Resources Top 4: Is this $15m capped lithium explorer sitting on the next Yinnetharra?

Pic: sutiporn, RooM, Via Getty Images

- Voltaic hits thick pegmatite next door to Delta Lithium’s potentially monstrous Yinnetharra project, surges 120%

- Advanced gold explorer Chesser receives takeover offer at 95% premium

- Besra’s US$300m Binding Gold Purchase Agreement with Quantum Metal Recovery Inc is now binding

Here are the biggest small cap resources winners in early trade, Tuesday May 9.

VOLTAIC STRATEGIC RESOURCES (ASX:VSR)

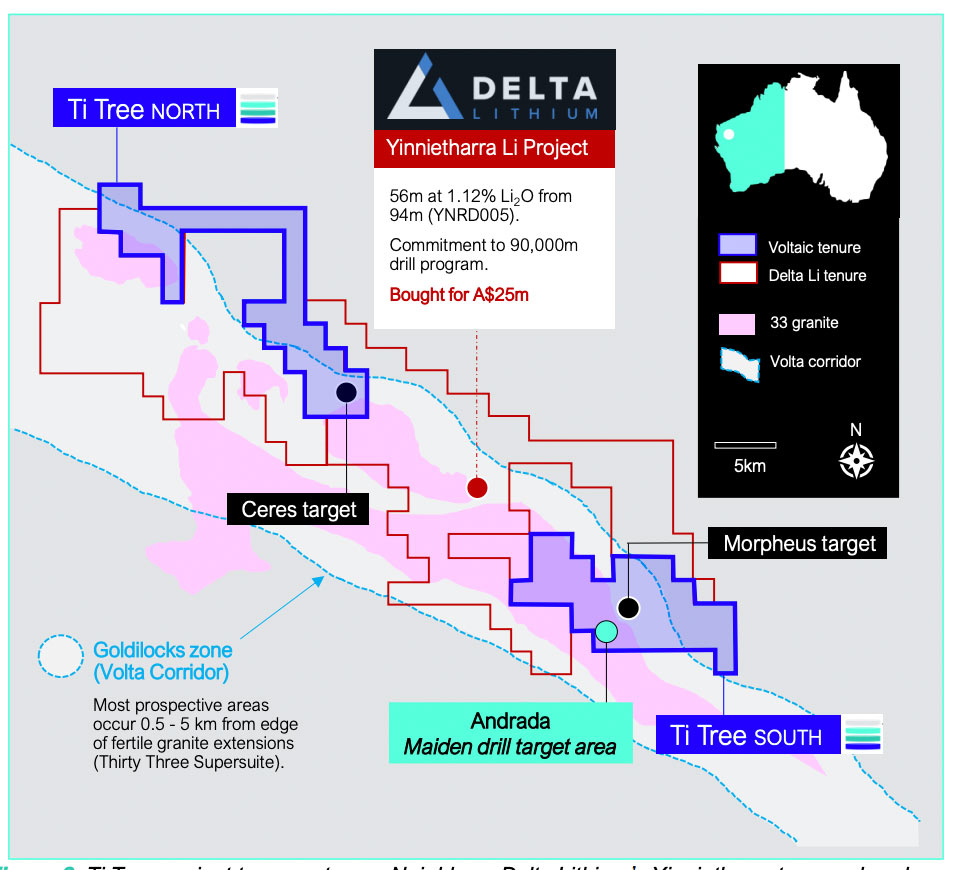

2022 relistee VSR has exploded out of the blocks on some promising lithium drilling results at Andrada, part of the Ti Tree project in the Gascoyne region of WA.

The 15-hole for 900m first pass program returned continuous pegmatite up to 58m thick, from surface across six targets.

All holes hit pegmatite – rock that contains lithium — which remains open at depth. Assays are due in about six weeks, VSR says.

Ti Tree sits around Delta Lithium’s (ASX:DLI) potentially monstrous Yinnetharra project, where the company recently hit 56m at 1.12% lithium as part of an extensive multi rig drill program. DLI boss David Flanagan says Yinnetharra “is looking more like a province than a project”.

$15m capped VSR is up 155% year-to-date. It had $2.4m in the bank at the end of March.

CHESSER RESOURCES (ASX:CHZ)

The advanced African gold explorer is recommending an all-share takeover offer from TSX/NYSE listed Fortuna Silver Mines at a 95% premium to the last closing price.

Under the proposal CHZ shareholders will receive 0.0248 shares in Fortuna per CHZ share. That’s an implied value of $0.142 per CHZ share, or $89m all up.

The attraction for $1.5bn capped Fortuna — which has five operating mines in Peru, Argentina, Mexico, Côte d’Ivoire, and Burkina Faso – is CHZ’s 860,000oz and growing Diamba Sud project in Senegal.

Diamba Sud lies 12km from Barrick’s 12.5Moz Loulo mine and 7km from its 5.5Moz Gounkoto mine.

A recent scoping study envisaged a low cost mine producing ~100kozpa at AISC US$856/oz over an intial 7-8 year mine life.

“In a short time, Chesser has done a great job advancing Diamba Sud from early-stage exploration to a PEA-stage [scoping] project with multiple targets yet to be tested,” Fortuna boss Jorge A. Ganoza says.

“Within the larger and diversified Fortuna portfolio, the advancement of Diamba Sud will benefit from our technical and operational strength and lower cost of capital.”

$70m capped CHZ is up 70% in early trade to 12-month highs.

BESRA GOLD (ASX:BEZ)

The US$300m Binding Gold Purchase Agreement with Quantum Metal Recovery Inc is now legally binding.

The facility, paid over 30 months against future gold production ounces, enables BEZ to fully fund development of the ~3Moz Bau project in Malaysia’s Sarawak region.

For Quantum, this is an opportunity to secure a long term supply of gold for its bullion trading business.

BEZ says this is probably one of the largest deals of its kind signed by an ASX listed junior.

“This extraordinary funding deal should provide ample funding for the development of Bau and allows us to bring the project into production in a way that is uniquely non-dilutive to our shareholders and to retain exposure to gold price movements, free of hedging or other onerous covenants,” exec chair Jocelyn Bennett says.

“Whilst we have several Conditions Precedent yet to fulfil we expect the US$300m facility to be fully operational by June 30, 2023.”

The company is now updating an old feasibility study completed back in 2013, with initial results due in the second half of 2023.

Pilot production is also pencilled in for later this year.

$110m capped BEZ is now up ~675% since inking the deal in March.

WILDCAT RESOURCES (ASX:WC8)

(Up on no news)

The junior gold stock jumped ~20% today before entering a trading pause.

Its main game is the Mt Adrah gold project in the Lachlan Fold Belt of NSW, where it recently finished drilling around the 770,000oz Hobbs Pipe gold deposit.

The 16-hole, 1300m program tested extensions and additional mineralised bodies of the intrusion-related gold system (IRGS) that hosts the significant gold resource at Hobbs Pipe.

Like porphyry copper-gold systems, IRGS often form in “camps” of multiple mineralised bodies, the company says.

Assays are pending.

The $28m capped stock is up 100% in 2023. It had $4.9m in the bank at the end of March.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.