Resources Top 4: Jackpot copper grades and Argosy to increase Rincon

Pic via Getty Images.

- E79 Gold Mines shares rocket, showing assays up to 45% copper and 11.75g/t from rock/soil sampling

- Argosy approved to increase lithium production to 10,000tpa

- Gold Mountain pumps, then dumps, on proximity to Latin Resources’ Rincon, based on latters’ quarterly

Here are the biggest small cap resources winners in morning trade, Friday, July 26. Prices accurate at time of writing.

E79 Gold Mines (ASX:E79)

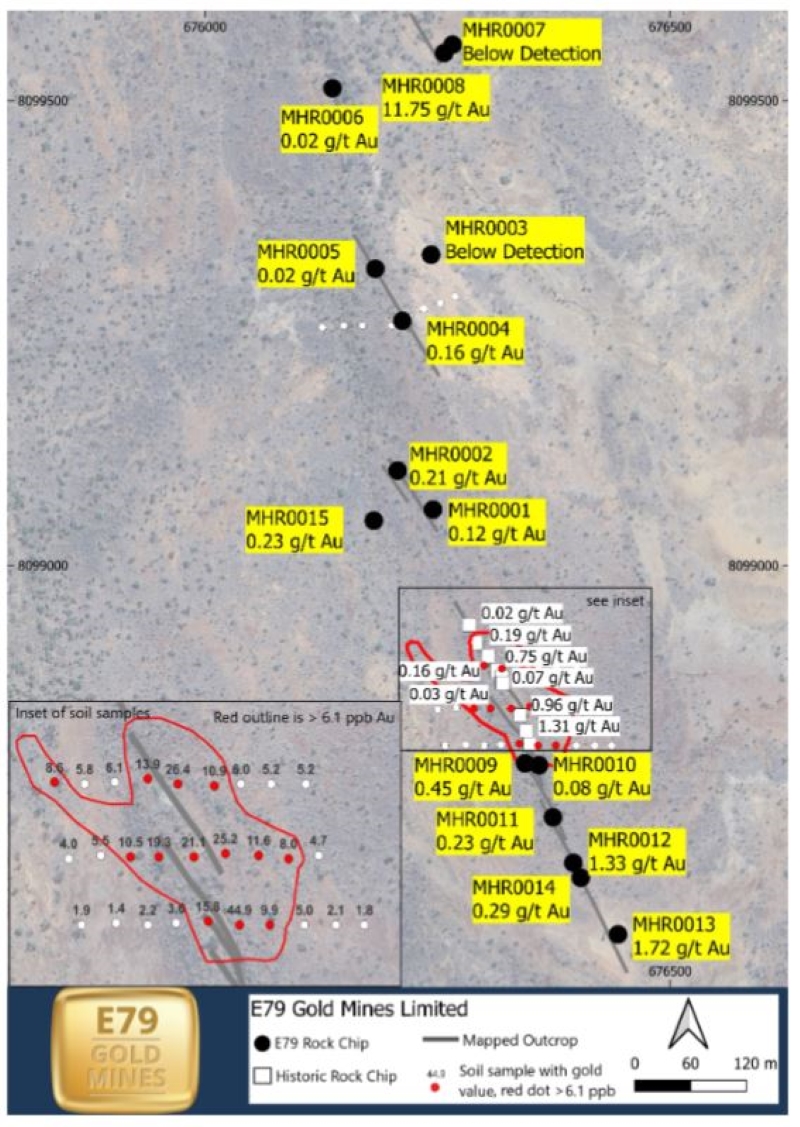

Today’s early trade winner, E79 stocks have resurrected themselves on high grades of copper and gold, identified in rock chips and soil sampling at its early-doors Mountain Home project in the NT.

Whether an ancient Thunder Bird carried the samples in its beak from 50km away to the tenure 40,000 years ago remains to be seen, but exploration has to start somewhere, right?

The junior does stipulate that it’s “worth noting that the samples, especially the higher-grade copper results, had abundant oxide-copper mineral malachite”, and that examples of drilling beneath these types of copper assay values will typically be lower grade.

It’s a credible starting point though, and sampled assays of upto 45% copper and is nothing to sneeze at.

The sampled copper and gold finds has extended the now identified mineralisation prospectivity to a 1000m-long outcrop.

Anomalous gold, which E79 says is rare for the region, returned up to 11.75g/t within the 868km2 tenement package within the McArthur Basin in the NT, home to the namesake and world-class zinc-lead mine.

The stock jumped a whopping 68% on early trade today and is still up 50% at time of writing to 5.1c per share.

Argosy Minerals (ASX:AGY)

A positive quarterly report has investor eyes on AGY after securing environmental approvals for a 10,000tpa LCE production expansion of its flagship Rincon lithium project.

The market noticed too, and is one of today’s best performers, correcting a recent dip in stock price.

That may be due to a recent US$5m strategic investment by battery innovator Amperex Tech, spot sales contracts that sold 20 metric tonnes of Li at a premium of US$13,400/t and strong cash reserves of $11.3m as of June 30.

