Resources Top 5: $490m compensation for GreenX as ASX juniors keep European dreams alive

Pic: Getty Images

- GreenX wins huge $490m compensation against Polish government over coal projects

- Dreadnought waves the flag for niobium in WA’s Gascoyne

- South HARZ to receive another $450,000 to realise its European potash dream

Here are the biggest small cap resources winners in morning trade, Wednesday, October 9. Prices accurate at time of writing.

GreenX Metals (ASX:GRX)

(Up on yesterday’s news)

A long and laboured fight by GRX for compensation from Poland over its Jan Karski and Dębieńsko coal projects since 2019 has come to a head. GRX (previously Prairie Mining) has now been awarded $490m through successful arbitration under the Australia-Poland Bilateral Investment and Energy Charter treaties.

The court found that the Polish government breached its obligations in regard to the Jan Karski mine, entitling GRX to compensation, however, claims for the same weren’t upheld by the Tribunal.

It’s a pretty hefty sum regardless, as the compensation figure was compounded with interest since 2019 and will continue to be until full payment is made.

The London and ASX-listed explorer has since reinvented itself into a copper hunter with a recent earn-in agreement for a 90% interest in Group 11 Exploration, holder of the Tannenberg exploration licence in Hesse, Germany – where a bunch of historical silver-copper mines exist.

Tannenberg contains multiple drill intercepts over the high-priority 14 km-long Richelsdorf Dome target, including 2.1m at 2.7% copper and 48g/t silver from 365.48 m and 1.5m at 3.7% Cu and 33 g/t Ag from 209.5m.

It’s also exploring its Arctic Rift project in Greenland with an earn-ion agreement to obtain 100% of the project from Greenfields Exploration.

GRX stocks rocketed on the LSE more than 100% to £77 and here on the Aussie bourse, shares are up almost 30% to trade at 88c at time of writing.

Dreadnought Resources (ASX:DRE)

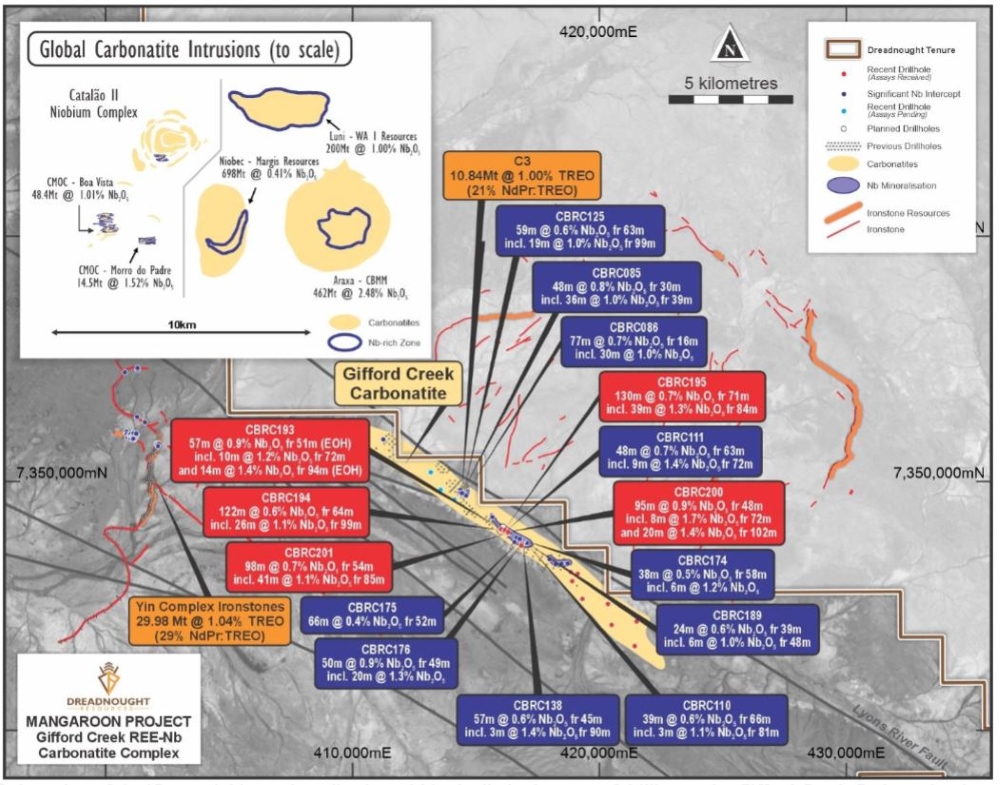

DRE is lighting the candle for carbonatite-hosted niobium (Nb) finds in WA’s Gascoyne. After a nine-hole drill program testing its Stinger discovery at Mangaroon, it’s popped up with what it says are exceptional hits into the Gifford Creek REE-Nb complex.

