Resources Top 4: History REE-peats in Malawi for a four-bagging DY6 Metals

Pic via Getty Images

- DY6 has absolutely burst up the bourse today – a 300%+ gain on historical African REE drill hits

- Armada Metals meanwhile is looking beyond Africa for critical metals – to the US for lithium

- Australasian Metals and Polymetals Resources also have needle-moving news today

Here are some of the biggest resources winners in early trade, Monday May 27.

DY6 Metals (ASX:DY6)

Minerals exploration minnow DY6 is bourse bursting today with heavy bags of gains to the tune of more than 300% at the time of writing.

“Exceptional” high grade historical drill hits confirm the Tundulu rare earths project in Malawi as a significant asset, says the company.

As we reported earlier, Malawi has been brewing as an attractive African mining jurisdiction since its government installed its Mines and Minerals Act in March last year, which incorporated incentives for foreign investment into the sector.

The country’s president, Lazarus Chakwera, has bold plans to increase the mineral sector’s long-term contribution to GDP from today’s ~1% up to 20%.

Highlights from the 7,000m program in 2014 included 101m at 1.02% TREO and 3.6% phosphate, from surface, as well as 91m 1.09% TREO and 7.6% phosphate from 46m.

DY6 CEO, Mr Lloyd Kaiser said:

“These additional historical results further illustrate the potential for a significant carbonatite rare earth deposit with scope to expand the extent of mineralisation over the southern and western side of Nathace Hill and across Tundulu Hill, areas that remain largely unexplored.

“We look forward to commencing the preliminary geological model from all the historic drill data. This will improve our knowledge of the mineralised nature of Tundulu and assist in mapping the next phase of exploration activity.”

📢Exceptional historical drill results from the Tundulu project confirm its potential to host a significant REE carbonatite system.

FULL ANNOUNCEMENT🔗063ybkzd8q81bl.pdf (https://t.co/duP5CnPbkN)

$DY6 $DY6.ax #rareearths #criticalminerals #exploration #Malawi pic.twitter.com/5vALpvBms1

— DY6 Metals Limited (@DY6Metals_Ltd) May 27, 2024

Read more on this > here

DY6 share price

Armada Metals (ASX:AMM)

This African-focused nickel-copper explorer is adding geographical and asset-based scope to its portfolio, announcing it’s acquiring Midwest Lithium, an explorer targeting hard rock deposits in the US.

Midwest, which was previously contemplating an ASX listing of its own, has ground in the spod-rich Black Hills of South Dakota.

On completion, Midwest shareholders will hold 50% of the enlarged post capital raising, issued share capital of Armada. The transaction is subject to various conditions, of course, “including execution of long form agreements and the completion of satisfactory legal, financial, tax and technical due diligence by Armada”.

What happens next? Capital raising, actually, with “not less than $5 million” in mind.

A “transformative” move for AMM? You know it. Actually, Rick Anthon, the company’s non-executive chairman said as much, adding:

“While we remain committed to our projects in Africa, we will be acquiring drill-ready lithium pegmatite projects in South Dakota, USA, where we will aim to generate rapid and successful exploration results.”

Armada Metals is pleased to announce that it has entered into a

binding term sheet to acquire 100% of the issued capital of Midwest #Lithium Limited.➡️View the announcement here: https://t.co/Syx22Qb4rw$AMM #ASX pic.twitter.com/0N54qSFnNg

— Rapid Lithium Limited (@Rapidlithium) May 26, 2024

AMM share price

Australasian Metals (ASX:A8G)

Australasian Metals Limited (formerly known as Australasian Gold) is a lithium, gold and precious metals exploration company focused on its projects in the Northern Territory and Queensland.

