Resources Top 5: Bargain gold stocks flying high on big hits

Pic: Stockhead, Getty Images

- Gold explorer Dateline up 35% before going into trading halt

- Wia Gold says Kokoseb “has the potential to become a major gold project”

- Lion One Metals uncovers major gold ‘feeder structure’ beneath current ~650,000oz Tuvatu project resource

Here are the biggest small cap resources winners in morning trade, Tuesday June 7.

DATELINE RESOURCES (ASX: DTR)

(Up on no news)

The advanced gold explorer jumped ~35% on no news before going into a trading halt “to plan and secure commitments from sophisticated and professional investors in relation to a proposed capital raising”.

DTR should be back trading on or before 9 June, it says.

Yesterday, it announced a colossal 100m intercept grading 4.16g/t gold from a down-hole depth of 79.24m at its ‘Colosseum’ project in California.

The hole, punched down the guts of the known system, was mostly designed to confirm historic drilling data.

Still, it was an epic hit.

A maiden JORC resource estimate is coming soon, DTR says.

Like MC Hammer, Colosseum operated in the late 80s-early 90s, producing a lot (344,000 oz) of gold before closing due to over supply and subsequent low demand.

Prior to mining, a resource of 1.1 million ounces had been defined, with DTR attracted to the potential of the remnant resources that hadn’t been removed.

The $62m market cap stock is up 84% year-to-date. It had $2.6m in the bank at the end of March.

WIA GOLD (ASX:WIA)

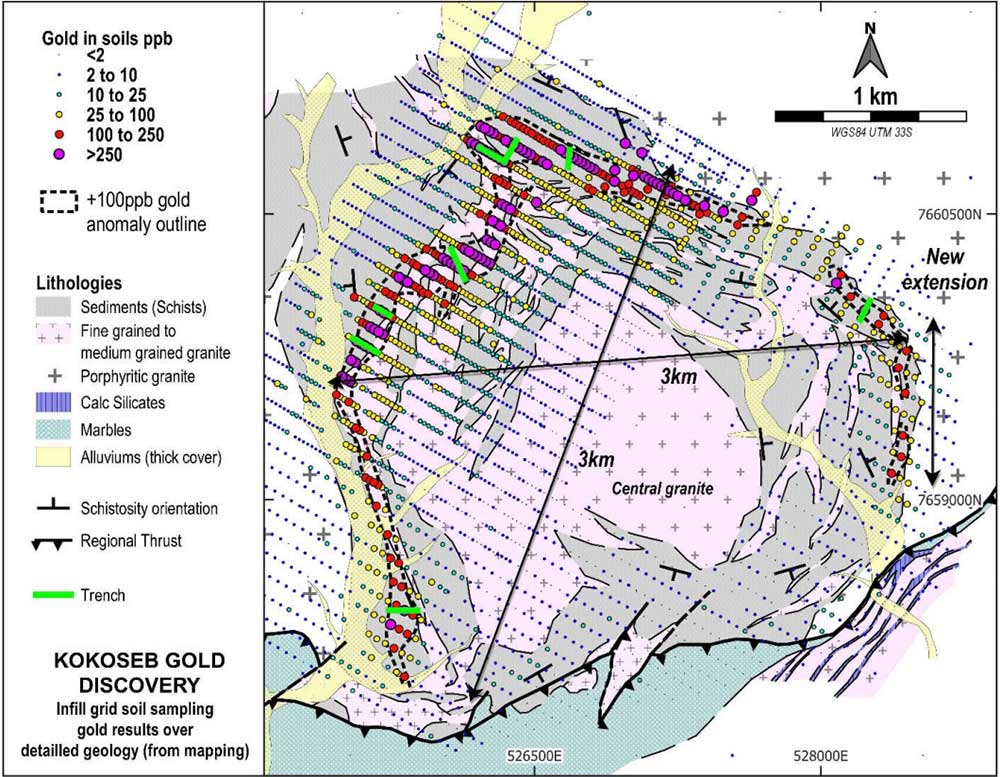

‘Kokoseb’ in Namibia “has the potential to become a major gold project”, WIA says, after the first three holes returned shallow, high-grade hits.

Results include 17.4m at 2.70 g/t gold, 4.8m at 4.38 g/t, 27m at 1.67 g/t and 19.9m at 1.47 g/t.