Reason? Because niobium’s properties are used to create high-strength, low-alloy steel that’s perfect for renewables, infrastructure and automobiles, reducing weight by up to 30%.

The explorer has held the tenure since September 2022 and spent much of last year fingerprinting high-grade zones of Nb and rare earths carbonatites across the 17km-long Gifford Creek carbonatite zone.

In DRE’s latest round of digging it’s cropped up three zones of thick oxide Nb mineralisation with up to 1.3% NbO5 discovered at Stinger.

The holes paint a picture of a 1.2km-long strike that’s open in all directions which DRE says has significant upside potential for Nb and other critical minerals such as rare earths (REE), scandium (Sc), titanium (Ti) and phosphorous (P).

The junior says there’s a bunch of results expected to hit the market this month, including from gold and base metal drilling, airborne surveys, drilling and testing of the Star prospect and metallurgy work at Mangaroon.

Dreadnought flew up the charts on the news today, up 11.7% to trade at 1.9c a share.

South HARZ Potash (ASX:SHP)

(Up on yesterday’s news)

SHP is adding $450,000 to its cash pile to assess the purchase of the Sollstedt mine and prep Stage 2 permitting of the neighbouring flagship Ohmgebirge brownfield potash development in Germany.

South HARZ’ namesake project has a 258Mt at 13.2% potassium indicated resource comprised of three perpetual potash mining licences: Ohmgebirge, Ebeleben and Mühlhausen-Nohra, and two potash exploration licences: Küllstedt and Gräfentonna.

SHP says the envisaged brownfield development of Ohmgebirge (as facilitated by the Sollstedt mine) delivers a “significantly lower pre-production capital expenditure and surface footprint” (relative to the greenfield alternatives).

The cash injection tips the total recent capital raising efforts over the $2m mark and notably, a lot of those funds are backed by the board.

Shares in the budding potash producer are trading up 33% to swap for 1.2c.

Polymetals Resources (ASX:POL)

POL is growing increasingly confident in its decision to restart the prolific Endeavor mine near Cobar in NSW after it cropped up some exceptional results from geotechnical drilling at the Upper North Lode area of the project.

The junior reckons the intercepts of up to 13.5g/t gold, 1410g/t silver, 12.5% zinc & 34.0% lead are evidence that a significant portion of Upper North Lode can support accelerated mining rates, especially after hitting into a nice, thick 67m at 517g/t silver and 2.01g/t gold mineralised zone.

The Endeavor mine is on track for an imminent restart with first cashflows in H1 2025 after an optimised mine plan demonstrated the mine could produce 260,000t zinc, 90,000t lead and 10.6Moz silver to generate a whopping $1.85 billion in revenue over an initial 10-year Stage 1 mine life.

And that doesn’t include the 13,000oz of gold that’s hosted within the the Upper North Lode that can potentially boost early revenues.

With the prices of gold, silver and zinc reaching new highs, investors have backed the news as shares in $77m market-capped POL have risen 17.6% on trade today.

Nova Minerals (ASX:NVA)

NVA has been digging into resource expansion of the RPM North pit area within its 500km2 Estelle gold project in Alaska’s prolific Tintina gold belt and the first eight holes of a 21-hole RC program have delivered multiple >5g/t gold from surface intersections.

Interval grades showed up to 39g/t in sections and a thick 43m at 4.4g/t gold mineralisation was discovered from the ground down.

The drilling is targeting the near-surface mineralisation above the current high-grade core of RPM North and things are looking upbeat to add results of the program to an upcoming resource update that will incorporate two years’ worth of exploration and resource drilling.

It’ll all be jigsawed in to an upcoming pre-feasibility study of the RPM starter mine with an aim to commence a smaller-scale, low-capex, high-margin operation as soon as possible, which will provide cashflow to fund the expansion of the larger Estelle project organically.

The junior also has antimony (Sb) prospectivity at Estelle which it’s looking to define, on top of the project’s growing 9.9Moz gold resource.

Antimony has been well-known to exist in the area and neighbouring ASX explorer Felix Gold (ASX:FXG) has raised capital to reboot the historical Scrafford mine within its Treasure Creek project, where the material was produced at extremely high grades of up to 58% Sb.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.