Resources Top 5: 1.3Moz at US$2/oz discovery cost – is this the cheapest large scale gold deposit ever found?

Pic: RossHelen, iStock / Getty Images Plus

- Westar up 100% after reporting “multiple thick pegmatites” up to 44m thick in maiden drilling

- WIA unveils monster 1.3Moz maiden resource for the Kokoseb gold deposit in Namibia

- Reach picks up rocks grading ~2.3% lithium right under the armpit of Delta Lithium’s (ASX:DLI) Yinnetharra

Here are the biggest small cap resources winners in early trade, Monday May 15.

WESTAR RESOURCES (ASX:WSR)

WSR is up 100% after hitting “multiple thick pegmatites” up to 44m thick in maiden drilling at the newly acquired Olga Rocks lithium-gold project, near Southern Cross in WA.

Traditionally a gold project, historical drilling at Olga was never assayed for lithium, despite its proximity to the Covalent Lithium’s emerging 380,000tpa Mt Holland project.

This 14-hole, 1400m program was design to test whether the multiple pegmatite/felsic intersections logged by previous explorers contained lithium.

The maiden drilling program successfully intersected pegmatites in 8 of the 14 drill holes, the thickest continuous pegmatite being 44m from just 17m depth.

On hole was drilled to validate old gold hits, including 8m @ 4.54g/t Au, 8m @ 4.69g/t Au, and 3m @ 10.6g/t Au.

Assays are expected in six weeks.

Meanwhile, WSR have begun detailed investigations into the pegmatite potential of the larger tenement package.

“Contingent on favourable assays, our geologists will commence planning a second phase of RC drilling to establish strike and depth potential of any mineralised pegmatites and LCT-potential of newly identified pegmatites,” it says.

“Additional studies including mapping and rock-chip sampling have commenced to advance gold exploration both in the southern tenure, and the BIF (Banded Iron Formation) to the north of recent drilling, where several historical shafts and workings exist.”

The $9m capped stock had $1.2m in the bank at the end of March.

WIA GOLD (ASX:WIA)

WIA today unveiled a monster 1.3Moz maiden resource for the Kokoseb gold deposit in Namibia, delivered just 11 months from the discovery drillhole.

The resource also contains a higher-grade portion of 15Mt at 1.5g/t gold for 720,000oz (at a cut-off grade of 1g/t).

At US$2/oz per ounce of contained gold, WIA says this is one of the lowest resource discovery costs by industry standards.

MinEx Consulting estimates that the average discovery cost for the global gold industry between 2009-2018 was US$62 per ounce of gold.

At the cheaper end of the spectrum is Predictive Discovery (ASX:PDI), which estimated a resource discovery cost of $4/oz (US$2.90/oz) at the tier 1 Bankan gold project, and De Grey (ASX:DEG), which estimated a resource discovery cost of $10/oz at Mallina in WA.

Kokoseb remains open with follow-up drilling already underway.

“RC drilling results continue to impress with their consistency,” chairman Andrew Pardey says.

“As we progress our exploration at Kokoseb, its potential becomes increasingly apparent, with the discovery of new mineralised shoots and strike extensions.”

“Kokoseb demonstrates excellent continuity in grade and width from surface.”

Meanwhile, early met work is returning excellent gold recoveries above 91% via gravity and standard direct leach tests; good news for any potential development.

“We look forward to continuing this exciting journey at Kokoseb as we seek to develop a significant gold project in Namibia, a stable and investment friendly jurisdiction where B2Gold has the [2.6Moz] Otjikoto Mine that has been in production since 2014 and Osino Resources is currently completing a study of the [3.1Moz] Twin Hills gold project,” Pardey says.

The $17m capped stock had $3.5m in the bank at the end of March.

INCA MINERALS (ASX:ICG)

(Up on no news)

Elephant hunter ICG is about to embark on an intensive drill campaign across its copper-lithium projects in the NT and QLD.

First up is a “high impact” program across a bunch of shallow copper and lithium targets at Jean Elson (NT) and MacAuley Creek (QLD).

ICG is currently finalising planning for mobilisation to site and expects to be on site drilling in Q3 2023, it says.

The $13m capped stock has ~$1.2m in the bank.

CORAZON MINING (ASX:CZN)

(Up on no news)

CZN has three assets: the Lake Lynn project (nickel-cobalt) in Canada, and the Miriam (nickel-lithium) and Mt Gilmore (copper-gold) projects in Australia.

Lake Lynn was a prolific historical nickel-copper-cobalt mining centre that was mined for 24 years before closure in 1976.

Mining studies examining a low-cost operation are now underway. Exploration is also ongoing to expand the already substantial 16.3Mt resource (116,800t nickel, 54,300t copper, 5300t cobalt).

At Miriam, near Coolgardie in WA, CZN has defined a 2.2km long lithium anomaly across two trends.

Work program approval applications for drilling of these lithium trends — along with drilling to test the Miriam nickel-sulphide trend targets –are underway, the company says.

The $9m capped stock had $3.4m in the bank at the end of March.

