Resources Top 3: Investors bite hard into Labyrinth gold

Mining

LRL is the big ressie winner of morning trade after entering a 12-month option to acquire the remaining 49% of its Comet Vale gold project from Sand Queen Gold Mines for a cool $3m cash.

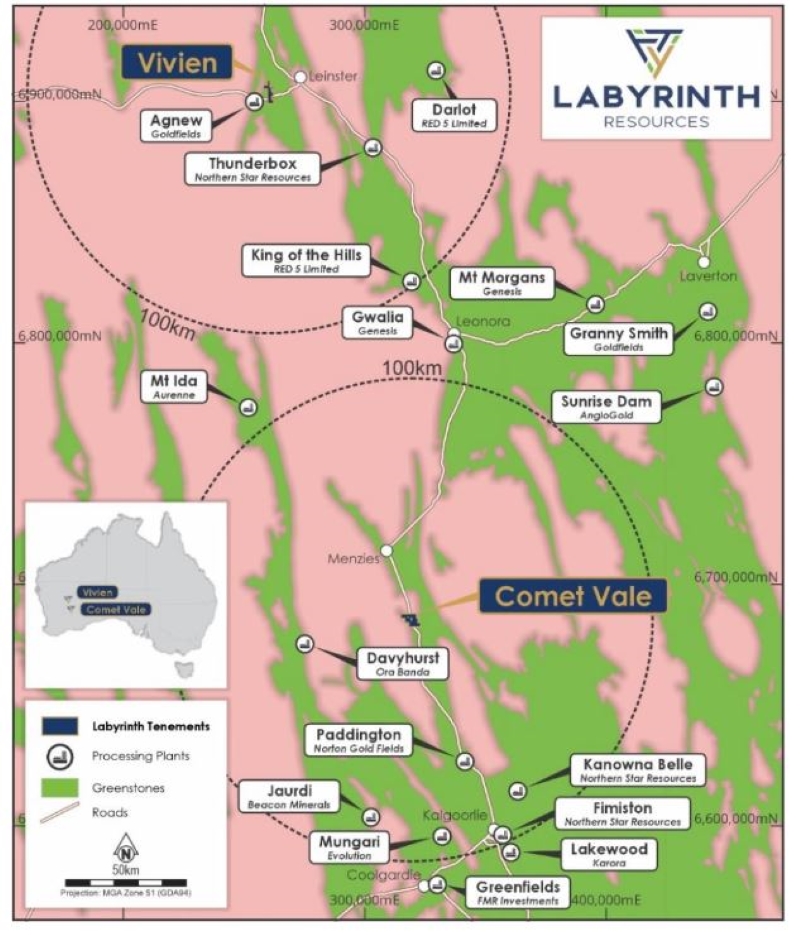

Comet Vale, 32km south of Menzies, is currently endowed with resource of 96,000oz at 4.8g/t gold.

It’s also snapping up the Vivien gold project by acquiring private company Distilled, whereby its vendors Alex Hewlett and Kelvin Flynn are expected to emerge with 12.3% and 10.2% voting power in LRL once transactions are finalised.

LRL’s new shiny project is just a hop, step and 6km jump from South African mining major Gold Fields’ >250,000ozpa Agnew mine, which was previously owned by gold producer Ramelius Resources (ASX:RMS).

Hewlett and Flynn come from roles driving value creation for WA exploration companies including Red Dirt Metals, now Delta Lithium (ASX:DLI), Spectrum Metals, Mineral Resources (ASX:MIN), Silver Lake (now part of Red 5 (ASX:RED)) and Wildcat Resources (ASX:WC8).

It gives the gold junior more exposure in the Goldfields and is part of its strategy to build ounces by consolidating and growing underexplored high-grade mines around the Menzies, Leinster and Leonora corridor.

The latest moves will be backed by a $4m cap raise with firm commitments for $2m in a share placement already, and a ~1-for-2 share entitlement offer for a further $2m, which it expects to fill.

Also, back in May, Labyrinth decided to keep and reassess options for its flagship Labyrinth gold project in the Abitibi mining region of Quebec, Canada, after terminating a purchase agreement with Gold Projects WA and pocketing the non-refundable $255,000 that was put as a downpayment.

Shares in Labyrinth have gone astronomical today, up 220% to be swapping over at 1.6c per share at time of writing.

SMM (formerly Tempus Resources) has identified a significant north-south gravity high at the Miguel deposit, part of the Prescott base metals project in Nunavut, Canada, which “could potentially be related to mineralisation from sedimentary-hosted copper deposit or a Mississippi Valley-type deposit”, says MD Chris Hansen.

“The Miguel block was the first of 16 blocks surveyed at the Prescott project as part of the ongoing airborne geophysical survey.

“Initial results from the survey have exceeded our expectations, serving to identify a significant 4 km north-south gravity high at Miguel, just 29km from American West Metals’ (ASX:AW1) Storm deposit.”

Shares in the minnow bounced up 25% to 0.4c per share, just to remain flat again by the time we went on to publish. Watch closely for volatility.

A board revamp and a two-for-three rights issue to raise $1.05m at 0.3c per share has caused less-than-a-penny-stock PKO swell up the charts in morning trade today.

The company accepted the resignation of Geoff Albers and will be replaced on the board by Gernot Abl, who has been nominated to become non-executive chairman.

Funds will be used for working capital and exploration across its existing projects.

Shares were up a handy 33% to 0.4c per share on the back of the news in morning trade today.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.