Resources Top 5: Battered graphite, uranium stocks catch a bid; phosphate hopeful in the spotlight as prices soar

Pic: Getty

- Volt Resources forced to mothball Ukraine graphite mine; progresses plans to supply graphite product to a US gigafactory

- Uranium stock Berkeley Energia has gained 170% since start of March on no news

- Boadicea Resources preps lithium drilling; Kalamazoo (gold, lithium) and Avenira (phosphates) up on no news

Here are the biggest small cap resources winners in early trade, Thursday March 24.

VOLT RESOURCES (ASX:VRC)

Last year, VRC recently acquired of a 70% controlling interest in the Ukraine graphite producer ZG Group, which help “deliver on its strategy to become a key supplier of natural flake graphite products and battery anode material to the growing EV and other graphite markets”.

But Russia’s invasion has disrupted these best laid plans, with the operation currently suspended.

The graphite mine and processing facilities are located adjacent to the town of Zavallya, approximately 280 kilometres south of the Ukrainian capital Kyiv and 230 kilometres north of the main port of Odessa.

“The town of Zavallya is located in a rural area with no military or major infrastructure targets in the region,” VRC said March 17.

“There has been no military action near Zavallya, and at this stage, ZG management see minimal risk to ZG staff, their families and the business assets from the conflict.”

Meanwhile, the company – which has another graphite project called ‘Bunyu’ in Tanzania — is progressing plans to supply coated spheronised purified graphite (CSPG) to a US gigafactory that is expected to commence operations in 2025.

PSG is a value-added product used to make the battery anode.

There isn’t much info about the gigafactory developer — a company called Energy Supply Developers (ESD) — but CEO Jeff Yambrick says it is “committed to … bringing the entire battery supply chain including cell manufacturing to America at our dedicated battery industrial park”.

On a recent call ESD said construction was to kick off in ~6 months, which sounds ambitious.

“ESD has entered into a number of LOI’s and is having further discussions with battery materials suppliers, cell manufacturers, property and construction groups and expects to make further announcements in relation to Gigafactory participants in the near future,” VRC says.

“Negotiations with US Midwest states for the ESD Gigafactory site location are nearly finalised.

“Once the site is selected, ESD will officially announce its development plans, board and management team and Gigafactory participants through a media and public relations launch including website and other traditional and social media platforms.”

The $50m market cap stock is down 50% year-to-date. It had $894,000 in the bank at the end of December and initiated a $2.5m cap raise in March.

VRC share price chart

BERKELEY ENERGIA (ASX:BKY)

(Up on no news)

This Spain based uranium stock now has gained 170% since the start of March to reach 9-month highs. On no news.

In response to a recent price query BKY points to Russia invasion of Ukraine and a high uranium price as catalysts.

“The company further notes that is light of Russia’s invasion in Ukraine and the current high energy prices in Europe, particularly in Spain which has seen spot electricity prices increase significantly to record highs in March, there have been news articles in the Spanish and European press referring to nuclear power being assessed as a viable alternative to decrease Europe’s dependence on Russian energy,” it says.

“This has already seen the French government order its state energy company, EDF, to establish new reactors as part of plan to strengthen France’s energy security and to sell more nuclear power into the European energy market, and other European governments commence reviews of their existing energy policies.”

“This has led to the significant strengthening of the uranium spot price which currently stands at US$55 per pound and represents a year-to-date increase of over 30%.”

The problem for BKY is that Spanish authorities have already rejected its plans to build its flagship uranium project at ‘Salamanca’.

This decision followed the unfavourable NSC II report issued by the Board of the Nuclear Safety Council (“NSC”) in July 2021, which sent the stock price plummeting.

BKY continues to appeal, but at this point there no indication the Gov will change its mind.

Those investors currently pumping up the share price are either dumb, very smart, or know something the rest of us don’t.

It probs important to note that with $78m in the bank at the end of December, the $250m market cap stock certainly has the cash on hand to complete a solid acquisition or two.

BKY share price chart

BOADICEA RESOURCES (ASX:BOA)

