Resources Top 5: Aruma has it… antimony that is, as juniors rise on Hemi-style digs

Pic: Getty Images

- Exploration at Fiery Creek hits into multiple high-grade copper and antimony mineralisation

- Metals Australia, New Age Exploration start digging near +10.5Moz monster gold deposit

- Stavely reinforces high-grade copper prospectivity

Here are the biggest small cap resources winners in morning trade, Tuesday, September 10. Prices accurate at time of writing.

Aruma Resources (ASX:AAJ)

One way to put a nitro booster up a stock at the moment is to uncover high grades of two hot commodities at the same time – and AAJ has done just that.

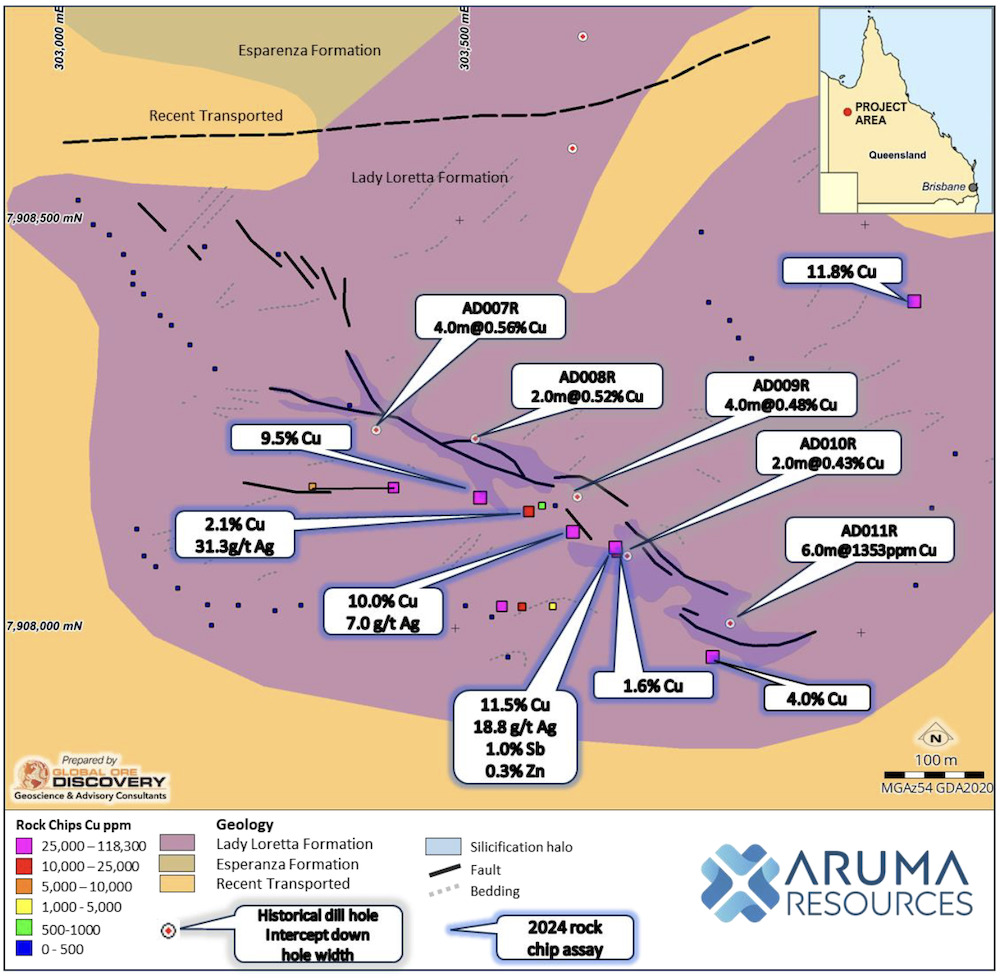

Assays from initial surface sampling of rock chips at its Fiery Creek project in the Mt Isa copper belt in QLD has cropped up multiple, very high-grade copper (Cu) and antimony (Sb) grades.

Mineralisation was found to be consistent across 600m of strike at the Piper prospect and include grades of up to 11.83% Cu and 10,883ppm Sb – along with high-grade silver (Ag) assays up to 31.3g/t.

The assays confirm historical rock chip samples at the target area, which contained 36% Cu, 25.4% Cu and 15.2% Cu.

Fiery Creek is a freshly acquired asset, part of a portfolio expansion for early-stage projects in May this year where Aruma also snapped up an IOC-uranium project near BHP’s (ASX:BHP) prolific Olympic Dam operations and Bortala – another copper play in Queensland.

