Resources Top 5: A tale of big pegmatite hits, massive gains, and an ill-timed trading halt

Pic: Via Getty

- Forrestania Resources explodes higher after hitting pegmatite in 13 of 14 drill holes at the Calypso prospect; now in trading halt

- Nearby junior Riversgold also up on no news in early trade

- Lincoln Minerals hitting broad zones of shallow, high-grade graphite at 3.88Mt Kookaburra Gully project

Here are the biggest small cap resources winners in early trade, Tuesday June 27.

FORRESTANIA RESOURCES (ASX:FRS)

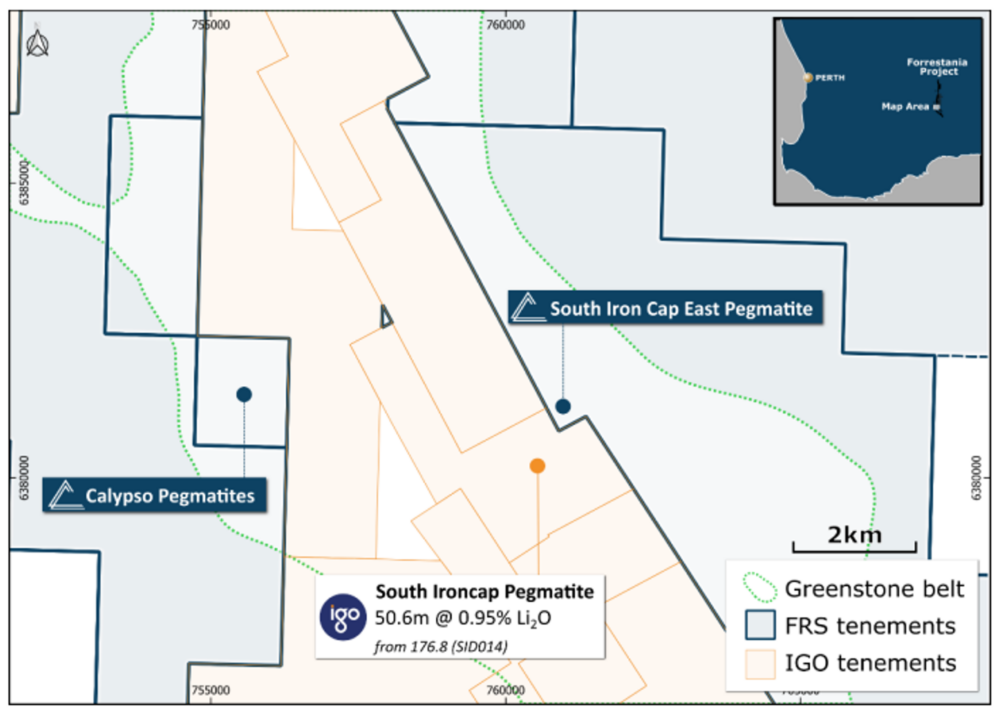

The junior explorer exploded higher on huge vols after hitting pegmatite in 13 of 14 drill holes at the Calypso prospect, part of the Forrestania project in WA.

Pegmatite is a type of rock that can contain lithium, as well as other valuable commodities.

The thickest intercept (probs not true width) was 63m, the company says.

Assays are due in ~6 weeks.

Drilling is ongoing at the nearby South Iron Cap East prospect, right next door to IGO’s (ASX:IGO) South Ironcap peggie where intercepts include 50.6m at 0.95% lithium:

“It’s fantastic to confirm that there are further pegmatites of significant thickness within Forrestania tenure,” says FRS boss Mike Anderson, who came to the company from ill-fated gold miner Firefinch.

“Calypso is only ~4.5km from a known mineralised pegmatite (South Ironcap), so any occurrence of pegmatite within this area is significant to Forrestania.”

FRS went into a halt mid-morning “pending a further announcement”.

$FRS – Pause in Trading already? pic.twitter.com/4z86SgEloy

— Para (@Para_Tweet) June 27, 2023

“Forrestania Resources requests a trading halt of the company’s securities, with immediate effect pending a supplementary table to be included for the purposes of visual estimation in Figures 5 and 6 on page 4 of the announcement dated 27 June 2023 ’63m pegmatite intersected at maiden Calypso drilling’,” it says.

