Resources Top 5: A rutile-graphite monster emerges

Pic: Getty

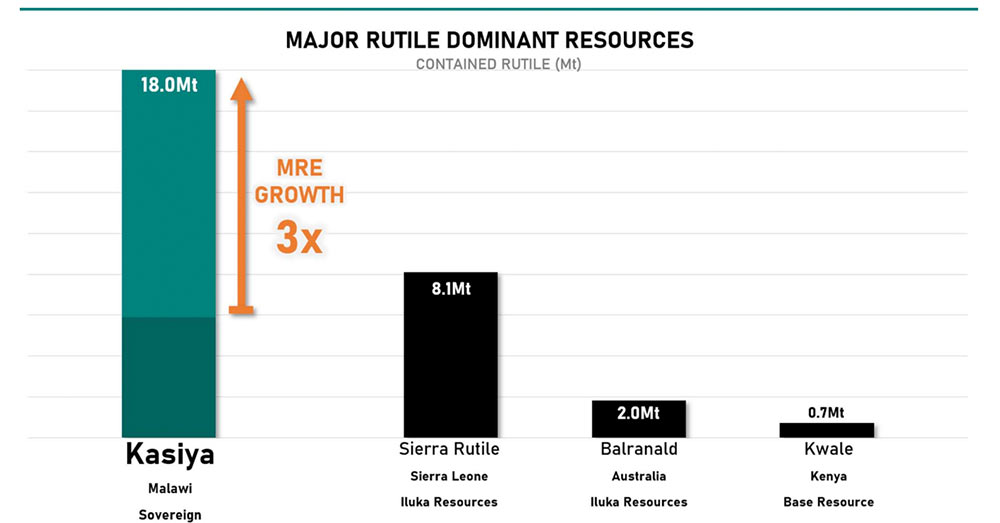

- Sovereign’s ‘Kasiya’ project now the largest rutile deposit (18Mt) and second largest graphite deposit (23Mt) ever discovered

- Flynn Gold reveals WA gold-lithium strategy

- Mitre Mining (rare earths), Redstone (copper, cobalt), and Admiralty (iron ore) up on no news

Here are the biggest small cap resources winners in early trade, Tuesday April 5.

SOVEREIGN METALS (ASX:SVM)

Following a resource upgrade, SVM’s ‘Kasiya’ project in Malawi is now the largest rutile deposit (18Mt) and second largest graphite deposit (23Mt) ever discovered.

That 18Mt contained rutile puts Kasiya miles ahead of its closest competitors. Just check this out:

Rutile is the rarest, highest grade and most valuable source of titanium.

Meanwhile, each electric vehicle requires ~55kg of flake graphite to make the battery anode.

Both markets have strong outlooks.

The deposit grade is also high at 1.64% RutEq, SVM says.

A 2021 project scoping study – the first proper look at the economics of building a mine – will now be updated to examine the impact of higher grades, increased production volumes, and increased mine-life.

It is targeted for completion in Q2 this year. A more advanced prefeasibility study is targeted for completion in early 2023.

“It is a remarkable achievement by our team to have made the largest natural rutile discovery ever in just two years since initial identification,” SVM managing director Dr Julian Stephens says.

“The JORC MRE of this scale and grade is clearly highly strategic, Tier 1 and of global significance in a market where natural rutile is in extreme supply deficit.

“The step-change in scale will now allow us to examine potentially higher-grade throughput, increased production levels and a longer mine life in the upcoming Scoping Study update.

“The company is targeting a large-scale, low carbon-footprint and environmentally sustainable natural rutile and graphite operation which will also positively impact the environmental footprint of titanium pigment and other industries and provide a significant contribution to the economy of Malawi.”

The $311m market cap stock is up 33% year-to-date. It had $3.7m in the bank at the end of December.

Sovereign Metals share price chart

FLYNN GOLD (ASX:FG1)

FG1 hit the boards last year with a focus on underexplored northeast Tassie, where the company believes there are ‘Fosterville-style’ gold deposits to be found.

