Resources Top 4: It’s prime brine time for Patagonia Lithium

Pic via Getty Images

- ‘Outstanding’ assay results delivered from Patagonia’s first brine well drilling at its Formentera project

- Black Canyon up after separating manganese into a useful concentrate

- Savannah rakes in the bucks on a coal deal, and Rincon keeps on keeping on

Here are some of the biggest resources winners in early trade, Friday May 3.

Patagonia Lithium (ASX:PL3)

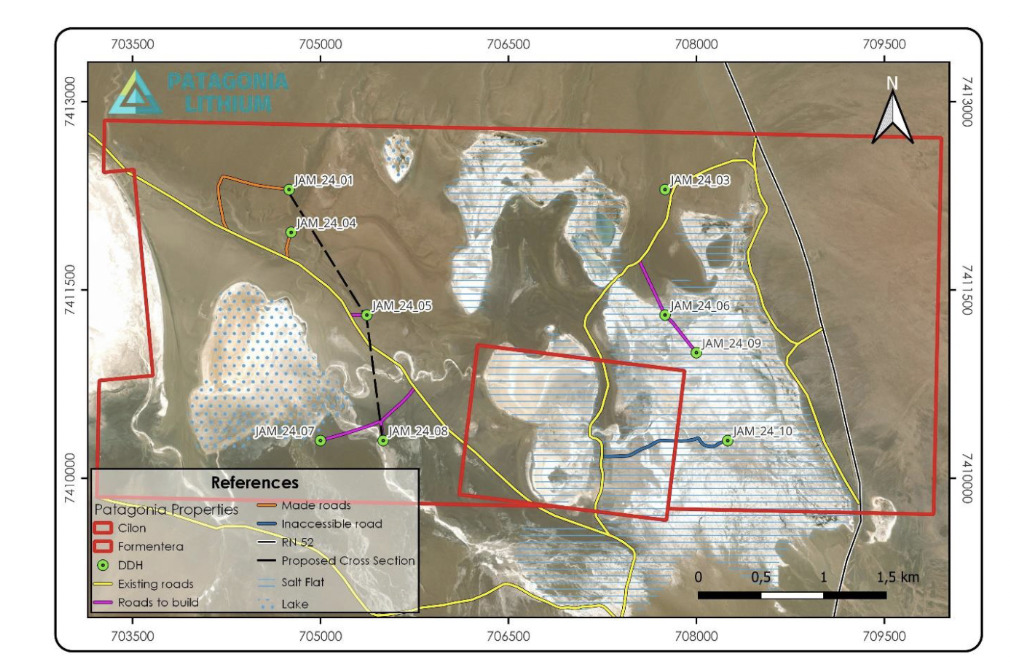

Junior explorer Patagonia Lithium has been hiking steadily up the bourse this morning after announcing “outstanding” assay results from its first drill well at the Formentera brines project in Argentina’s part of the ‘Lithium Triangle’.

It’s also on the hunt for rare earths and niobium there, but as its name suggests, lithium’s the main game, with two major brine projects on the go – Formentera/Cilon in Salar de Jama, Jujuy province and Tomas III at Incahuasi Salar in Salta Province.

Re the Formentera drill well news, the highlight intercept was 200m at 235ppm from 170m depth, including a 21m chunk grading 591ppm.

Also noted: very low levels of deleterious ions (Mg:Li 1.49 at 591ppm Li, boron 522ppm, calcium 358ppm).

“An interval of 200m with lithium values over 235ppm is truly an indication of a world class project,” said boss Phil Thomas.

“Brine flow is as important as lithium assay values and we have achieved evidence of both parts of the equation for a prospective successful project.”

PL3 share price

Black Canyon (ASX:BCA)

Manganese explorer and developer Black Canyon is up more than 20% based on some ‘dense media separation’.

If only that meant a shake-up and parting of ways in the braindead mainstream Aussie breakfast telly news and current affairs schtick.

Dense medium/media separation in the world of mining, meanwhile, is where particles are sorted on the basis of their densities.

In Black Canyon’s case, it’s talking the delivery of almost 32% manganese concentrate in this instance.

Specifically, grades of 31.8% Mn and 31.3% Mn from its KR1 and KR2 test samples conducted recently.

“The KR1 & KR2 samples were processed using larger scale DMS equipment that simulate beneficiation processing used across mining operations to upgrade manganese and iron ore in the Pilbara region,” notes the company, adding:

“These results complement previously announced Heavy Liquid Separation (HLS)

concentrates grades ranging between 29.2% Mn & 37.4% Mn also from KR1 and KR2.”

Manganese is having a bit of a moment of late, with the manganese benchmark ore prices continuing to rally.

“The 44% Mn benchmark price at the end of March was US$4.20/dmtu and has since risen to US$5.65/dmtu an increase of 34% over the month,” notes Black Canyon.

Black Canyon’s MD Brendan Cummins said:

“For the first time the company has utilised larger scale DMS equipment that is similar to beneficiation units used at existing manganese and iron ore mines in the Pilbara region.

The results confirmed our expectations that Black Canyon will be able to deliver a quality oxide manganese concentrate ranging between 30 to 33% Mn, in-line with end user requirements.”

BCA share price

Savannah Goldfields (ASX:SVG)

Small Aussie goldie – explorer and producer – Savannah also has interest in coking coal, which it is now offloading.

The company stands to rake in a “total consideration” of $3.95m, including $3,060,000 in cash to be paid to at the completion of a Sale of Interest deal regarding the Ashford coking coal project in the Northern Tablelands of NSW.

Definitive Transaction Agreements have now been signed for the sale of Savannah’s remaining shareholding in Renison Coal, which owns the Ashford project, to Clara Resources Australia (ASX:C7A).

