Resources Top 5: A new gold discovery, imminent drill results, and a red hot nickel play

Pic: Getty

- Torque makes new discovery, hitting thick and high-grade gold underneath historic pits

- Drill assays are pending for Enterprise – Evolution gold joint venture

- Pacific Nickel Mines (nickel), Consolidated Zinc (zinc, lead) and Audalia (vanadium, titanium) surge on no news

Here are the biggest small cap resources winners in early trade, Monday, October 18.

ENTERPRISE METALS (ASX:ENT)

(Up on no news)

ENT enjoys ‘free-carried’ Western Australian JV ventures with Sandfire Resources (ASX:SFR) for copper, Evolution Mining (ASX:ASX:EVN) for gold, and Constellation Resources (ASX:CR1) for nickel-copper sulphides.

‘Free carried’ means ENT pays no exploration costs while the JV partners earn into their respective projects.

It also has a couple of wholly owned gold and SOP projects in WA.

During the June quarter, EVN completed 4 drill holes at the Behring gold prospect.

Assays are currently pending for most of this drilling program and are expected to be reported this month, ENT says.

In late September, CR1 announced a “compelling greenfields nickel sulphide target” at the ‘Eyre South’ prospect that is 380m long, up to 110m wide and ‘open’ at depth.

A diamond drilling program will kick off later this year to test this target in more detail.

ENT (30% ownership) doesn’t have to pay exploration costs until the completion of a bankable feasibility study (BFS) – the most advanced of studies designed to demonstrate if a project is economic to build.

The $12.6m market cap stock is up 70% over the past month but remains down 15% year-to-date.

PACIFIC NICKEL MINES (ASX:PNM)

(Up on no news)

$30m market cap PNM is up 130% over the past month, and 300% year-to-date.

PNM has two nickel laterite direct shipping ore (DSO) projects in the Solomon Islands, ‘Kolosori’ and ‘Jejevo’.

DSO ores — which can be dug up and sold with no processing, translating to low capital and operating costs — could provide feedstock for the hungry stainless-steel industry, the company says.

Kolosori currently has a resource of 5.89 million tonnes grading 1.55% nickel; 40% of which is in the higher confidence measured and indicated categories.

An almost-completed drilling program will support an ongoing definitive feasibility study, which is expected to be completed by the end of 2021.

Samples from the first stage 83-hole program are already at ALS Brisbane for assaying, the company says.

TORQUE METALS (ASX:TOR)

The freshly minted WA explorer has made a new discovery, hitting thick high grade gold underneath and adjacent to the historic ‘Paris and ‘HHH’ pits, part of the Paris project near Kalgoorlie.

Highlight intercepts include 6m @ 34.6 g/t gold within a broader zone of 24m @ 10.7 g/t gold from 141m.

That’s thick and high grade.

An RC rig with ~300m capacity has been secured for follow up drilling at these prospects “to commence as soon as practicable”, TOR says.

The company expects to be drilling follow up holes early in the new year but will fast track if they can find a rig sooner.

These first results below the old pits have exceeded our best expectations, exec chairman Ian Finch says.

“We have been able to achieve all these objectives in a little over three months after listing on ASX.

“The above results, coupled with the new gold discoveries at the ‘Strauss’ and ‘Observation’ prospects [at Paris] indicate exciting times ahead.”

TOR is up 60% on its IPO price of 20c per share.

CONSOLIDATED ZINC (ASX:CZL)

(Up on no news)

30%-owned by big name investor Steve Copulos, CZL’s main focus is the recently refurbished ‘Plomosas’ zinc-lead-silver operation in Mexico.

In Q2, the $8.3m market cap company eked out a $195,000 profit before tax on the sale of 632t zinc and 158t lead in concentrate.

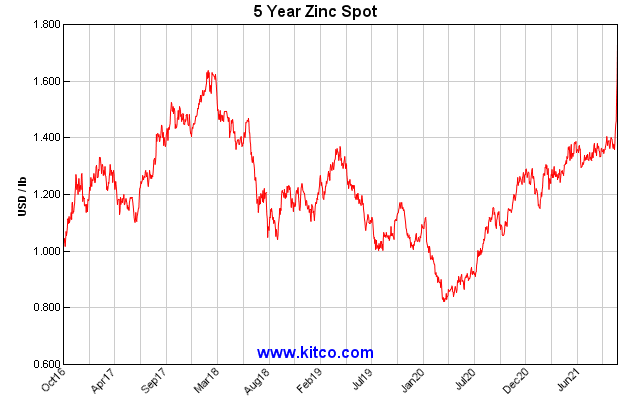

Cash costs for zinc produced were $1US.30/lb for the quarter, and $US1.18 year-to-date.

The zinc price just surpassed five-year highs following a recent spike, and currently sells for over $US1.70/lb.

CZL is now ramping up to 4,500t per month throughput from 9,000t of ore processed during the last quarter (~3,000/t per month).

The company had $3.6m cash at the end of Q2, and about $100,000 in debt.

The $14m market cap stock is up 40% over the past month but remains down 16% year-to-date.

AUDALIA RESOURCES (ASX:ACP)

(Up on no news)

ACP’s main game is the ‘Medcalf’ vanadium-titanium project in WA, which contains a resource estimate of 31.8Mt at 0.45% vanadium and 8.36% titanium.

Successful pilot scale production in 2020 (a smaller version of the real thing) showed high recoveries of iron, vanadium, and titanium.

The explorer is currently chasing environmental approvals, a ‘must-have’ for project construction to go ahead.

$16.5m market cap ACP is up 70% over the past month but remains 43% in the red year-to-date.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.