Resources Top 5: ASX ressies bucking the trend as markets start to bounce

Pic: Getty Images

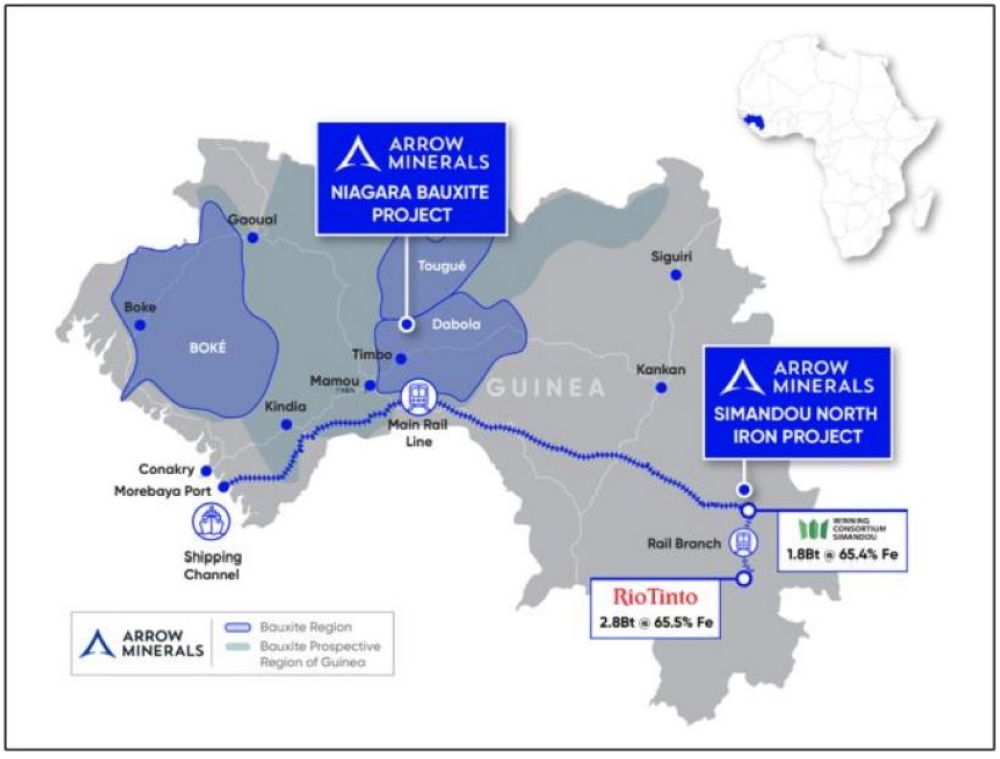

- David Flanagan’s Arrow secures Niagara bauxite project in Guinea

- Arizona Lithium’s pilot plant pumps out first battery-grade Li carbonate

- Iceni Gold, Metal Hawk and Helix all rise on recent gold hits

Here are the biggest small cap resources winners in morning trade, Wednesday, August 7. Prices accurate at time of writing.

As the markets start to bounce back, ASX resources small caps are still relatively quiet, however a few juniors are bucking the trend with fresh and pending news across gold, lithium and bauxite.

Arrow Minerals (ASX:AMD)

An exploration target of 170-340Mt for AMD’s Niagara bauxite project in Guinea has been produced and has investors buzzing in early trade today.

AMD reckons there’s good synergies between Niagara and its Simandou North iron ore project – both have access to multi-user rail for the transport of bulk commodities and other infrastructure being developed for the giant US$23.2 billion Simandou iron ore project.

“Since this project was last drilled by Vale in 2007, there have been some very encouraging developments,” AMD MD David Flanagan says.

“Global demand for bauxite has more than doubled from ~210Mtpa to ~440Mtpa, we’ve seen continued strength in bauxite pricing ~US$75/t and importantly, a multi-user railway is about to arrive, due for commissioning from late 2025.”

