Resources Top 4: Belararox eyes up big Argentinian copper targets… in 3D

Pic via Getty Images

- Battery minerals-hunting juniors are amongst the big gainers this morning.

- Belararox is well up after providing further evidence of a significant porphyry copper target in Argentina

- While Volt Resources, Summit Minerals and RareX are all well energised, too

Here are some of the biggest resources winners in early trade, Tuesday June 11.

Belararox (ASX:BRX)

Battery and renewables mineral exploration company Belararox’s share price is up nicely this morning after the company provided further evidence of a significant copper porphyry target.

This is of “considerable size”, according to the company, and is located at the Malambo prospect at its Toro-Malambo-Toro (TMT) project in Argentina.

It shows substantial exploration potential for a large porphyry copper deposit over 800m long, 600m wide, and a depth of about 600m.

A 3D video aid helped interpret BRX’s latest assay results, providing the additional confirmation.

This was apparently achieved using two independent 3D algorithms with Malambo’s geochemical results were compared to the Yerington porphyry copper deposit and other US porphyry systems.

Similar modelling results from porphyry deposits in Ecuador, Chile, and Mongolia also reportedly support these findings.

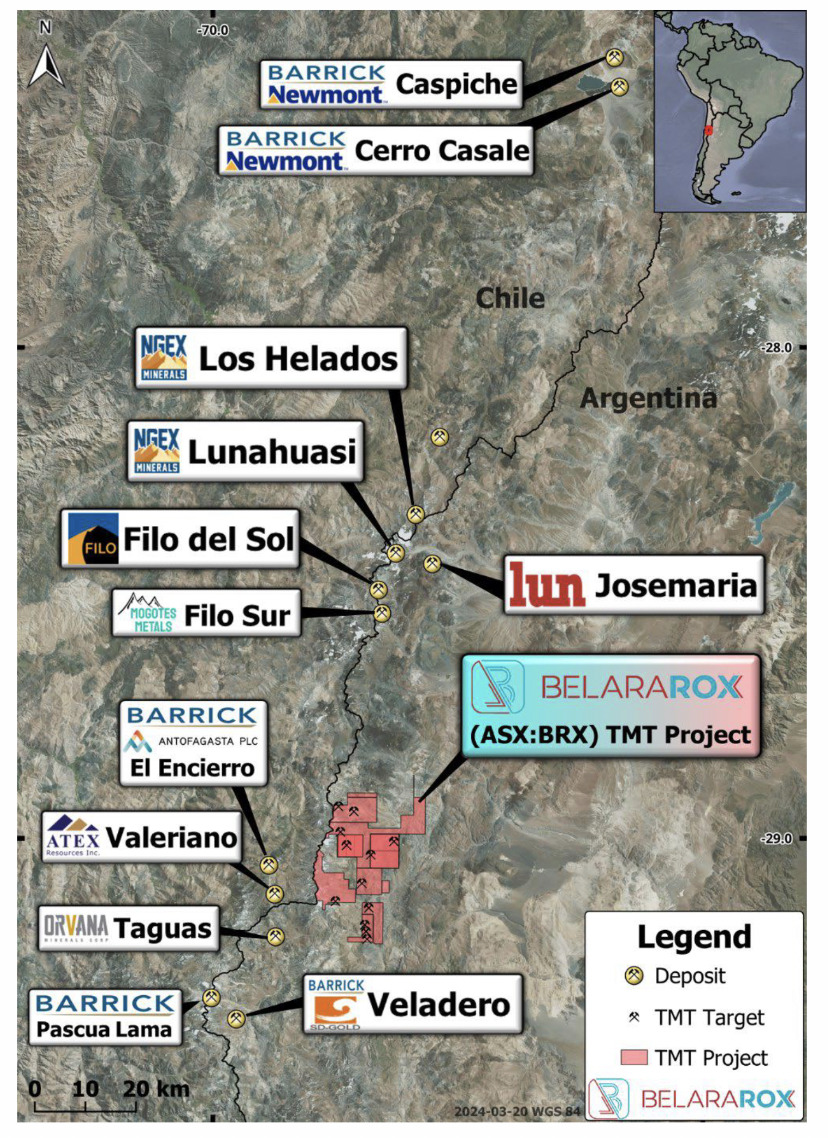

“Malambo is shaping as a great drilling target at our TMT project in Argentina, which is surrounded by several significant discoveries, including Filo Del Sol, Los Helados and Luanhausi etc,” noted BRX. (See below.)