“It is expected the trading halt will end on the earlier of the commencement of normal trading on Wednesday 28 2023, or when the announcement of the additional information relating to the announcement is lodged.”

The $17m capped stock is up 55% year-to-date.

LINCOLN MINERALS (ASX:LML)

LML is hitting broad zones of shallow, high-grade graphite alongside the existing 1.85Mt @ 9.8% Koppio resource, part of the 3.88Mt Kookaburra Gully project in South Australia.

New results include a highlight 29m @ 12.65% total graphitic carbon (TGC) from 60m, including 13m @ 18.24% TGC from 69m.

Graphite mineralisation remains open and undefined to the north and the south, the company says.

LML will update the resource using this latest data, as well as a 2017 mining feasibility study on the project. Fresh drilling is also planned.

“Lincoln has met key objectives of the Q1 drilling program in expanding the size and confidence in the Koppio mineralised area of the Kookaburra Gully graphite resource,” LML boss Cath Norman says.

“Our forward plan includes upgrading our inventory of mineral resources at Koppio and additional drilling in late 2023 which will focus on the Kookaburra Gully extension prospects that correlate well with electromagnetic anomalies that are, to date, indicating graphite mineralisation.

“These are important tasks to accomplish as we review and upgrade the 2017 Mining Feasibility Study.”

LML spent over two years in bourse purgatory, finally relisting on the ASX in January this year after working out its finances.

The $9m capped stock had $1.8m in the bank at the end of March.

RIVERSGOLD (ASX:RGL)

(Up on no news)

The former goldie has pivoted to lithium and REE exploration in a big way.

It has four main projects: ‘Pilbara’ (lithium), ‘Mt Holland’ (lithium), ‘Mt Weld’ (REEs), and ‘Northern Zone’ (gold), all in WA.

Mt Holland is near the FRS tenure which explains its share price movement in early trade today.

Earlier this month RGL also reported initial assays up to 2,200ppm (0.22%) REEs at the Mt Weld JV, right next door to Lynas’ (ASX:LYC) tier 1 Mt Weld mine.

By mid-June it had drilled five holes of an initial seven-hole (~2,000m) reverse circulation (RC) program. Remaining assays are pending.

The $21m capped stock is down 46% year-to-date. It had $6.3m in the bank at the end of March.

STRATEGIC ENERGY RESOURCES (ASX:SER)

SER has raised $2.5m at a small discount which will be used to drill at the ‘Isa North’ project in QLD and the ‘Achilles’ copper-gold prospect in NSW.

Last week, the junior inked a deal with mining major FMG (ASX:FMG), who will spend up to $8m over six years to earn up to 80% on the ‘Canobie’ IOCG-nickel sulphide project in QLD.

The proposed 2023 exploration program will include drill testing a magmatic nickel and three IOCG targets in August.

Assays are due October, the company says.

“The company is now in a fantastic position and will commence drilling in the coming months with the financial backing of FMG at Canobie, and begin preparations at our other drill-ready projects which will see ongoing news flow well into the new year,” MD David DeTata says.

The $4m capped stock is up 60% year-to-date.

VIKING MINES (ASX:VKA)

(Up on no news)

In late November VKA inked a farm-in deal over the ‘Canegrass’ vanadium project in WA, which has an existing resource of 79Mt at 0.64% V2O5.

The flagship resource is based on just 1.9km of an 8km-long mineralised trend, the company says.

A new exploration target of 144Mt-192Mt at 0.45%-0.99% V2O5 for 1.44-4.19 billion pounds V2O5 was released mid-June.

A 6,000m drilling program currently underway, which is expected to be completed in July.

“With a current vanadium price above A$10/lb, the board is encouraged by the outlook for vanadium, especially given the growth market and commercial uptake of Vanadium Redox Flow Batteries and research in other Vanadium solid state battery technologies,” VKA boss Julian Woodcock says.

The $414m capped stock is up 30% year to date.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.