Resources Top 5: ARR sails into 40pc intraday green; SI6 set to explore Brazil for REEs

Pic via Getty Images

- American Rare Earths is flying the REE flag today with a very solid, 40% gain or thereabouts

- And talking of things that go “REE”, Si6 Metals is set to explore Brazilian clay for mineralisation

- Meanwhile RareX, Arizona Lithium and Macro Metals are also turning heads

Here are some of the biggest resources winners in early trade, Monday February 12.

American Rare Earths (ASX:ARR)

No, it’s not International Talk Like a Pirate Day – that’s September 19. But nevertheless, avast ye hearties and so forth, because ARR has hoisted the main sail and… look, we’re sick of this analogy already. Just know it sailed into 40%+ waters a bit earlier today.

And that’s possibly on the heels of Friday’s investor presentation, and late news that chairman Ken Traub has been replaced by non-executive director Richard Hudson. Traub isn’t walking the plank – he’s set to remain an integral and valued leader for the company – on the board as a non-executive director.

Suppose you want a few highlights from said presentation? Righto then…

• ARR has the largest ASX-listed portfolio of strategic rare earth element assets in the US.

• Its flagship Halleck Creek Project (100% owned) has, says the company, potential to be largest rare earths deposit in the US.

• ARR has projects across southwest US in favourable mining jurisdictions together covering 17,400 acres.

• As of February 2024, the company’s JORC REE resource is 2.34 billion tonnes.

• 1.42 billion tonnes of measured and indicated resources were estimated at a grade of 3,296 ppm TREO using a 1,000ppm TREO cut-off.

• And how about its coffers? Healthy, sitting at a $6.3 million cash position at last count, and $5.2m in invested assets.

ARR share price

Si6 Metals (ASX:SI6)

Explorer SI6 is looking far and wide for the list of minerals in its growing portfolio. Including Brazil.

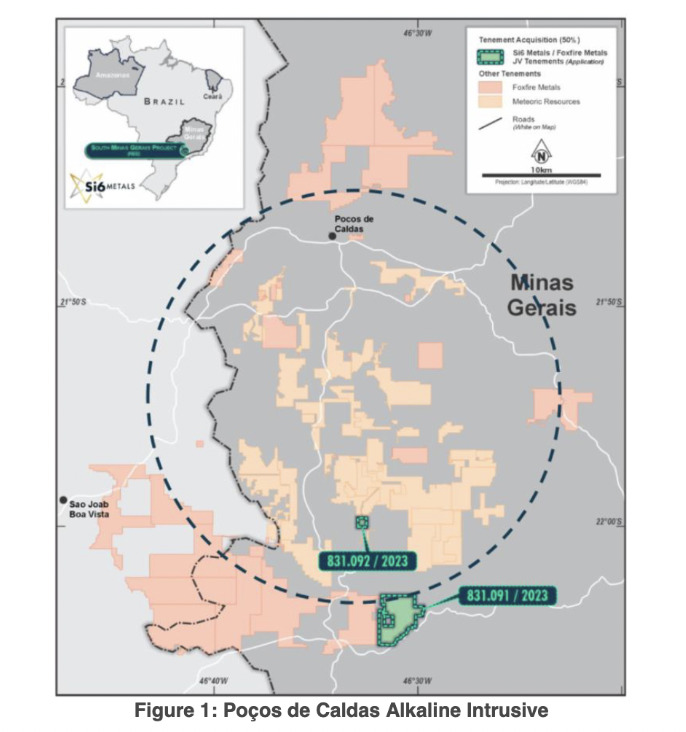

And that’s where its main news stems from today, with a reveal that its maiden exploration (Phase 1) program is set to commence at the Caldera Project in the Pocos de Caldas Alkaline Intrusive, which will be targeting Ionic Adsorption Clays (IAC) enriched with REE.

The project area is situated close to Meteoric Resources’ (ASX:MEI) world class Caldeira Project, as well as Viridis Mining and Minerals’ (ASX:VMM) Colossus REE project.

The Phase 1 program will consist of field reconnaissance to identify potential anomalous REE targets for a Phase 2 auger drill program to get underway shortly after.

And two additional exploration programs are planned by SI6, too, in Q2 of this year – in Brazil’s Lithium Valley, targeting lithium-hosting spodumene from pegmatites at the Araçuai project (adjacent to Atlas Lithium and ~25km West of Sigma) and IAC REE at the Padre Paraiso project.

Over to you, SI6 MD Jim Malone:

“We are pleased that exploration work will commence at our Brazilian joint venture projects as we fast track an initial aggressive program at Caldera.