The diamond drilling program consisted of 12 holes all up, with results of the remaining nine holes expected in July.

Meanwhile, trenching has intersected in situ mineralisation at every location of the gold in soil anomaly, which has been extended by infill soil sampling.

The latest soils extended the Kokoseb anomaly a further 900m on the eastern flank, giving it an approx. diameter of 3km in each direction.

A monster.

WIA now plans to undertake a systematic 20,000m reverse circulation drilling program, with the first drill rig to mobilise later this month.

“We are delighted with these results from our maiden diamond drilling program at Kokoseb, which have defined a significant new gold discovery in Namibia and demonstrate the large-scale opportunity at Kokoseb,” WIA chairman Andrew Pardey says.

“Not only does Kokoseb have scale, as shown by the most recent soil sampling results and by the in-situ mineralisation intersected in trenches, it also hosts high-grade mineralisation, with all three diamond drillholes returning high-grade gold intercepts.

“Our progress at Kokoseb, which has been one of progressive acceleration, now has significant momentum, with a 20,000-metre reverse circulation drilling program and further follow up programs to commence shortly.”

The $33m market cap stock formerly known as Tanga Resources is 27% year-to-date. It had $4.8m in the bank at the end of March.

R3D RESOURCES (ASX:R3D)

(Up on no news)

A failed public relations firm reskinned as a copper-gold-zinc-silver explorer via its mid 2021 takeover of Tartana Resources?

Meet R3D, where the new focus is to advance its small copper sulphate project in Queensland into production in the second half of 2022.

R3D aims to produce 6,000 to 7,000tpa of copper sulphate, which was selling for about $3,513/t late April. That is a decent margin at production costs of about $854/t.

In Tasmania, Tartana is selling low-grade zinc furnace slag/matte from its Zeehan stockpiles.

The next stage in this project requires Stage 2 permitting to crush the slag and access the northern stockpile. This process has moved on to the advertising stage, R3D said yesterday.

These two projects have the potential to generate a cash flow to underpin the R3D’s extensive exploration activities in the Chillagoe region of QLD.

The $12m market cap stock is down 20% year-to-date. It had ~3.7m in the bank following a recent placement and cap raise.

LION ONE METALS (ASX:LLO)

The TSX-ASX listed stock spiked to ~2-year highs after uncovering a major new gold ‘feeder structure’ beneath the current ~650,000oz resource at the ‘Tuvatu’ project in Fiji.

Hole TUG-141 pulled up the longest high-grade intercept yet recorded at Tuvatu — 20.86 g/t gold over 75.9m, including 43.62 g/t gold over 30m.

“I believe this new robust high-grade gold feeder mineralization encountered by hole TUG-141 represents a substantial discovery for Lion One,” CEO Walter Berukoff says.

“The notable high grades and continuity of mineralization of this intercept demonstrate Tuvatu’s potential to become a large-scale, high-grade underground gold mine.

Berukoff says he has long encouraged the LLO team to find that “gold room” at Tuvatu.

“Hole TUG-141 leads me to believe they have found it,” he says.

“We have only to look at other notable large alkaline Au deposits as direct analogues to better understand what this latest discovery tells us, and it is clear that the discovery of a major high-grade feeder such as this should be viewed as very promising.

“I am confident that Tuvatu will one day fall in the ranks of notable multi-million-ounce Au deposits such as Porgera and Vatukoula.”

Porgera –which produced +20Moz between 1990 and 2017 — is the second largest mine in Papua New Guinea and one of the world’s top ten gold mines.

ALVO MINERALS (ASX:ALV)

(Up on no news)

In a nice salvo to Alvo, Stockhead contributor Guy le Page says ALV’s ‘Palma’ copper-zinc project in Brazil “ticks a lot of boxes”.

“Size does matter in mining and ALV is consolidating more ground along a 60km strike, proximal to infrastructure, where recent exploration has continued to highlight the high-grade Cu-Zn volcanogenic massive sulphide mineralisation potential which already includes a 4.6Mt JORC Resource grading 1% Cu, 3.9% Zn, 0.4% Pb and 20g/t Ag,” he says.

“I believe the potential to outline mining resources well in excess of +10Mt of high-grade Cu-Zn is very real here and with an enterprise value of only $10 million, there is plenty of blue sky left in the ALV share price.”

The now-$20m market cap stock is down 10% year-to-date. It had $7.1m in the bank at the end of March.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.