Resources Top 5: Another potential gold merger leads the headlines

If the deal is approved, Maximus and Astral could consolidate their assets in Kambalda. Pic: Getty Images

- Maximus Resources fields 7c per share takeover offer from Astral Resources

- Green Critical Minerals, Bowen Coking Coal among no news gainers

- Two gold plays also see price moves/strong>

Your standout small cap resources stocks on Monday, December 30, 2024.

MAXIMUS RESOURCES (ASX:MXR)

The company has received a bid from Kambalda neighbour Astral Resources (ASX:AAR) for 7c per share by way of an all-scrip, off-market takeover.

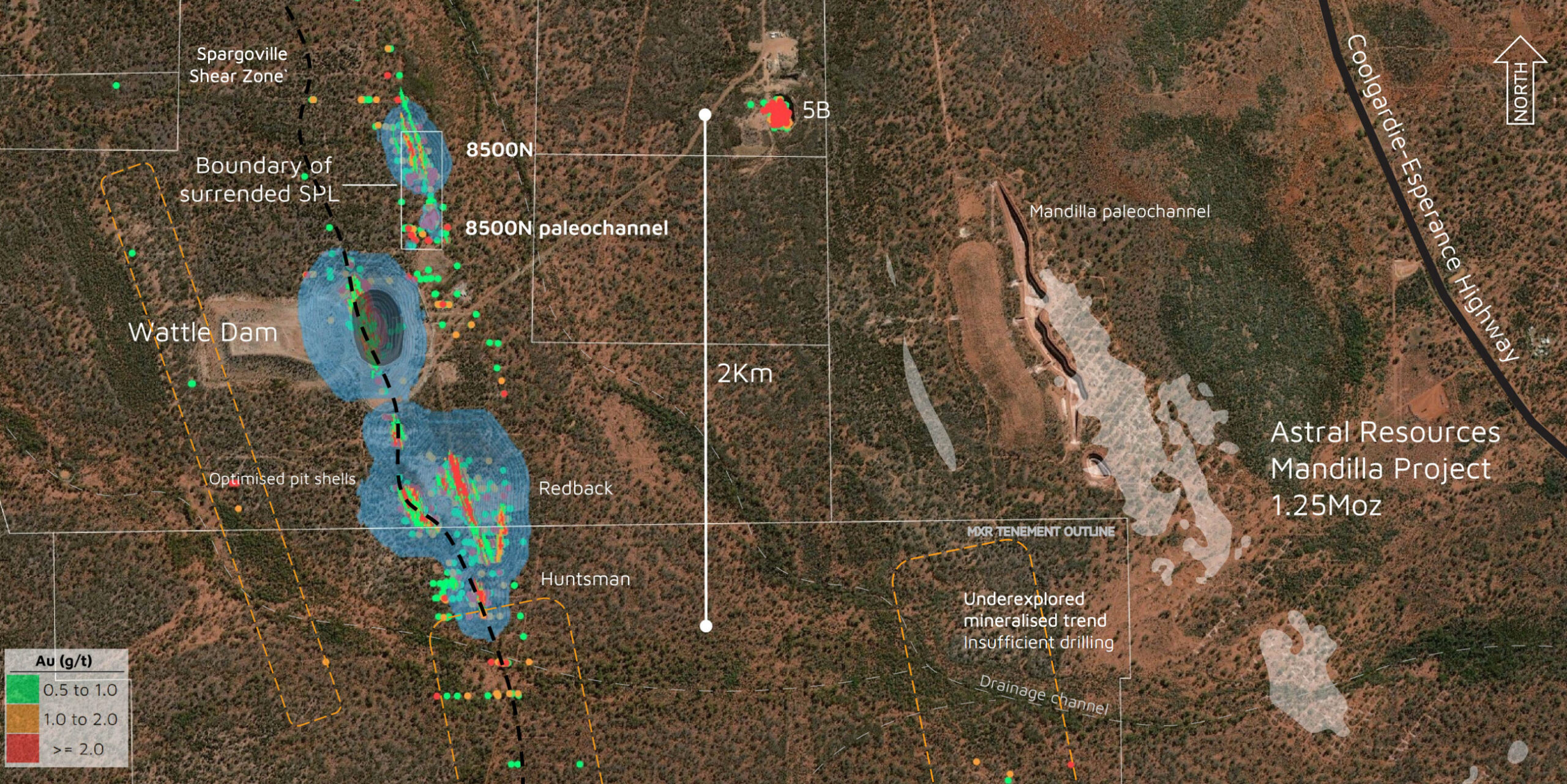

The move could see the parties combine to create a company with a substantial resource inventory of around 1.8Moz, consolidating key assets in the Kambalda region of WA’s Eastern Goldfields.

Astral boasts over 1Moz of gold in its growing Mandilla and Feysville projects near the famous Goldfields mining town and has long been mooted as a logical target for South African giant Gold Fields, which needs additional material for its St Ives gold mine.

On the flip side, $23 million capped MXR owns the ~250,000oz Wattle Dam gold project, the lower grade material (5.4Mt at 1.45g/t) identified after Ramelius Resources mined the extraordinarily high grade and nuggety gold found near surface in its early stages as an ASX listed gold miner (267,000oz at 10.6g/t from 2006-2012).

