Resources Top 5: Alto sings like a Brightstar as Gold M&A lights up the market

Alto, Brightstar, Gateway: The Sandstone gold merger is the latest ASX supergroup. Pic: Getty Images

- Alto Metals surges on Brightstar merger, as gold consolidation takes centre stage ahead of Diggers and Dealers

- Constellation and European Metals up on no news

- Which explorer is poking the bear by getting their Diggers presso in early?

Here are the big small cap resources winners in morning trade, Friday, August 2.

Alto Metals (ASX:AME) & Brightstar Resources (ASX:BTR)

We’re on the cusp of Diggers and Dealers, the Kalgoorlie gabfest known as the Australian mining industry’s biggest party.

And while most resources stocks have been down in the tailings storage facility this past year, a couple juniors with a fine yarn to spin around the booths at the Goldfields Arts Centre marquee will be Alto Metals (ASX:AME) and Brightstar Resources (ASX:BTR).

They announced a merger late yesterday, coincident with a $24 million fundraising for acquirer BTR, with Alex Rovira’s ambitious but small gold explorer-cum-producer taking a shine to Alto’s roughly 1Moz resources around the Sandstone gold district.

One of Australia’s historic gold fields stationed in the Mid West, it’s seen little in the way of activity since the departure of Troy Resources for South America, the former WA gold miner having left behind a now disused mill and a swag of ground largely untested by modern exploration.

$46 million capped AME shares were up in the order of 75% this morning as news of the consolidation play became tradeable.

The 4:1 Alto scheme comes in the form of scrip equivalent to 6c in cash, 82% above Alto’s last closing price of 3.3c and 81% up on its 30-day VWAP.

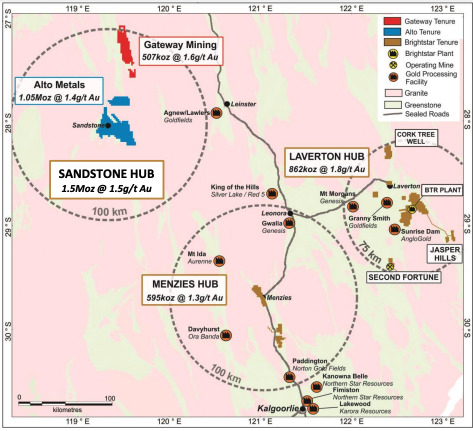

With Brightstar also picking up the Montague project from Gateway Mining (ASX:GML) in a $14m cash and scrip deal, the consolidated company will have three gold fields in its portfolio including a 1.5Moz hub at Sandstone with two smaller hubs around Laverton and Menzies.

BTR shareholders will hold 66% of the final entity, with 29% controlled by Alto and 5% Gateway.

The pitch is that the combined company, which will boast $31m in cash post raising, will aim to become “a multi asset mid-tier WA gold producer,” with a further 50,000m of drilling expected to be rolled out at Sandstone in the near term. The historic gold field, of which BTR will control over 1000km2, has produced 1.3Moz across its history.

Definitive feasibility studies are also due for the Menzies and Laverton gold projects in the first half of 2025, cashflows BTR’s Alex Rovira said it plans to use to fund investment in the Sandstone and Montague East projects.

“The Scheme announced today is a key step towards building a significant gold business and provides Alto shareholders with an exciting opportunity to become part of an emerging gold producer,” Alto’s MD and future BTR non-exec director Matt Bowles said of the scheme.

“In addition to delivering a significant premium, the Scheme, if approved and implemented, will allow Alto shareholders to retain ongoing exposure to the development of the Sandstone Gold Project, as part of a larger resources group holding multiple projects, which will reduce the risks associated with holding a single project.

“We believe this transaction is a great outcome for Alto shareholders and stakeholders, who will benefit from the development of the Sandstone Gold Project as part of an enlarged gold company with an exciting future.”

Brightstar shares rose 13.33% on the news as well, while Gateway’s fell 4.35% having risen 10% yesterday.

Constellation Resources (ASX:CR1)

Up on no news

Does someone know something we don’t? Constellation Resources is flying today, up 38% on barely a whiff of news.

The stock is one of the more curious exploration plays on the ASX, having originally spun out of Gabon-focused gold and base metals explorer Apollo Minerals (ASX:AON) to place a telescope on nickel and copper targets in the Fraser Range near IGO’s (ASX:IGO) Nova nickel mine.

The inclusion of former Mincor Resources boss Peter Mucilli as technical director certainly makes sense for a base metals explorer.