Flanagan is no stranger to developing bulk commodity projects. He steered Atlas Iron from a junior explorer to an ASX top 50 iron ore producer which was bought by Gina Rinehart for $390m.

Shares in the junior rocketed 50% to 0.3c on the news.

Arizona Lithium (ASX:AZL)

First lithium carbonate from AZL’s pilot plant at its Prairie project in Canada has been produced using direct lithium extraction (DLE) tech and the first commercial production well at Pad #1 has been drilled.

The milestones are sending the lithium-brine developer well on its way to becoming a fully-fledged producer, especially because Pad #1 has recveived a conditional $21.6m investment incentive by the Saskatchewan government.

Full production is set to begin at the 6.3Mt LCE Prairie next year, pumping out battery-grade lithium carbonate.

For now, the pilot plant material is being put up in the shop window for potential project partners to test.

“Producing battery grade lithium carbonate from our flowsheet is an important step in showing the market the quality of product that we can produce,” AZL MD Paul Lloyd says.

“The battery grade product we produced is in sufficient quantities to go out to all the offtakers and strategic partners we are in conversation with.”

Shares rose 12.5% to 1.8c per share.

Iceni Gold (ASX:ICL)

(Up on no news)

Relatively quiet since a massive 300% gain on the back of its Christmas Gift gold discovery at 14 Mile Well in May, ICL is bouncing back up the charts after a staggered three-month sell-off in share price down to 3.1c.

The junior exposed multiple “spectacular” gold-bearing quartz veins across a 20km-long strike length and produced a 9.5oz gold doré bar from a sample trench that had ridiculous grades in rock chips of up to 18,207g/t.

Interestingly, the prospect is about 750m south of the historical Castlemaine mine, which produced 5.6Moz.

A six-hole diamond drill program was completed in July to evaluate the gold-laden structure, with assays still pending.

“This recent program has yielded some positive geological indicators that will provide [an] important baseline date to support further work in both targets,” ICL MD Wade Johnson said a week ago.

“In particular, the geology intersected in hole FMDD0052 is a very exciting and important development for the 14 Mile project and the company.

“The hole was originally planned as a +1000m deep EIS hole to evaluate a possible buried granite at depth, but we have intersected a totally unexpected volcano sedimentary package that is still open at depth and we are yet to complete the hole.”

Shares in the $10.9m market-capped gold hunter have gone north again, up 35.5% to 4.2c.

Helix Resources (ASX:HLX)

(Up on no news)

Something’s a-rumblin’ around gold minnow HLX, which, last heard, has found prospective “Tritton-style copper-gold” at the Collerina copper trend, part of its Eastern Group Tenements near Nyngan in NSW.

It’s got a whopping chunk of land that covers 1570km2 directly south and along strike of Aeris Resources’ (ASX:AIS) Tritton processing facility and several operating copper-gold mines.

Some 600 augur sample assays confirmed both copper and gold mineralisation and the explorer said it was continuing infill and extension augur sampling, AC drilling and detailed assessment of the anomaly to delineate future targets.

“The results demonstrate this is a major prospective zone and the signatures we are observing in the data are consistent with signatures for Tritton-style copper gold deposits,” Helix MD Kylie Prendergast says.

Shares in HLX are up 16.67% to 0.4c per share and up 40% for the month at time of writing.

Metal Hawk (ASX:MHK)

(Up on no news)

Another 20% rise for MHK today as the rock chips up to 20.2g/t the explorer sampled at its Siberian Tiger prospect at Leinster South are still piquing investor interest.

The targeted area is on the southeastern limb of the Agnew Greenstone Belt and 15km from the Lawlers mining centre (which produced 4.5Moz at 5g/t gold) in the WA Goldfields.

The $8.35m market-capped MHK’s shares pumped 32.1% on Monday and are up again today to trade at 8.4c per share.

At Stockhead we tell it like it is. While Arizona Lithium is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.