Astral considers the transaction a “compelling opportunity for Maximus shareholders”, who would also benefit from significantly more share liquidity and no near-term capital raising requirements.

Not to mention, the offer price represents a 56% premium to Maximus’ last closing price of 4.5c on December 24, 2024.

“The proposed offer price also represents a value of $91/oz based on the current Maximus published JORC-compliant mineral resource estimates,” AAR said.

The Maximus Board has not made a final determination, but has agreed to progress due diligence and negotiations of a binding transaction implementation deed with Astral on an exclusive basis.

In the meantime, AAR entered into two separate share sale agreements to acquire approximately 85.5 million Maximus shares, representing a stake of around 19.99%, and the largest in MXR.

If a merger comes to life it would create among the largest junior gold resource holders in the WA gold space.

GREEN CRITICAL MINERALS (ASX:GCM)

(Up on no news)

GCM has begun construction on a pilot plant in New South Wales to produce VHD graphite blocks for use as heat sinks in the high performance computing sector and solar-thermal energy storage systems.

Invested by scientist Professor Charles Sorrell and a team working at the University of New South Wales, the very high density – or VHD – graphite blocks can be used in materials for the defence and nuclear industries, electrical discharge machining, thermal energy storage, electronics, aerospace, semiconductors and heat sink appliances.

That takes GCM beyond the currently faltering battery metals supply chain, where prices of a host of commodities have come off the boil due to faltering economic growth in China and oversupply.

The promise of the process is that it can produce block graphite in just 24-36 hours at around half the temperature (1500C v 2900C) of the primary synthetic graphite process.

Similar products currently made today via nuclear and pyrolitic processes can sell for over US$1000/kg in premium markets, GCM says.

Production could start late next year, with commissioning of a pilot plant, already under construction, due in Q3 2025.

GCM is up 180% over the past week, and played a straight bat to questions about its rapid price gains on Friday.

BOWEN COKING COAL (ASX:BCB)

(Up on no news)

Bowen Coking Coal continues to rise after Friday’s charge off the back of what the miner called record quarterly sales from its Burton met coal complex in Queensland.

On Friday, the company, which has focused on reducing its strip ratio to alter its cost base, announced a 31% QoQ lift in coal sales to 544,000t for December so far, a new record for the company.

“The Burton Mine Complex continues at steady-state and we are proud to report another record being achieved, this time a quarterly coal sales record,” CEO Daryl Edwards said at the time.

“Product stockpiles have been depleted to normalised levels and we have now overtaken any sales shortfall previously reported, with 0.96Mt being sold this financial year to date,” CEO Daryl Edwards said.

“This is guiding to the top end of our annual outlook range of 1.6-1.9Mt at the half-way mark of the 2025 financial year. Our focus remains maintaining steady-state production, further cost-improvement, strict capital allocation and striving for improved cash generation from our operations. We are now also looking at expansion opportunities at the Burton Complex.”

It’s some rare good news for long-suffering shareholders, who have seen over 90% lopped off the value of their stock in 2024.

BLACK DRAGON GOLD (ASX:BDG)

(Up on no news)

BDG received some disheartening news earlier this month that its rezoning application, part of the permitting process for the development of the 1.5Moz Salave gold project in Spain, was knocked back by the Tapia de Casariego Council.

Last we were told BDG was assessing the ‘highly frustrating decision’ while it awaits the formal minutes of the meeting, saying there were no environmental grounds to reject the application to rezone its land from agriculture to industrial production.

The company issued a bland no response to a speeding ticket from the ASX on last week, only to climb higher on Christmas Eve as punters filed in before the early close. Chatter online suggests shareholders are hoping some regulatory changes in Spain’s Asturias region, which as an aside recently had its local cider culture enshrined in UNESCO’s intangible cultural heritage list, could be beneficial for Salave.

We put the question to company reps ahead of Christmas but couldn’t get to the bottom of it.

We’ll see what specifics around the Salave development and regulatory environment emerge after the break.

AFRICAN GOLD (ASX:A1G)

(Up on no news)

Back in October, African Gold uncovered a wide, high-grade gold vein of an eye-whopping 65m at 5.6g/t at the Blaffo Guetto prospect at the Didievi project, along with shallow intercepts of 9m at 1.7g/t of gold from 23m and 28m at 1.1g/t from 77m.

Not one for grandiosity, A1G said the results will go towards a ‘positive’ update to Didievi’s existing 4.93Mt at 2.93g/t resource, which at a 1g/t cut off translates to 452,000oz.

Didievi has other exciting prospects that remain substantially untested, says the explorer, including the Kouassi and Akissi prospects to the north of Blaffo Guetto and the 11km-long Poku gold trend located to the south-west.

A 10,000m drill program is underway at the project, focusing on the high-grade zone at Blaffo Guetto.

“Having such a diverse range of high potential targets within a single tenement package gives us considerable flexibility in expanding the company’s resource base,” CEO Adam Oehlman said earlier this month.

“With continued success, the Didievi Project has the potential to evolve into a multi-million-ounce gold deposit, positioning us for significant growth in the years ahead.”

At Stockhead, we tell it like it is. While Astral Resources and Green Critical Minerals are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.