The completion of the sale, says Savannah, will allow it to remain focused on progressing its gold mining and exploration projects. In fact, it plans to become a ‘pure play’ goldie, while still retaining some exposure to the Ashford coking coal project’s future ops in an investment sense.

SVG share price

Rincon Resources (ASX:RCR)

Bit of a broken record here, but critical metals (REEs, niobium, copper, gold) junior player keeps on busting up the bourse.

It’s now up a stonking 192% for the week, 400% for the past 30 days and 328% YTD.

Recently it uncovered what it describes as a ‘bullseye’ gravity target dubbed Avalon at its project in the West Arunta region. It’s of “of similar size and character” to the Luni carbonatite, and IOCG deposits such as Prominent Hill and Ernest Henry.

The market liked that. And it also seemed to dig the fact the company’s RC drilling campaign is now underway as of earlier this week.

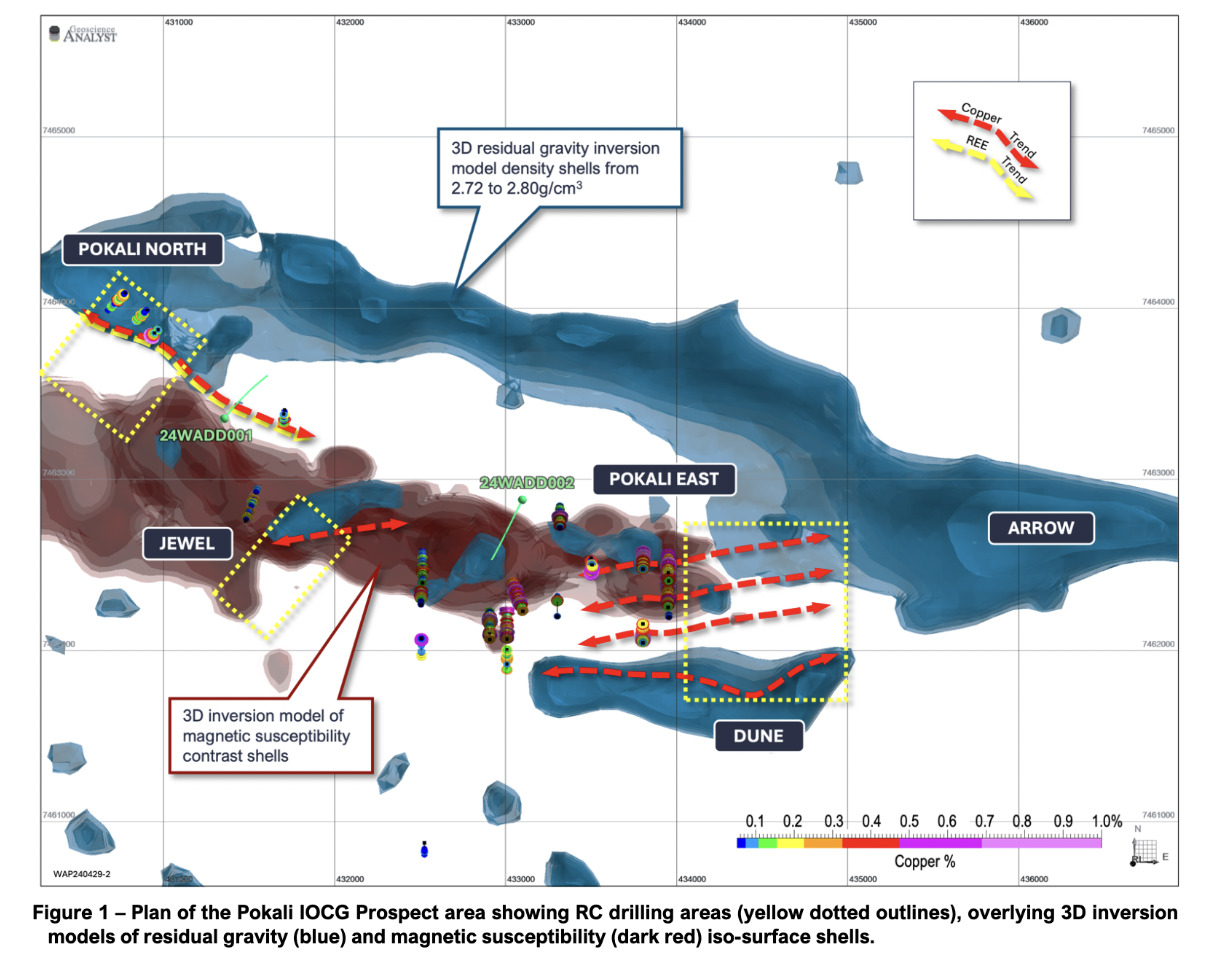

The company is targeting up to 2,000m at Pokali prospect within the West Arunta Project – to test four target areas (see image below).

Pokali East will extend IOCG copper mineralisation by up to 600m to the east of historic drilling intercepts that include, among others, 14m at 1.00% Cu from 168m, within 62m at 0.39% Cu from 152m; and 4m at 1.36% Cu from 222m, within 42m at 0.33% Cu from 196m.

The Dune target meanwhile is an initial drill test of the NEW Dune gravity target, adjacent to the south of existing mineralisation at Pokali East.

Pokali North will see additional drilling to test a coincident magnetic/gravity target area for copper-gold and REEs.

And Jewel will see testing of a new coincident magnetic/gravity anomaly that the company notes is identical to the Pokali East deep geophysical target.

Regarding the bullseye Avalon target, meanwhile, MD Gary Harvey said this:

“The new Avalon target is one of the best bullseye targets for carbonatite-Nb-REE or IOCG mineralisation styles that we have seen in the West Arunta region. We hope to emulate the success other companies such as WA1 Resources have had drilling these types of targets in the region.”

RCR share price

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.