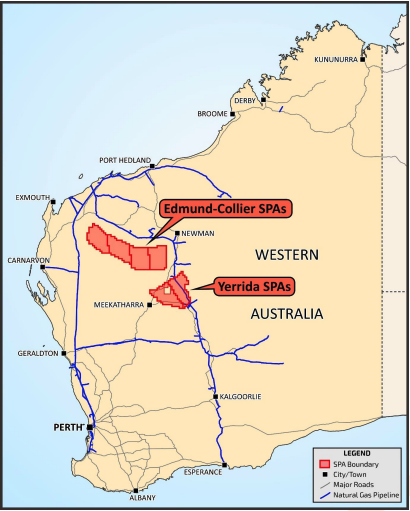

But WA nickel isn’t the most exciting thing right now and CR1 is more fitfully on the trail of naturally occurring hydrogen as the preferred applicant for six special prospecting authorities over 56,192km2 in WA’s Gascoyne region.

The ‘first mover applications’ contain two basin scale opportunities considered highly prospective for natural hydrogen and helium, CR1 said in its quarterly last month.

It comes after an amendment passed in May to legislation governing WA’s onshore petroleum and gas exploration rules, which will also allow for the injection of hydrogen into existing gas pipelines.

That has been viewed as a way to build the demand side for hydrogen. Natural hydrogen exploration comes as an alternative to the main source of hydrogen production currently – product derived from natural gas known as grey hydrogen – and the heavily hyped but as yet not cost comparable green hydrogen sector.

The latter is based off using electrolysers powered by renewables to split water into its components of hydrogen and oxygen.

The only known producing natural hydrogen field is Bourakebougou in Mali, Constellation says, generating carbon free electricity since 2012, with CR1 believing its Edmund Collier and Yerrida Basin projects have potential to be a larger scale analogue.

CR1 has $2.3m in the bank at June 30.

European Metals (ASX:EMH)

(Up on no news)

Up 13% with little to sing about, perhaps investors are continuing to digest the relative non-event on Wednesday that it was taking more time to finalise the timeline for a DFS on its Cinovec lithium processing plant in Czechia.

It comes with the decision to move the proposed plant from Dukla to Prunerov, a major industrial site which hosts the European country’s largest coal-fired power station, owned by EMH’s project level partner CEZ.

The previous site at Dukla was closer to the proposed mine but found to have limited capacity and support from nearby municipalities.

EMH says there have been process flowsheet improvements leading to better recoveries and higher grades, with concentrate grades lifting from 1.198% Li (2.58% Li2O) to a near pure zinnwaldite con at 1.46% Li (3.14% Li2O).

Recoveries were running at around 80% including the removal of gangue, or waste, material. Work is also ongoing on processing test work for lithium chemicals.

There’s plenty of sidebars to this one, including a funding application to the Czech Republic’s “Just Transition Fund”, so we’ll just leave you with exec chair Keith Coughlan’s summary:

“Whilst it is disappointing to not be able to provide a formal completion timeline for the definitive feasibility study at this time, it is very pleasing to see the progress made and the positive outcomes of the recent testwork optimising our processing plant, in particular in respect to the anticipated reductions in capex and opex.

“The recent commencement of the site geotechnical work is expected to deliver a suitable base for the recommencement of the DFS. These optimisation works, together with the new site, are expected to deliver stronger project economics.

“The progress made by Geomet (the project’s holding company) with regards to Just Transition Fund support and the approval given by the Regional Standing Conference for funding again indicates the level of support for the Cinovec Project has at all levels of government in the Czech Republic.”

EMH’s response today has the hallmarks of a rebound after a sell off yesterday.

Noronex (ASX:NRX)

Noronex, the copper junior which has ASX giant South32 (ASX:S32) on board to find it some Kalahari copper belt discoveries in Namibia via a $15m earn-in and JV deal, was up 15.5% this morn after dropping its Diggers presso some three days early.

Well done on that, Diggers Monday is the sort of crowded marketplace where you go to lose a child.

As an aside, one of the bugbears of the sometimes curmudgeonly but always warm late Diggers administrator John Langford, whose name now adorns the event’s media room, was the “Diggers and Dealers presentations” dropped by companies who weren’t actually presenting at the forum.

As another aside, no one will match the impact (not necessarily positive) of David Flanagan’s extremely direct presentation while at the helm of Delta Lithium (ASX:DLI) last year.

READ: Diggers and Dealers: Who dug a hole with their presentation at mining’s biggest talkfest?

They say simplicity is the ultimate sophistication. The share price reaction after Flanno dropped the ‘big and very good’ slide may say otherwise.

Noronex has fallen into no such pits with its pre-event drop, reminding the market of its ownership of one of the larger deposits in the Kalahari copper belt, the 10Mt at 1.3% Cu Witvlei in Namibia.

It sits down the end of a long and very much interpretive road from Sandfire’s Motheo and the now Chinese owned Khoemacau mine, together producing around 90,000t of copper a year and rising.

At Stockhead, we tell it like it is. While Brightstar Resources was a Stockhead advertiser at the time of writing, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.