Resources Top … 3: ‘Significant and widening garnet supply deficit’ puts this advanced ASX explorer in a great spot

Pic: David Malan, Stone/ Via Getty Images

- Drilling complete at Heavy Minerals’ Port Gregory garnet project, with “first batch of assays due to be received”

- Garnets used as gemstones for jewellery, as abrasives, and in emerging battery applications

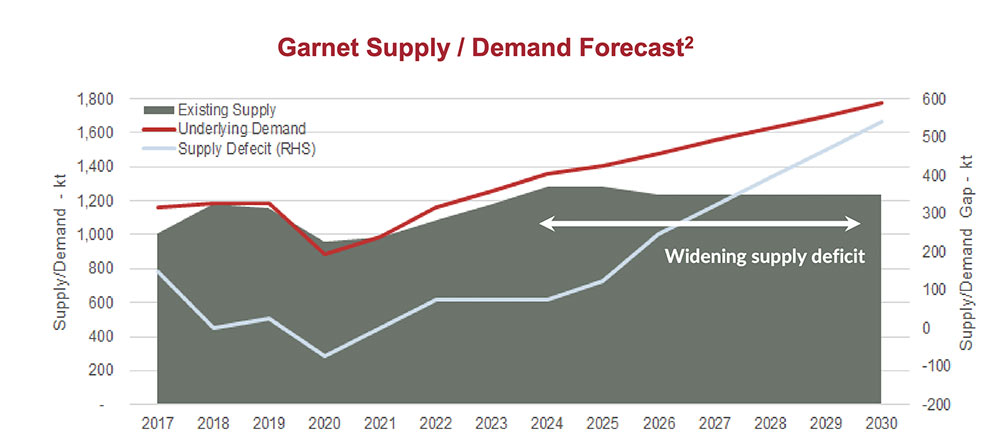

- A “significant and widening [garnet] supply deficit forecast from 2022 onwards”

Here are the biggest small cap resources winners in early trade, Friday December 23.

It’s Christmas eve-eve, everyone has checked out and there are only three stocks in our Resources Top 5. Happy Holidays.

HEAVY MINERALS (ASX:HVY)

In an update to a December 21 announcement (what did they update though? It looks the same) HVY said drilling at the Port Gregory garnet project in WA was complete, with the “first batch of assays due to be received”.

Garnets have been used since the Bronze Age as gemstones for jewellery and ornaments and as abrasives, according to Geoscience Australia.

“Because garnet is so hard and resistant to weathering, it can be used as skid resistant road aggregate, skid resistant paints, and for filler in concrete being used in harsh environments,” it says.

“More recently, lithium-oxide garnets have been receiving a lot of interest from researchers, because they can be used as electrolytes for batteries.”

HVY says is a “significant and widening [garnet] supply deficit forecast from 2022 onwards”.

This will culminate in a 540kt deficit in 2030 without new sources of supply:

The purpose of HVY latest drilling campaign was to upgrade and expand the Port Gregory resource, currently 135 million tonnes (Mt) @ 4.0% THM for 4.9Mt garnet.

The results, due over the next few months, will be used in an updated resource (March) and a project pre-feasibility study (April start).

Meanwhile, drilling at the Red Hill discovery, about 40km away, will kick off in early January.

Assay results for the Red Hill program are anticipated to be received in March 2023 with a potential resource being released in Q2 CY 2023.

PODIUM MINERALS (ASX:POD)

(Up on no news)

POD wants to be Australia’s first platinum group metals producer at Parkes Reef, a 15km long, 6Moz deposit in WA which also contains gold and base metal (Cu + Ni) mineralisation.

The orebody remains ‘open’ below ~250m along the full 15km strike.

In November, metallurgical testwork showed the ability to produce a saleable PGM flotation concentrate suitable for PGM smelter feed.

In addition to a PGM flotation concentrate, downstream processing developments have proven that high metal recovery of all eight payable metals can be achieved using atmospheric leaching.

Extracting high metal recoveries via the leach process to create a product suitable as a PGM refinery feed is a significant milestone for Podium, managing director Sam Rodda says.

“The leach test work has successfully demonstrated recovery for both oxide ore and sulphide ore,” he says.

“Leaching test work, when compared to the flotation process, could deliver a step change in unlocking value for Parks Reef due to the potential for Podium to produce a higher-grade product attractive to PGM refineries globally.

“This process offers new potential avenues to develop our project and routes to commercialise our products.”

A preferred metal recovery pathway is under development to produce PGM and base metal products. This work kicked off in October 2022, with results expected early 2023.

METALSTECH (ASX:MTC)

Yesterday, this advanced gold project developer got a $3m cash injection from Chifeng, one of China’s biggest precious metals miners with a market cap of ~$7 billion.

The placement, done at 40c per share, increases Chifeng’s stake in MTC to 9%. The Chinese co had also been increasing its position via on-market buying.

“Chifeng is widely considered to be the most successful gold miner in China owing to the experience of their chairman Mr Wang Jianhua who before transforming Chifeng in his role as chairman, served as CEO of $58 billion capped Zijin Mining and before that, served as chairman of $18 billion capped Shandong Gold,” MTC director Gino D’Anna says.

“We are delighted that Chifeng continues to increase its ownership in our exciting company.”

MTC is focused bringing the mothballed 1.5Moz gold, 10.93Moz silver Sturec mine in Slovakia back into production.

A recent scoping study on a combined open pit/underground operation deliver a pre-tax NPV of up to $846m with a pre-tax IRR of 102.5%, but this was done a gold price above $US2,000oz.

Still, MTC estimates low all-in sustaining costs of $US753/oz which would provide it with a nice profit margin.

A PFS will kick off following completion of an ongoing drilling program and resource update.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.