Resources Top 4: Lithium hunter James Bay Minerals makes a yellowcake detour in Quebec

Lithium is still the main game for JBY. But still uranium… and REEs. (Pic via Getty)

- James Bay Minerals is leading the ressie gains pack today, which is good, because it actually has fresh news

- Artemis Resources, Prodigy Gold and Olympio Metals are also having fine double-digit days, even if Feb 15 announcements appear thin on the ground

Here are some of the biggest resources winners in early trade, Thursday February 15.

James Bay Minerals (ASX:JBY)

Canadian-focused lithium explorer JBY has been cutting a swathe up and to the right through the local bourse this morning on… actually not so much lithium this time, but yellow-hot uranium. And REEs.

The hits just keep on coming over in Quebec. Well, the targets for potential big hits in this particular instance.

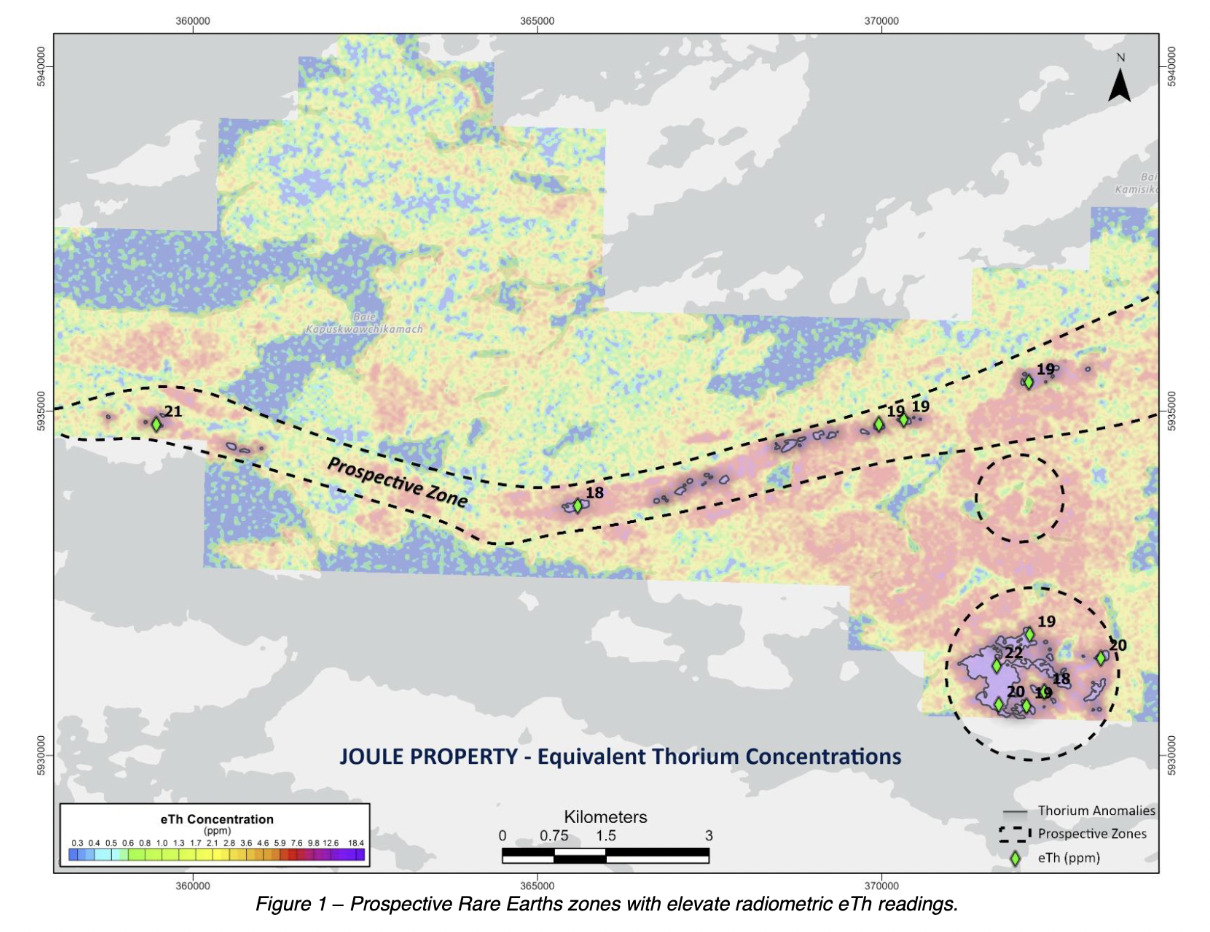

The company reports that a review of aeromagnetic and spectromagnetic survey results across its flagship Joule Property, within the 100%-owned La Grande lithium project in the James Bay region of Quebec, Canada, has generated significant new rare earths and uranium targets.

JBY notes that the “exceptional geophysics results” include elevated equivalent-Thorium (eTh) concentrations of up to 22ppm, typical of significant Rare Earth Element (REE) mineralisation, identified from radiometric surveys.

Additionally, Equivalent-Uranium (eU) readings of up to 29ppm were obtained from radiometric surveys, with significant readings identified in three specific zones the company intends to investigate further.

The La Grande project is located between 50km to 190km east of Radisson in northwest Quebec, Canada. And the Joule prospect – the project’s top asset, covers an area of 16,385 hectares along the Robert-Bourassa reservoir.