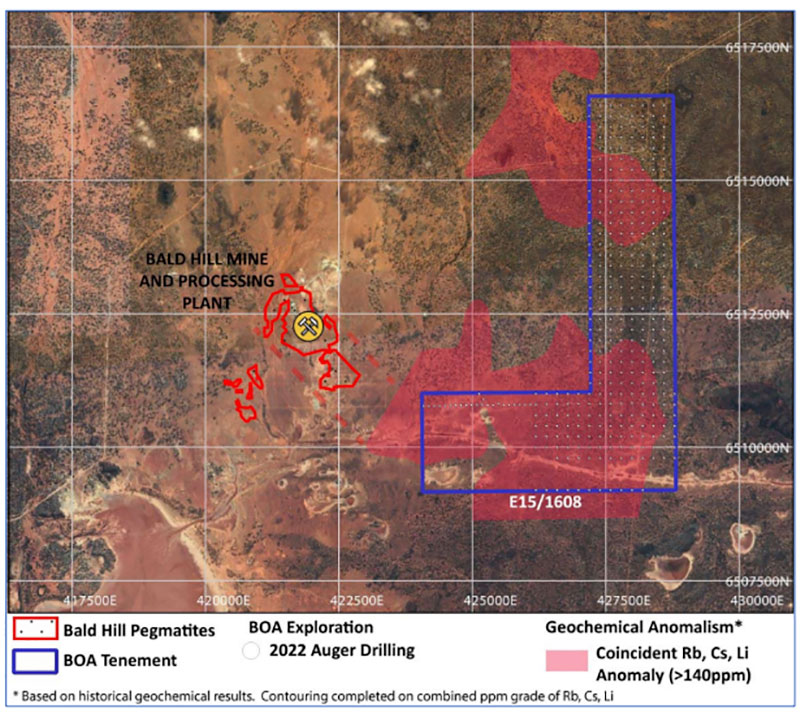

BOA has completed a 346-sample augur drilling program testing a lithium anomaly at ‘Bald Hill East’, ~2km from the mothballed ‘Bald Hill’ mine and processing plant near Kambalda in WA.

Assays are pending, it says. If all goes to plan, the next phase of exploration will include deeper drilling.

“The completion of the first phase of exploration activity at the Bald Hill East lithium program paves the way for more advanced exploration with drill testing of potential lithium targets,” BOA managing director Jon Reynolds says.

“The interpreted along strike extension of the Bald Hill Mine provides Boadicea the most advanced exploration opportunity for a potential commercial lithium discovery.”

A March 2019 presentation from the previous mine owners at Bald Hill included the statement “the resource possibly extends to the south-east and west”.

E15/1608 is in the southeast direction of the main resource:

The $17.5m market cap stock is flat year-to-date. It had $4.5m in the bank at the end of December.

BOA share price chart

KALAMAZOO RESOURCES (ASX:KZR)

(Up on no news)

This explorer has a couple of historical gold projects in the Victorian Goldfields, as well as a handful of gold and lithium projects in the Pilbara.

The most advanced is the 1.65Moz ‘Ashburton’ project in WA, where the company is looking to expand the resource ahead of a development decision.

A Scoping Study – the first proper look at the economics of building a project – will commence in Q2.

Meanwhile, it is progressing the ‘DOM’S Hill’ and ‘Marble Bar’ lithium project with JV partner SQM, a major global producer.

A major field reconnaissance/mapping and rock chip sampling campaign was to kick off this month, prior to a planned extensive drill program.

“We consider that the likelihood for LCT pegmatite mineralisation in the immediate area is very high, which is supported by Global Lithium’s nearby Archer 10.5Mt @ 1.0% Li20 deposit to the north,” Chairman and CEO Luke Reinehr said late Feb.

“Our exploration activities at both Marble Bar and DOM’s Hill, in conjunction with our JV exploration partner SQM, will now accelerate as we undertake further work leading towards future drill programs across both projects.”

The $50m market cap stock is down 11% year-to-date. It had $4.6m in the bank at the end of December.

KZR share price chart

AVENIRA (ASX:AEV)

(Up on no news)

Fertiliser is the latest commodity experiencing a parabolic price increase, with CRU Group’s fertiliser price index hitting a new record high of $377 per metric tonne.

That’s a 30% gain since the start of the year and higher than previous record in 2008 – and the commodities analysts say the peak has yet to be seen.

CRU’s Fertilizer price index hit a new record. #Nitrogen broke its record a couple of weeks ago, #potash recently. #Phosphate will do the same in the coming weeks. CRU believes that the peak is yet to be seen.@FertilizerWeek1 | @WillisThomas pic.twitter.com/eabGkHxh3j

— CRU Group (@CRUGROUP) March 21, 2022

AEV’s advanced but neglected ‘Wonarah’ phosphate project in the NT was dusted off and propelled to the front of its portfolio after prices began soaring late last year.

A scoping study (the first proper look at the economics of building a project) is now investigating the development of Wonarah to produce critical end products for LFP (lithium iron phosphate) batteries.

AEV has appointed a dedicated project manager and discussions with strategic downstream industry participants are also ongoing, it says.

The $20m market cap stock is up 10% year-to-date. It only had $900,000 in the bank at the end of December, which means some sort of cap raise is probs imminent.

AEV share price chart

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.