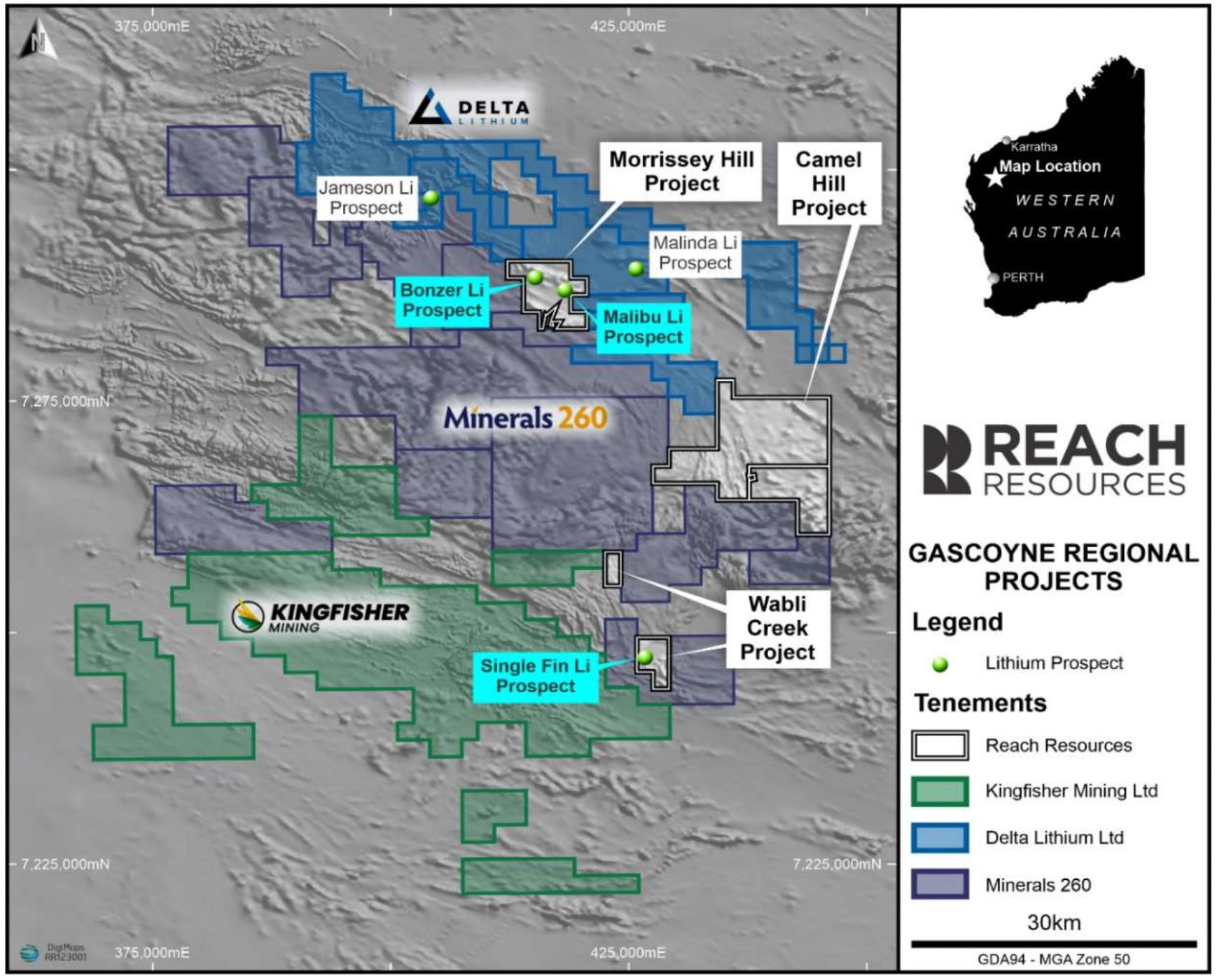

REACH RESOURCES (ASX:RR1)

Minnow RR1 is picking up rock chips grading ~2.3% lithium right under the armpit of Delta Lithium’s (ASX:DLI) potentially large discovery at Yinnetharra in WA:

This is promising, the company says, especially as it only had time to target a small percentage of the total outcropping pegmatites across its project area (rock that can contain lithium).

RR1’s 232sqkm of ground in the Gascoyne comprises three projects: Morrissey Hill, Camel Hill, and Wabli Creek.

“We estimate in excess of over 50 pegmatites remain untested across our three projects,” CEO Jeremy Bower says.

“We are particularly excited about the Bonzer prospect [Morrissey Hill], which is a clear walk-up drill target.

“We now have consistently high lithium grades from this very large pegmatite which is at least 1.5km long with lithium bearing minerals at surface.”

This will be the #1 target for an upcoming maiden drill program scheduled to commence during Q3 2023, Bower says.

“It is great to see the likes of David Flanagan’s Delta Lithium and Tim Goyder’s Minerals 260 taking big positions around us, we are clearly in a sweet spot of one of the hottest critical mineral regions in Australia right now.”

WA project developer DLI has high hopes for Yinnetharra, where it recently announced drilling results like 56m at 1.12% lithium as part of an extensive multi-rig drill program.

The buzz kicked up a notch last week when 2022 relistee Voltaic Strategic Resources (ASX:VSR) bagged on some promising lithium drilling results at the adjacent Ti Tree project.

The 15-hole for 900m first pass program returned continuous pegmatite up to 58m thick, from surface across six targets.

The $7m capped stock has ~$1.7m in bank.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.