Belararox has already successfully identified numerous promising targets within the TMT project. And these are set to undergo intensive exploration.

Tune in to hear Belararox’s MD Arvind Misra chat with Stockhead about the company’s latest field activities > here.

Volt Resources (ASX:VRC)

Battery minerals company Volt is up a decent amount so far today after it revealed it’s begun production trials for a precursor anode active material for use in EV batteries.

Volt is largely focused on its 100% owned graphite and gold projects in Africa, but also has a 70% interest in the Zavalievsky Graphite business with an operating graphite mine and plant in Ukraine.

The new chemical purification process is being developed to produce a “high purity active anode precursor material (pAAM)” for use in lithium-ion batteries.

Volt says it’s “leveraging” existing in-house purification process technology and is looking to create a high-value product using environmentally friendly processes.

The company’s MD, Prashant Chintawar, noted, among other things:

“This relatively low capital development cost process could lead to early stage revenue generation”.

Video footage from Volt Resources Limited’s ($VRC: #ASX) subsidiary ZG Graphite mine @ZavalivskyGraph which has been operating since 1934.

Key facts about the mine:

⚖ 22.9 million ton at a grade of 6.8% carbon

~90% graphite is fine mesh suitable for lithium-ion batteries

… pic.twitter.com/AAbh0wFGZo— Volt Resources (@asxvolt) June 6, 2024

Summit Minerals (ASX:SUM)

ASX-housed battery minerals explorers seem to be energising today, because here’s another one making a double-digit climb.

Thanks to some high-grade assay results, the company has confirmed the strong niobium potential at its recently acquired Equador niobium and REE project in northeast Brazil.

It’s talking rock samples grading as much as 40% niobium, as well as tantalum over a 1.2km strike length.

Specific assay highlights, including partial rare earth oxides (PREO) from surface pegmatite rock chips, include:

• 40.84% Nb2O5, 15.74% Ta2O5 and 4,660 ppm PREO

• 34.45% Nb2O5, 26.73% Ta2O5 and 5,330 ppm PREO

The company notes that multiple new potential pegmatites have been identified across the project as well as the discovery of previously unmapped artisanal mines in multiple locations.

Numerous rock chip samples now await further assay results, while exploration and further sampling continues.

Summit Minerals Limited (ASX: SUM) is pleased to provide an update on exploration activities related to its recently acquired Equador Nb-Ta-REE Project in northeast Brazil’s Borborema Pegmatitic Province (BPP), Paraiba State.

Read more: https://t.co/4h7r2vLlIE$SUM #REE pic.twitter.com/Pkj8Yxl34o

— SUMMIT Minerals Ltd (@summit_minerals) June 11, 2024

RareX (ASX:REE)

Rare earths hunter RareX is back in the news, and gains, after announcing an update regarding its “district-scale” Khaleesi niobium and REE project in the East Yilgarn region of Western Australia.

The company has found that its geophysical data analysis of “high-quality historical exploration data” from the recently acquired Khaleesi has delivered encouraging early results, highlighting several gravity anomalies and confirming strong potential for niobium mineralisation.

RareX is currently reviewing more than 65,000 metres of gold-focused historical air core drilling data from across the project area. The few historical holes assayed for niobium show up to 1,000ppm.

Also, based on the strength of this positive analysis, the company has decided to expand its territory at the site, gaining an additional 336km2 land package.

RareX considers Khaleesi a highly promising exploration opportunity to complement its engineering-stage, 100%-owned Cummins Range REE and phosphate project.

RareX CEO James Durrant said:

“Our growing understanding of the geology and geophysics at the Khaleesi Project continues to support our growing excitement for this region, which has now seen the company move to expand its exploration footprint.

“Drill targets are emerging and we are looking forward to re-assay some of the historical gold-focused drilling for niobium and rare earths mineralisation.

“We have also begun working with Central Desert Native Title Services, as the native title service provider for the Upurli Upurli Nguratja Aboriginal Corporation, and look forward to securing an agreement to manage native title heritage over the Khaleesi Project area.”

At Stockhead we tell it like it is. While Belararox, Summit Minerals and RareX are Stockhead advertisers at the time of writing, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.