Encouraged by the prospect for significant and diverse mineralisation at its Joule site, JBY executive director Andrew Dornan said:

“While our exploration efforts will remain firmly focused on LCT pegmatites with potential for world-class lithium discoveries, the results obtained from aeromagnetic and spectromagnetic surveys cannot be ignored.”

JBY share price

Artemis Resources (ASX:ARV)

Pilbara-focused gold’n’copper’n’lithium explorer Artemis is working its way up again after a down-and-up start to the year. It’s currently +35% for the week, +18% intraday.

Latest news? A West Pilbara lithium exploration update delivered this week, focusing on recent drill core and rock chip sample results.

The company’s stratigraphic diamond holes indicate potential sub vertical orientation of pegmatites at the Kobe and Osborne tenements, with Drill hole #1 potentially stopped short of Osborne target, ARV notes.

Significant mineralisation in the western extension of Osborne has been confirmed, then, with these assay results:

• 2.36% Li2O, 32ppm Ta2O5 and 92 ppm Nb2O5

• 1.64% Li2O, 3ppm Ta2O5 and 14 ppm Nb2O5

• 1.22% Li2O, 45ppm Ta2O5 and 76 ppm Nb2O5

• 1.15% Li2O, 38ppm Ta2O5 and 102 ppm Nb2O5

Osborne, by the way, is a highly prospective lithium tenement being advanced under a JV with GreenTech Metals (ASX:GRE), which has a 51% stake/control, with ARV the other 49%. GRE is also up today, with a 10% gain at time of writing.

⛏️Exploration Update – Ruth Well & Osborne JV

-Stratigraphic diamond holes indicate sub vertical orientation of #pegmatites at Kobe & Osborne

-Outcrop sampling confirms significant mineralisation in 600m western extension to Osborne pegmatitehttps://t.co/aILy36Bfhr $GRE $GRE.ax pic.twitter.com/uSpCLIjJn0— GreenTech Metals (@GreenTechMetals) February 12, 2024

What next for ARV? A maiden RC drilling program to test Osborne targets is planned for March 2024 to test a near surface lithium rich zone where access has now been granted.

Exec direc George Ventouras ventured the following: “The results from the stratigraphic holes drilled on the Osborne JV tenement have provided valuable information for the technical team to refine and develop further drill programs.

“The geology has provided clear evidence as to the subterrain and potential location of the pegmatites which will be followed up shortly.

“Additionally, we are encouraged by the extension to the Osborne trend and look forward to further ground reconnaissance in the same area. With the above and our results from the Mt Marie lithium prospect, we are very excited for the next few months of activity and news flow.”

ARV share price

Prodigy Gold (ASX:PRX)

(Up on no news)

Well, we say no news – we just mean today, of course. Goldie Prodigy, like just about every other Aussie explorer and miner you can think of is over in Perth, representing at the RIU conference this week.

It may be that more than a few resources companies are up on the buzz surrounding that event alone.

Prodigy, which has a greenfields and brownfields exploration portfolio in the proven multi-million-ounce Tanami gold district of the NT, released an update of its 2024 exploration plans the other day.

This includes, as priority, the continual drilling at the Tanami North project, including Hyperion, Tregony, Boco and Brokenwood deposits.

Prodigy Gold has released its exploration plans for the 2024 field season which includes the continual drilling at the Hyperion, Tregony, Boco and Brokenwood deposits.

You can read the full release here: https://t.co/6WEQfRpae4 pic.twitter.com/5EbURgtIe1— Prodigy Gold (@ProdigyGoldAu) February 12, 2024

Prodigy Gold MD Mark Edwards confirmed: “The Prodigy Gold team is currently busy finalising plans for the 2024 field season in the Tanami Region of the Northern Territory.

The proposed work plans centre around follow-up drilling of the successful 2023 campaigns completed at Hyperion and Tregony. Additional drilling is also being planned for the Boco, Mark’s Rise and Brokenwood prospects to increase the understanding of mineralisation in areas away from the currently reported Mineral Resources.”

PRX share price

Olympio Metals (ASX:OLY)

(Up on no news)

Olympio is an exploration and and development company focused on gold and lithium commodities at its two 100% owned exploration projects in the Goldfields and East Kimberley regions of WA.

It’s nicely up today – about 16% at time of tapping keys – although we’re not entirely sure why as there is no fresh, needle-moving announcement.

Reverting to last major news, then, which was only about 10 days ago, and we can tell you that the company has commenced its maiden diamond drilling program at its Cadillac lithium project in Quebec, Canada.

Priority drill targets at the project include LCT pegmatite Dyke Z, which measures 1.3km long and up to 150m wide, which Olympio believes provides scale for a potentially significant discovery.

The drill program, for up to 3,000m, is planned to test several of the 400+ pegmatite targets across the 190km2 ground coverage at Cadillac, which is strategically located less than 50km from the infrastructure-tastic mining town of Val d’Or.

Olympio’s MD, Sean Delaney, described the project as “underexplored”, adding:

“Cadillac is in a great location with all infrastructure in place serviced by the mining town of Val d’Or, which helps keep our exploration costs down.”

OLY share price

At Stockhead we tell it like it is. While JBY is a Stockhead advertiser, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.