Rincon currently has a resource of 245,120t contained lithium carbonate and exploration upside could see that potentially double in the near future, with recent data modelling showing lithium brine could be pumped for upto 42 years.

Shares are significantly up a whopping 45% to 4.9c on today’s trade.

Gold Mountain (ASX:GMN)

(Interest on yesterday’s news)

Recently pivoting to lithium, GMN has announced assays from stream sampling sediments of up to 672ppm at its Salinas II project in Brazil’s Lithium Valley.

The junior’s tenements are along strike from Latin Resources’ advanced 70Mt @ 1.25% Collina hard rock lithium resource, which has struck into “incredible” intercepts at the Planalto prospect showing up to 2.52% Li2O.

It could explain the on-market action today, based on announcing high Li2O grades at its Planalto discovery yesterday as it progresses towards a maiden resource estimate for the discovery.

High priority target zones have been identified from 55 samples taken at Salinas II and the explorer says a future mapping and soil sampling program is being proposed to develop drill targets.

Shares in GMN pumped early in trade, yet slid back by lunch to 0.3c per share.

New Age Exploration (ASX:NAE)

(Up on no news)

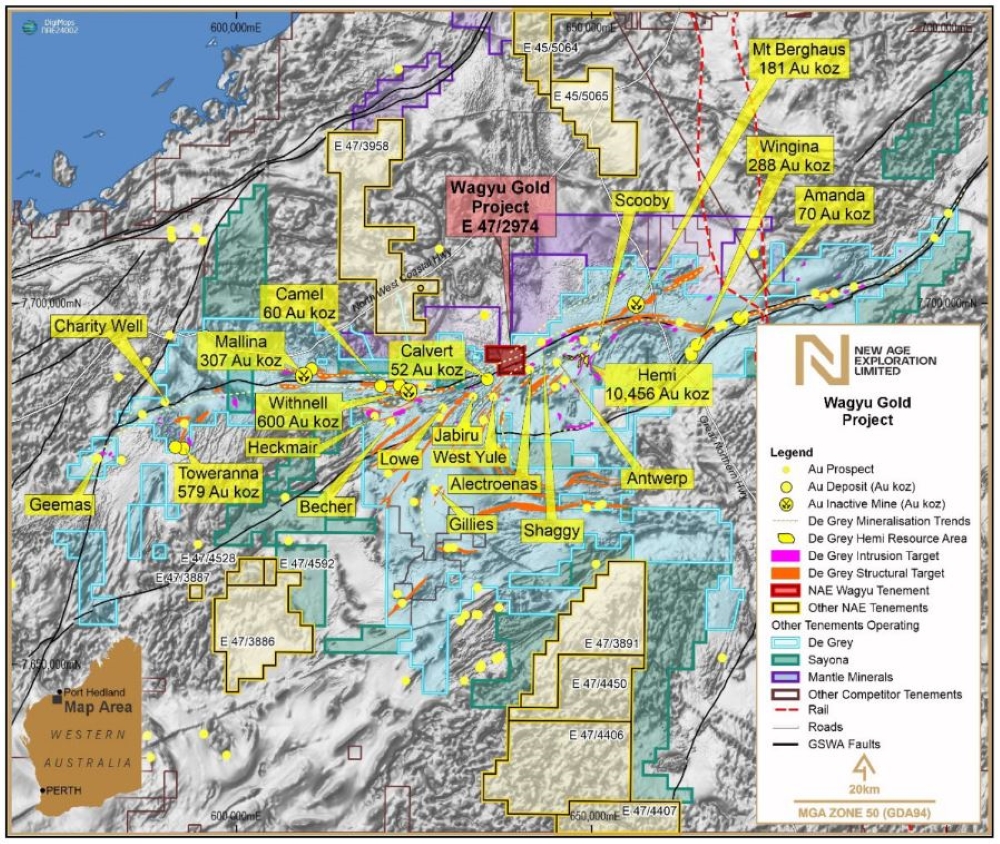

Junior NAE has bounced up in share price today as the market awaits for imminent results from its Wagyu gold project which is nestled right between De Grey Mining’s monster 10.5Moz+ Hemi deposit.

This stock is one to watch, as you can see from the location in this image:

Speaking to Stockhead, Wellisch tells how he and his team got into Wagyu in the Pilbara and of the excitement around being adjacent to one of the most exciting new gold deposits in Australia.

“We saw some extremely attractive targets ~7km along strike from Hemi and got on board a very experienced geologist in Greg Hudson that brings a lot of expertise to help us deliver the project,” Wellisch says.

The explorer is in the midst of a six month exploration program with AC drilling results across developed targets looking to warrant further inspection of what lies deeper under the ground.

READ MORE: Three ASX sleepers looking to make noise near world-class deposits

Share were up 33% to on trade to 0.4c today.

At Stockhead we tell it like it is. While New Age Exploration is a Stockhead advertiser, they did not sponsor this article. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.