Resources Top 5: 3500% in 7 months – The WA1 Resources fairy tale continues

Pic:RomoloTavani,iStock / Getty Images Plus

- Blaze Minerals to buy greenfields North Spirit lithium project in Ontario

- WA1 Resources enjoying breathless rise from 13.5c tiddler to $4.85 market darling in a touch over 7 months

- Up on no news: Lepidico (lithium), Ark (rare earths), Polymetals (silver)

Here are the biggest small cap resources winners in early trade, Friday May 26.

BLAZE MINERALS (ASX:BLZ)

The mass emigration of Aussie explorers into Canadian lithium isn’t slowing down. The latest to take the long trip north is former shell BLZ, which is buying the 340sqkm greenfields North Spirit lithium project in Ontario.

North Spirit is 30km along strike from the 50Mt PAK and Spark projects, where owner Frontier Lithium (TSX.V:FL) recently pulled up an eyewatering 398m @ 1.88% Li2O1, including 23m @ 3.12% Li2O2 in one drillhole.

It is also in the same neighbourhood as recently listed Patriot Lithium (ASX:PAT).

BLZ says initial work will target pegmatites “which compare favourably to 2001 results of Frontier Lithium’s PAK deposit”.

2001 results? Yeah, we’re not sure either. (We asked the company for clarification but they didn’t get back prior to deadline.)

The acquisition will cost BLZ an initial $100,000 cash and $550,000 worth of shares (55m shares at 1c). The company will then pay an additional $2.65m cash and $5.95m shares in staged payments right up to the release of a mining feasibility study.

The vendor will also retain a 2% net smelter royalty (NSR) should the project enter production.

$10m capped BLZ is up 140% in early trade. It is raising $2m via placement at 1c per share, a 1.35% premium to the 15-day VWAP.

LEPIDICO (ASX:LPD)

(Up on no news)

LPD wants to build a lepidolite lithium mine and concentrator in Namibia, and a 5600tpa chemical conversion plant in Abu Dhabi.

The integrated Phase 1 project has a base case NPV8% of US$530m and IRR of 42% at a long-term lithium hydroxide price of US$22,840/t

Some fairly conservative lithium price sensitivity analysis sees the NPV8% range from a downside scenario of US$452m ($675m) based on a US$16,800/t lithium hydroxide price to an upside figure of US$703m ($1,050m) based on a lithium hydroxide price of US$32,350/t.

The capital cost estimate including contingency for the chemical plant is US$203m and for the concentrator US$63m for a combined US$266m.

The next step is for LPD is to lock in financing and offtake.

The $80m capped project developer is struggling for traction in 2023, down 40% year-to-date. It had $15.3m in the bank at the end of March.

ARK MINES (ASX:AHK)

(Up on no news)

This battler emerged from voluntary administration December 2021 with two priority projects in Queensland – ‘Mount Jess’ (copper and iron ore) and ‘Gunnawarra’ (nickel and cobalt).

In March it dipped its toe into rare earths, acquiring the fairly advanced ‘Sandy Mitchell’ project in North Queensland for just $200,000 cash.

A bunch of exploration work has already been done on the project by previous owners, which included state-owned Japan Organization for Metals and Energy Security (JOGMEC).

This exploration returned very high grades up to 18.4% TREO hosted in sands, which could be panned into a concentrate allowing “low-cost, fast start up, straightforward beneficiation by gravity processing”, AHK says.

The company, which sees opportunity for a quick, low capex development, is already applying for a mining licence.

Drilling kicked off earlier this week, which will form the basis of a maiden resource.

Meanwhile, a maiden JORC resource was completed last quarter for Gunnawarra of 1.341 million tonnes at .53% Ni, 602,000 tonnes cobalt at .066% and 191,500 tonnes of copper at .054%.

The deposit remains open in numerous directions, with further drilling planned “in early 2023”.

The $12m capped stock is up 60% year-to-date. It had $1.8m in the bank at the end of March.

WA1 RESOURCES (ASX:WA1)

WA1 shareholders have enjoyed a breathless rise from 13.5c tiddler to $4.85 market darling in a touch over seven months.

That’s a ~3500% gain, sparked by ongoing exploration success at the super high-grade West Arunta niobium project on the WA/NT border.

Niobium is mainly used to make steel better, but also has growing uses in lithium-ion batteries, intelligent glass, solar panels, 5G tech, and nuclear energy.

Ferroniobium metal (65% Nb) sells for ~US$45,000/t.

Two discoveries have been made thus far, Luni and P2. The more advanced Luni is returning shallow high grade drill hits like 13m at 5.0% Nb2O5 (within an overall interval of 31m at 3.5% Nb2O5) and 10m at 4.0% Nb2O5 (within an overall interval from 39m of 24m at 2.1% Nb2O5).

Luni is currently 400m long and 200m wide, and open in all directions.

For reference, there are three major niobium mines in the world; two are high grade (between 1% and 2.5% ore grade), while the third sits at around 0.5%.

Meanwhile, the Panda Hill niobium project, previously owned by Cradle Resources (ASX:CXX), had an ore reserve grade of 0.68%, while Globe Metals and Mining’s (ASX:GBE) advanced Kanyika project has a resource of 68Mt at a grade of 0.283%.

WA1 says diamond drilling is set to commence in June, while RC drilling is ongoing.