Its main game is the ‘Golden Ridge’ and ‘Portland’ projects, where drilling is ongoing.

In early 2022, it picked up some gold-lithium project tenements in WA, which were the focus of a company presso released today.

The 1232sqkm lithium-gold portfolio is near the world class Pilgangoora, Wodgina, Mt Holland and Mt Cattlin lithium deposits.

‘Mt Dove’ in the Pilbara includes multiple gold-lithium targets located just 11km from the 6.8Moz Hemi gold project and along strike from Kairos’ Kangan gold-lithium target.

On ground exploration to commence at Mt Dove in May/June 2022, FG1 says.

FG1 also has plans to further increase the size and quality of its lithium-gold portfolio in 2022.

The $12.5m market cap stock is up 33% year-to-date. It had $6.9m in the bank at the end of December.

Flynn Gold share price chart

MITRE MINING (ASX:MMC)

(Up on no news)

The newly listed stock is focused on lithium, rare earths, gold, and base metals in the mineral rich Lachlan Fold Belt of NSW.

The company is taking a “multi-commodity, multi-deposit style approach to exploration” at the flagship ‘Bateman’ project, MMC chief exec Clinton Carey says, starting with the important — but relatively boring – early stage stuff.

In late March it said that over 2,700 portable XRF readings at Batemans had shown widespread anomalous rare earths.

While XRF technology is not as reliable as lab assays in reflecting the amount of contained mineralisation, it is still a respectable indicator.

The results show anomalous rare earth results extend along major structures over multiple strike lengths “generating a mineralised target area greater than 4km and up to 800m wide”, MMC says.

Assay results are pending and anticipated shortly.

The $6.2m market cap stock is up ~20% year-to-date. It had ~$4.3m in the bank at the end of December.

Mitre Mining share price chart

REDSTONE RESOURCES (ASX:RDS)

(Up on no news)

This quiet tiddler is drilling to grow the 38,000t copper, 535t cobalt ‘Tollu Copper Vein’ deposit, part of the ‘West Musgrave’ project in WA.

Tollu hosts “a giant swarm of hydrothermal copper rich veins” in a mineralised system covering a +5sqkm area, ~40km from OZ Minerals’ (ASX:OZL) world-class Nebo-Babel nickel-copper deposit.

A conceptual (theoretical, not real yet) exploration target suggests up to 627,000t of copper may be present, the company says.

RDS says deeper RC drilling program at priority targets will kick off in the first half of 2022.

“Timing for this drilling is subject to Redstone securing a suitable RC drill rig that can accommodate deeper drilling and the necessary personnel,” it said January 31.

The $9m market cap stock is up 20% year-to-date. It had ~$2m in the bank at the end of December.

Redstone Resources share price chart

ADMIRALTY RESOURCES (ASX:ADY)

(Up on no news)

This iron ore-nickel-cobalt explorer/project developer has been largely MIA in 2022.

In February last year, ADY signed a deal to hopefully commercialise its Mariposa iron ore project in Chile.

Under the contract, Chinese company Hainan fully funds mining and construction “with all capital contributions, security, legal costs, risks and potential losses borne by Hainan solely”.

The deal covers the first 2 million tonnes of iron ore. Admiralty will get a ‘laddered’ royalty rate up to 7 per cent per tonne of iron ore produced if the price stays above US$90/t.

In its Dec quarterly the company said it was “now progressing to settling a final Joint Venture Agreement between the Company and Hainan”.

Start of construction was pencilled in for end of May 2022.

“The Company notes that delays in settling the Joint Venture Agreement and enabling commencement of activities at Mariposa were largely due to COVID-19 related travel disruption, particularly given Hainan’s operations team have previously been unable to apply for visas to enter Chile, however this process is now underway,” it says.

The 420m market cap stock is up 80% year-to-date. It had $1.7m in the bank at the end of December.

Admiralty Resources share price chart

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.