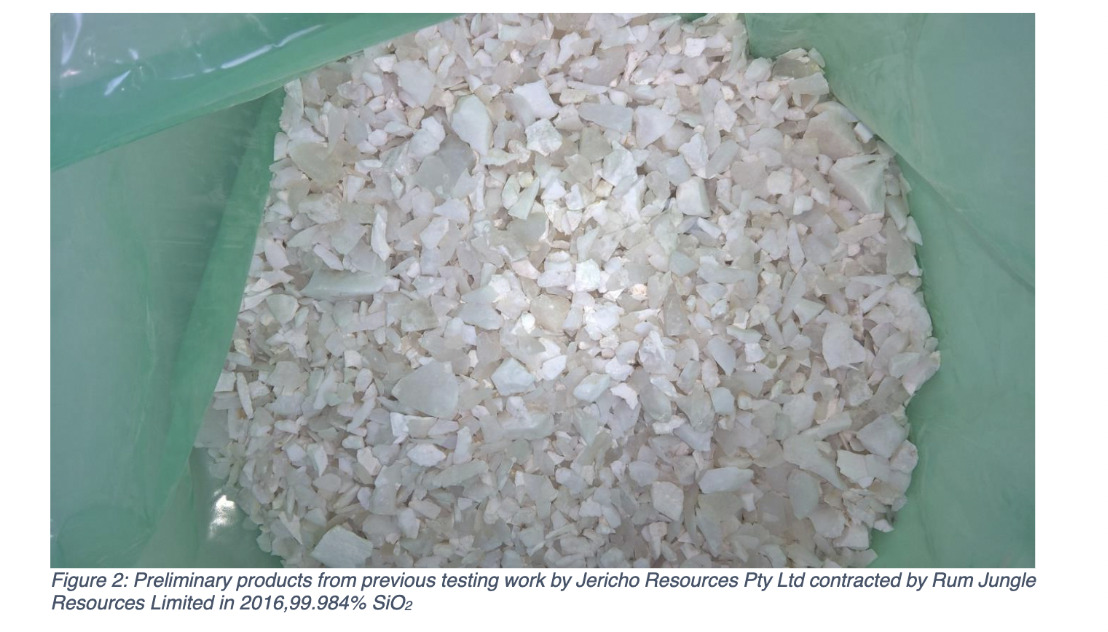

The company has announced this morning it’s signed an option to acquire a high pure quartz project in the NT.

That operation is known as the Dingo Hole high pure quartz project and A8G has entered an agreement with Verdant Minerals regarding it.

High Pure Quartz HPQ is a rapidly growing minerals sector, and that’s largely due to the material’s high industrial usage in the tech and electronics industry (yes, AI), including for semiconductors, solar panels, optical glass, optical fibres and more.

The Dingo Hole project is situated in the Georgina Basin, approximately 300km southeast of Tennant Creek and covers som 35.16km2. It was explored on a limited basis by Rum Jungle Resources, which was renamed Verdant Minerals, between 2012 and 2016.

A8G MD Dr Qingtao Zeng said:

“The High Pure Quartz market is highly sought-after in the world given the significant demands for AI-related semiconductor applications and photovoltaic solar silica growth.

“The Dingo Hole quartz samples have unique geological characteristics with extremely low impurities of Al, Ti and Li. We believe there are sufficient indications that the material in Dingo Hole has potential to produce high pure Silica (HPQ). We are excited to test and further define the potential of this project.”

A8G share price

Polymetals Resources (ASX:POL)

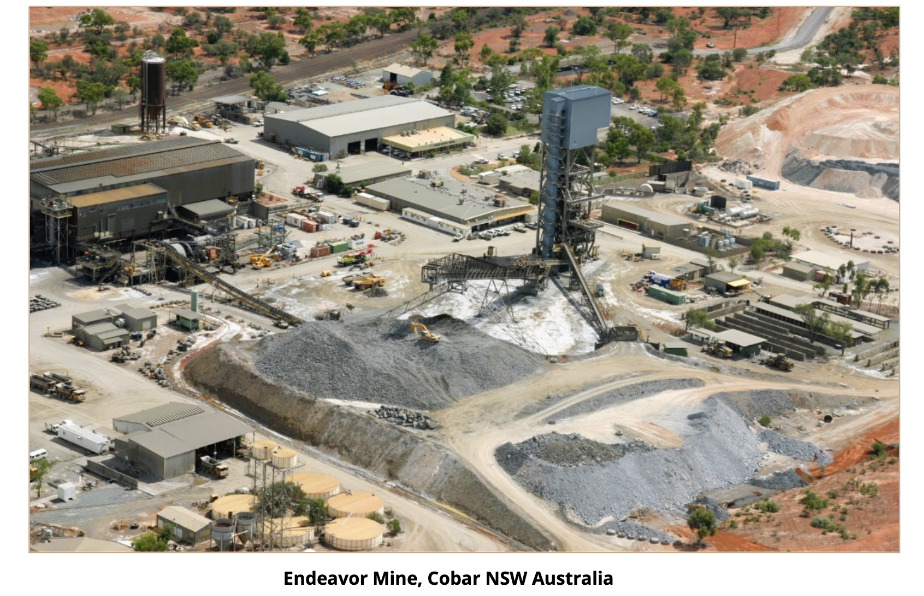

Metals Acquisition (ASX:MAC) and Polymetals have formed a non-exclusive strategic alliance to extract greater value from both the Endeavor and CSA copper mines in the Cobar Basin of NSW.

MAC will also invest up to $5m @ $0.35/share in POL.

Polymetals is surging on the news, by the way, up more than 20% at the time of writing, while Metals Acquisition’s share price is also faring well, up a more modest 4% or so – but still significant considering the size of the company’s market cap, which is in excess of $1.46b.

It’s a very big deal for POL, this, and will see the joint operation treat high-grade zinc ore at Endeavor. POL will also provide MAC with excess water offtake to enhance CSA ore treatment capacity.

Polymetals exec chair Dave Sproule said:

“Polymetals has operated in the Cobar Basin for many years and is confident the alliance with MAC will generate significant benefit for all stakeholders. Both companies are managed by long term solution focussed operators which will unlock value from existing synergies and identify other opportunities as the relationship grows.”

POL share price

At Stockhead we tell it like it is. While DY6 is a Stockhead advertiser at the time of writing, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.