$WA1.ax latest images from 21/5 pic.twitter.com/F3TXF7CRMc

— GIGACHAD (@InspectionDeep) May 24, 2023

This ongoing drilling is designed to support a maiden resource estimate at Luni in the second half of 2023, alongside follow-up step out exploration drilling at the P2 carbonatite discovery.

The $180m capped stock has ~$20m in the bank following a recent placement.

POLYMETAL RESOURCES (ASX:POL)

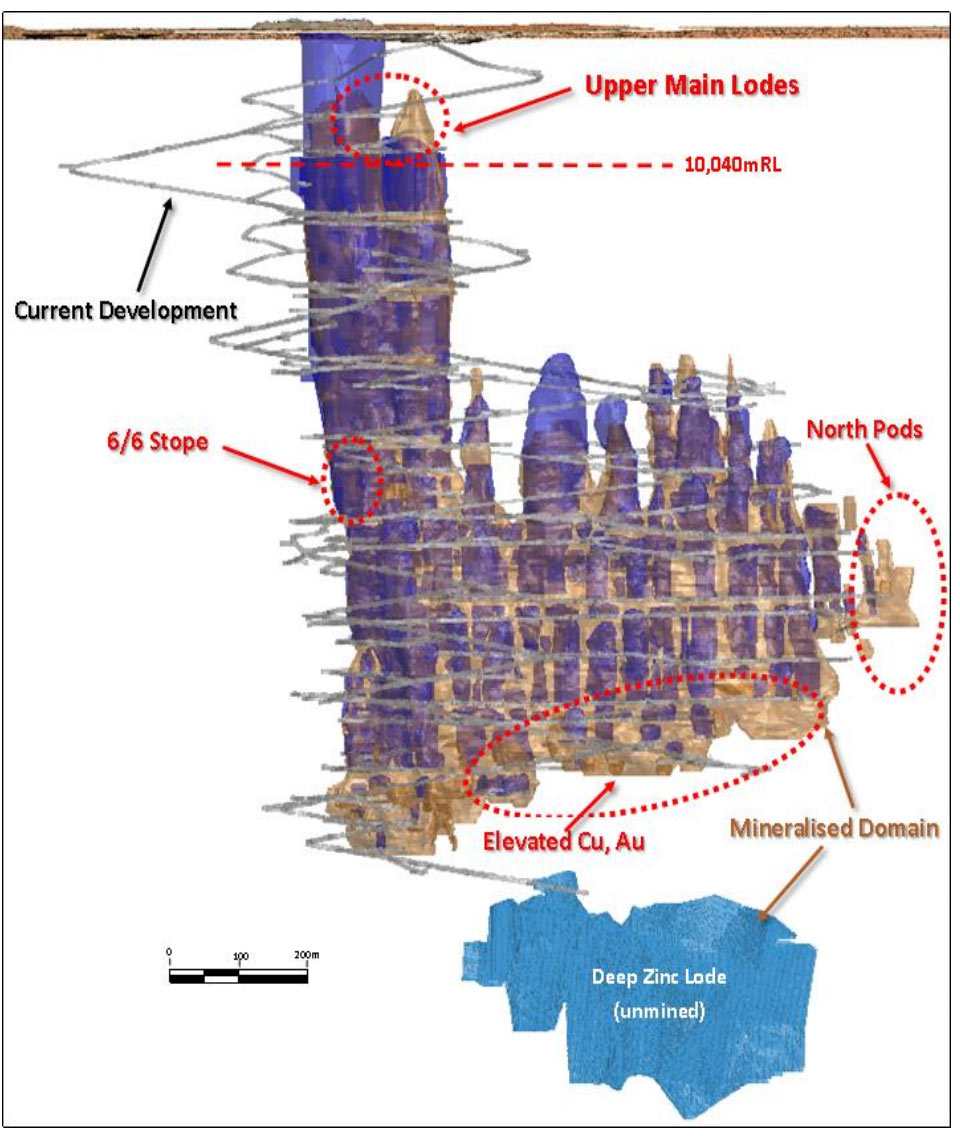

Aspiring silver-base metals miner POL recently increased near surface resources at the mothballed Endeavour mine to 8.9Moz silver, plus lead and zinc credits.

That resource from the Upper Main Lodes (less than 180m depth,) comprises 818,000t at 7.1% zinc, 5.1% lead and 338g/t silver.

In contrast to the February 2023 Total MRE, the recalculated May 2023 Total MRE has improved the silver grade by 31% and tonnage by 13% within the Upper Main Lodes, resulting in a contained silver increase of 48% or 2.9Moz.

Gold is yet to be added into the MRE, POL says.

Feasibility work on Upper Main Lode mine development is targeted to be completed during calendar Q4 2023.

“What is becoming evident is that the Endeavor project may evolve in two stages, with the near surface high value resources potentially delivering a first stage low entry cost mining programme with cashflow applied to funding the anticipated +10-year mining operation,” POL exec chair Dave Sproule says.

Endeavour was placed in care and maintenance by the previous owner in 2019 due to depleting reserves after ~37 years of operation.

32.2Mt of ore grading 8.01% zinc, 5.04% lead and 89.2g/t silver had been mined and processed to that point, with a 16.3Mt resource remaining when POL bought the project for ~$10.4m in shares (52m shares priced at 20c).

$30m capped POL – which listed on the ASX mid 2021 to hunt gold deposits in the West African nation of Guinea — is now up 35% year-to-date.

It had $830,000 in the bank at the end of March.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.