Resources Top 4: Some small cap ressies Trump’s win didn’t punch in the gut

These small caps didn't get a share price gut punch today. Pic: Getty Images

- Strickland is up >4%; it has a webinar today with an update on Yandal and Rogozna gold projects

- King River is on the rise on high-grade gold discovery potential at Kurundi

- Australian Critical Minerals eyes Pilbara iron ore

US election results have sent commodities down the gurgler, but here’s a handful treading above water on Thursday, November 7. Prices accurate at time of writing.

Strickland Metals (ASX:STK)

STK has announced a webinar with its senior leadership team at 1pm WST today – perhaps the reason the global gold hunter is one of the few ressies up on the bourse today.

The junior is going to lay down an update on recent exploration progress at both its Rogozna gold and base metals project in Serbia and at the 100%-owned Yandal gold project in WA.

STK MD Paul L’Herpiniere and non-exec director and geoscientist Dr Jon Hronsky OAM are providing a comprehensive overview of the company’s exploration and growth strategy across both assets.

The company has been busy with exploration this past year after selling its Millrose gold project to Northern Star Resources (ASX:NST) last year for $61m – cash it’s using to put straight back into the ground at Yandal and now Rogozna.

Yandal’s Horse Well gold camp is continuing to prove up a high-grade gold system across the advanced 53,900oz Warmblood deposit and Palomino prospect, with other prospects in the vicinity.

And the recently acquired Rogozna gold project, with its current ~5.4Moz gold equivalent resource defined across the Shanac and Copper Canyon deposits, is currently undergoing expansion drilling at the Medenovac, Kotlovi, Gradina and Shanac deposits, with four rigs on site.

The live video chat kicks off at 1pm AWST / 4pm AEDT today here: Strickland Metals Investor Webinar.

King River Resources (ASX:KRR)

(Up on yesterday’s news)

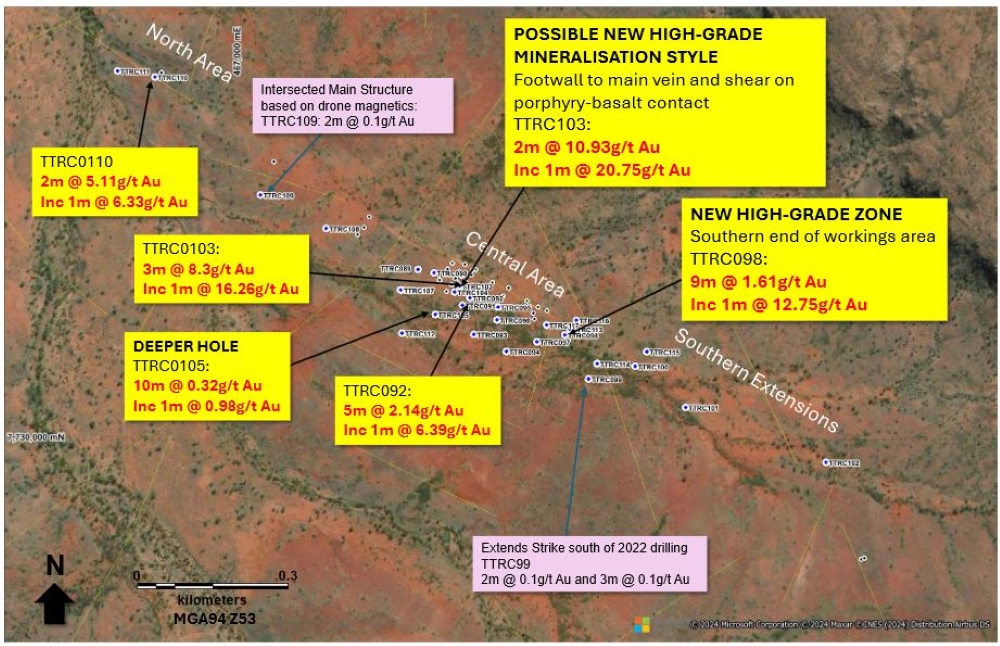

KRR’s 2024 drilling campaign has discovered a new 250m-long gold zone at Kurundi, south of the central main workings with grades of up to 12.75g/t gold.

Exploration was focused on extending previously discovered high-grade gold mineralisation it sussed out from drone magnetic surveyance last year.

Other results showed: 3m at 8.3g/t gold from 35m, including 1m at 16.25/t gold from 36m at the central main zone and 2m at 5.11g/t from 44m, including 1m at 6.33g/t from 45m at the northern workings.

There’s also a possible new style of mineralisation on a porphyry-basalt contact, in the footwall to the central main mineralised zone, which KRR says requires further investigation after hitting into 2m at 10.93g/t gold from 51m, including 1m at 20.75g/t from 51m at hole TTRC103.

The explorer says all intersections are stated as down-hole widths, which are close to true widths for the Kurundi Main structure.

A second phase of drilling has now commenced to test the new southern high-grade zone and continue exploring the other Kurundi main targets.

Australian Critical Minerals (ASX:ACM)

(Up on no news)

With nothing to report since its quarterly at the end of last month, ACM is up ~6% early as it looks to prove up another Pilbara channel iron deposit (CID) across its 453km2 landholding.

The Shaw and Cooletha exploration licences have been rock chip sampled, returning up to 61.3% Fe at a 55.5% Fe average at Shaw and up to 62.6% Fe at a 54.9% average at Cooletha.

There’s a 9km stretch of banded iron formations confirmed at Shaw and a whopping 42km of combined channel iron deposits at Cooletha to explore.

ACM says it’s planned systematic sampling of Shaw’s extensive BIF horizons and grid sampling of Cooletha’s CID outcrops and scree slopes to uncover their prospectivity this month.

CID deposits are lucrative in the Pilbara, with significant projects such as BHP (ASX:BHP) and Rio Tinto’s (ASX:RIO) mammoth Yandicoogina deposits and the latter’s Robe in operation nearby.

The explorer is also waiting on assays from 221 samples collected during the September quarter at both projects to guide further exploration and target refinement.

Miramar Resources (ASX:M2R)

(Up on no news)

Nothing heard from M2R lately, yet the penny stock is one of the only ASX ressies to rise today. It recently pointed to its Mount Vernon prospect’s potential for nickel (Ni), copper (Cu), cobalt (Co) and platinum group element (PGE) sulphide mineralisation, similar to the super giant Norilsk-Talnakh deposits in Russia.

Mount Vernon is part of a geological province in WA’s Gascoyne region that is the same age as the Giles Complex, which hosts BHP’s huge Nebo and Babel Ni-Cu deposits in the West Musgrave.

The company plans to sign up to the CSIRO’s indicator minerals project (for magmatic mafic-ultramafic ore systems including Ni, Cu, Co, PGEs, V, Ti) and provide selected samples from the recent drilling program for further petrographic and geochemical analysis.

At Stockhead we tell it like it is. While Strickland Metals and Miramar Resources Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.