Due to its proximity to the world-class Caldeira Project discovered by Meteoric Resources, we are confident we are in the right areas to make a significant discovery.”

SI6 is up nicely today with a 25% gain at time of writing, although that may have changed by the time you’re looking at the chart below. It’s also currently up about 11% for the week.

SI6 share price

RareX (ASX:REE)

(Up on no news)

And also talking of things that go “REE”, RareX is also well up today, with a current 35%+ intraday gain.

What’s doin’? Mining Geek has an idea:

RareX (ASX: REE) advances Australia’s largest undeveloped rare earth deposit at Cummins Range, WA. Updated mineral resource estimate confirms its potential as a key supplier for neodymium-praseodymium magnets and lithium iron phosphate batteries. #mining #ASX @rarex_asx pic.twitter.com/1zJQpUbr95

— Mining Geek (@mining_geek2) February 9, 2024

Per recent reports released by the company, 2023’s infill drilling at the company’s flagship Cummins Range Rare Earths & Phosphate Project increased the indicated resource 10% to 77Mt, improving definition in readiness for DFS mine scheduling, noted RareX.

The updated Mineral Resource Estimate for the project revealed: 524Mt at 0.31% TREO and 4.6% P2O5 for 1.6 million tonnes of contained TREO and 24 million tonnes of contained P2O5.

The company noted that: “High-value NdPr content represents an excellent 22% of total contained TREO, with 353Kt of NdPr contained.”

Cummins Range, in the Kimberley region of WA, remains the largest undeveloped rare earths project in Australia.

REE share price

Arizona Lithium (ASX:AZL)

Where’s the lithium love in this Valentine’s Day week? AZL is bringing it, with a double-digit gain at time of key tapping.

Arizona Lithium recently appointed Rhythm Engineering as the drill contractor for the upcoming program at the Prairie lithium project in Saskatchewan, Canada, that will test two deeper brine formations.

Arizona Lithium has appointed Rhythm Engineering as the drill contractor for the upcoming program at the Prairie lithium project in Saskatchewan, Canada, that will test two deeper brine formations.https://t.co/DSjYBWqHiw #ASX @ArizonaLithium

— Stockhead (@StockheadAU) February 6, 2024

Meanwhile, the company reports today that the pilot phase at Prairie is now in the final phase of operation.

The Direct Lithium Extraction (DLE) pilot plant at the project has reportedly processed more than 200,000 litres of brine and produced more than 13,500 litres of lithium concentrate, representing approximately 80kg of Lithium Carbonate Equivalent (LCE).

Prairie has a resource of 6.3Mt of contained lithium carbonate equivalent – including 4.5Mt in the higher confidence indicated category – and benefits from being in one of the world’s top mining friendly jurisdictions with easy access to key infrastructure including electricity, natural gas, fresh water, paved highways, and railroads.

AZL notes that the pilot plant has “operated exceptionally well over the past three months, producing very high quality and consistent results”.

At present, the data is currently being used to finalise the design and engineering of the commercial DLE facility, and the company will be releasing full results from the pilot soon.

AZL share price

Macro Metals (ASX:M4M)

Macro Metals has reached an agreement with Aurora Energy Metals (ASX:1AE) to extend the exclusivity period in relation to Macro Metals’ proposed acquisition of an 85% interest in the lithium rights over the Aurora Energy Metals Project in Oregon, USA, announced to the market back in late November last year.

“In consideration for the extension of the exclusive option period, Macro Metals has paid Aurora an additional A$50,000 in accordance with the terms of the agreement,” reads an ASX announcement made by M4M this morning.

As a result, the exclusive option period has been extended until 7 May 2024.

Due diligence activities with Aurora are currently progressing.

$M4M has mutually agreed with @Aurora_1AE to extend the exclusivity period by 3-mths in relation to the proposed #acquisition of an 85% interest in the #lithium rights over the Aurora Energy Metals Project, as announced on 14/11/23.

Read more here: https://t.co/U1favStpko pic.twitter.com/FGvfpkfvVu

— MacroMetals (@MacroMetals) February 11, 2024

Macro Metals (formerly Kogi Iron Limited) is a Perth-based explorer now making lithium moves in a major US lithium hotspot, but otherwise is primarily known as an iron ore-producing hopeful in West Africa, with a portfolio of iron ore projects also in the Pilbara and mid-west regions of WA.

M4M share price

At Stockhead we tell it like it is. While Arizona Lithium is a Stockhead advertiser at the time of writing, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.