“While still conducting early-doors fieldwork at Fiery Creek, it’s always encouraging to hit into past results and expand a target area for future stages of exploration,” AAJ MD Glenn Grayson said.

“These results, in conjunction with historic exploration results, help provide key base-line data for our next phase of field work.

“Ground-based geophysical surveys are planned in the coming weeks, with the aim of defining targets for a maiden drilling program.

“Also of significant, wider importance is that the data generated from soil sampling to date indicates strong copper anomalism across the Fiery Creek project, beyond the initial Piper and Fiery Creek targets.”

AAJ has been hugely traded and the stock went galactic in early trade, up 143%, with daily gains still swapping up 119% at 3.6c a share at time of writing.

Metals Australia (ASX:MLS)

They say things come in threes and it’s no different for explorer MLS, where drilling and exploration is kicking off across (you guessed it!) three projects in WA and the NT, testing for gold, lithium-pegmatite and nickel-copper-cobalt mineralisation.

The tenure is just 10km from SQM and Hancock Prospecting’s Andover lithium discovery, bought in the takeover of Azure Minerals for $1.7bn back in May.

A 6000m AC drill program is underway at its Warrambie project in WA’s Pilbara – a set of tenements straddling the Scholl Shear Zone, which is analogous to the Mallina Shear – and host to the De Grey Mining’s (ASX:DEG) monster +10Moz Hemi gold deposit.

In WA’s Murchison, a 120-hole AC drill program has been permitted to follow an extensive soil sampling and gravity program underway at Big Bell North, prospective for gold as it’s along strike from Westgold Resources’ (ASX:WGX) +5Moz Big Bell deposit.

A third drilling program is also imminent at the junior’s Warrego East copper-gold project within the Tennant Creek Mineral Field, which historically produced a world-class 25Mt at 6.9g/t Au and 2.8% Cu.

Drilling will test a series of gravity and magnetics-defined copper-gold targets within a corridor that links the Warrego mine with CuFe’s (ASX:CUF) combined 7.3Mt at 1.7% Cu Gecko and Orlando copper-gold deposits.

On the back of the news shares in MLS have jumped 15% to trade at 2.3c at time of writing.

Stavely Minerals (ASX:SVY)

Rising in share price for a second day in a row, SVY has laid eyes on copper oxide minerals (azurite and malachite) and copper sulphides as part of a now-completed AC drilling campaign at its Stavely project in Victoria.

While assays are pending, the visual identification of mineralisation bodes well to complement significant historical intercepts at the Junction prospect, which included 35m at 3.44% Cu and 26g/t Ag from 24m to end-of-hole.

The explorer says given the spatial distribution of the past drill holes, there may be a number of mineralised structures within the mineralised zone.

Assays are expected in a few weeks in the expectation they confirm preliminary interpretations of high-grade copper.

Shares in the junior are up >20% this week so far, including 11.5% today to trade at 2.9c.

New Age Exploration (ASX:NAE)

Phase 1 drilling at NAE’s Wagyu gold project in WA’s Pilbara – nestled between De Grey’s tenements and right near its monster +10Moz Hemi gold deposit – has just been completed.

The four-week exploration program involved the drilling and sampling of 156 AC drill holes for a total of 7460m.

It’s looking for the same ‘Hemi-style’ intrusive system and Phase 1 is the start of a thoroughly formulated six-month exploration program.

Phase 2 will include follow-up AC drilling and sampling based on pending results, which NAE says will be crucial to further exploration planning.

Additional ground gravity and passive seismic surveys are also in the mix at Wagyu, including carrying out work on the dry Yule Riverbed.

NAE jumped on the news of Phase 1 being tied off and rose 33% to trade at 0.4c a share.

Noble Helium (ASX:NHE)

After analysing new data that became available for auditor evaluation of NHE’s North Rukwa Western Margin helium resource, larger and higher concentrations of the finite gasseous element have been realised.

The total Western Margin P50 helium prospective resource has now increased by 66%, including Lake Beds by 31% and the deeper Karoo resource jumping a whopping 500% after mapping the 2023 seismic data.

The gas play says the revelation has significant implications for Eastern Margin and a prospective resource update is now in progress.

“This prospective resource upgrade is further confirmation that the North Rukwa basin is a prolific, unique helium-producing system,” NHE CEO Shaun Scott said.

“As I’ve said before we are in the right place with the best house in the best street. I look forward to drilling the shallow targets we are in the process of maturing and confirming commercial flow rates.”

Shares in the $28.5m helium hunter are up 18.2% to trade at 6.5c.

At Stockhead we tell it like it is. While New Age Exploration is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.