as soon as the planned drilling is completed.

The results support the potential for continuation of the Heemskirk system at depth and along strike and reinforce the potential to grow the resource.

SRZ is buoyed by the fact that the nearby Renison mine started with a 4Mt tin reserve in 1968 supporting an initial 5-year life, yet is still being mined 50 years later.

Firebird Metals (ASX:FRB)

(Up on no news)

Firebird Metals is an advanced manganese developer focused on combining mining and downstream processing with a dedication to advancing the EV battery sector.

The company is progressing its China-focused lithium manganese iron phosphate (LMFP) battery strategy with the aim to become a near-term producer of high-purity, battery-grade manganese sulphate, a key cathode material in LMFP batteries for electric vehicles.

In late June FRB received positive results from ongoing testwork as part of a binding strategic collaboration agreement with Central South University of Hunan, China.

Laboratory testing on the production of LMFP cathode active material (CAM) returned encouraging discharge specific capacity results using materials that are all commercially available and from third-party chemical suppliers.

Results confirm that Firebird’s MFP precursor materials can produce batteries that meet, and in some cases exceed, Chinese Industry standards. This demonstrates their strong potential as suitable feedstock for CAM manufacturers.

Shares reached 10c, a 29.9% improvement.

Norwest Minerals (ASX:NWM)

(Up on no news)

With drilling imminent at Bulgera gold project in WA’s Mid West in an effort to grow the 217,500oz resource, Norwest Minerals increased 27.27% to 1.4c.

Strike Drilling has been contracted for an 11-hole RC step-out program totalling 2600m to begin in mid-July to test shear-hosted gold mineralisation from 50m up to 200m down dip of near-surface prospects identified in the mining lease.

“Strike’s RC rig can drill to over 300m which will allow testing of the multiple gold-bearing shear structures at depths known to host high-grade gold mineralisation along the Plutonic Well greenstone belt,” NWM CEO Charles Schaus said.

“In 2021 Norwest drilled below the old Bulgera pit to define shear hosted gold mineralisation to 550m down dip. Norwest is looking for similar extensions to the shear-hosted gold being targeted in the campaign.”

Once Bulgera drilling is completed, the rig will be moved to the nearby Marymia East project to drill several gold targets.

This article does not constitute financial product advice. You should consider obtaining independent financial advice before making any financial decisions. While Norwest Minerals is a Stockhead advertiser, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.