Veteran teams, proven ability and hungrier than ever

These companies have leaders who have been there and done it before. Pic: Getty Images

- The Resources Rising Stars conference is in full swing on the Gold Coast, with more than 50 established and up-and-coming ASX-listed companies in attendance

- Among them are industry veterans applying deep expertise to new challenges with explorers and producers of great potential

- Copper player Develop Global and goldies Uvre and Gorilla are three beneficiaries of glittering mining careers

With so many quality companies to choose from and big commodity gains making them more attractive by the day, it can be hard to figure out which stocks have not just the assets and the funding, but the expertise to bring their projects to fruition.

While it’s important to remember the old market adage that previous performance doesn’t guarantee future returns, it’s certainly reassuring when your management team has done it all before.

Here are three Resources Rising Stars attendees that bring veteran executives and all the experience that entails to the table.

Develop Global (ASX:DVP)

Develop is a copper and base metal company with a dual business model, engaged in both developing its mineral assets and providing mining services to the wider industry.

It’s also one of the largest copper-focused companies nearing production at a time when ASX-listed copper entities are in short supply.

MAC Copper is en route to being acquired by Harmony Gold for $1.6 billion, Xanadu Mines by a Singapore-led consortium for $160m, and New World Resources by Kinterra Capital in a cash takeover valued at $243m.

That leaves Develop with few peers to speak of, and big potential to grow into a market with fairly low competition.

For exNorthern Star Resources (ASX:NST) head honcho and now Develop managing director Bill Beament, success is based just as much on who you’re working with as what you’re working in.

“Your number one asset in any business regardless of commodities, materials, industrials (is) your people,” Beament told Stockhead at the Resources Rising Stars Conference.

“A lot of us have worked together across numerous different entities, and I always invest in people first.

“You surround yourself with the best and the brightest and the youngest and nurture them. I think we’ve put an amazing team together and they’re all hungry, they’re all incentivised.”

Develop recently brought Nathan Stoitis, one of Australia’s top metallurgists, onto the team as General Manager.

He’s a highly respected name who’s long been involved with Bill Beament’s companies, running peer review for a myriad of ASX entities.

“I was trying to get Nathan onboard for 15 years,” Bill laughed.

“When you come across someone who’s got an amazing skill set in D&A, you either want them in your business or you want them associated with your business and that’s one of the key things, spotting talent – the people who don’t let you down.”

Develop is advancing three core projects – the Woodlawn copper and zinc mine, the Sulphur Springs zinc and copper project, and the Pioneer Dome lithium project.

Woodlawn is already at the commissioning and ramp-up stage, targeting a 850,000tpa nameplate capacity and several parcels of product (copper, zinc and lead) already shipped to Trafigura with payments received.

Trafigura and Develop recently entered into a 5-year offtake deal that covers all of Woodlawn’s projected production volume over that period as well as opening a $100m loan facility to commission the project.

Uvre (ASX:UVA)

Uvre is another company backed by executives with some wins under their belt.

The company is focused on Kiwi gold, having shifted targets from lithium and uranium after inking a deal with mining legend Norm Seckold.

Seckold was previously chair of Santana Minerals (ASX:SMI), which discovered the most significant Kiwi gold deposit in over four decades in the form of the Bendigo-Ophir project in Central Otago. That’s on top of his biggest success as the executive chair at Indonesian nickel giant Nickel Industries (ASX:NIC).

Bendigo-Ophir now holds a resource estimate of ~2.5Moz of gold. It is expected to produce 120,000 ounces of gold a year and generate more than NZ$6 billion in revenue.

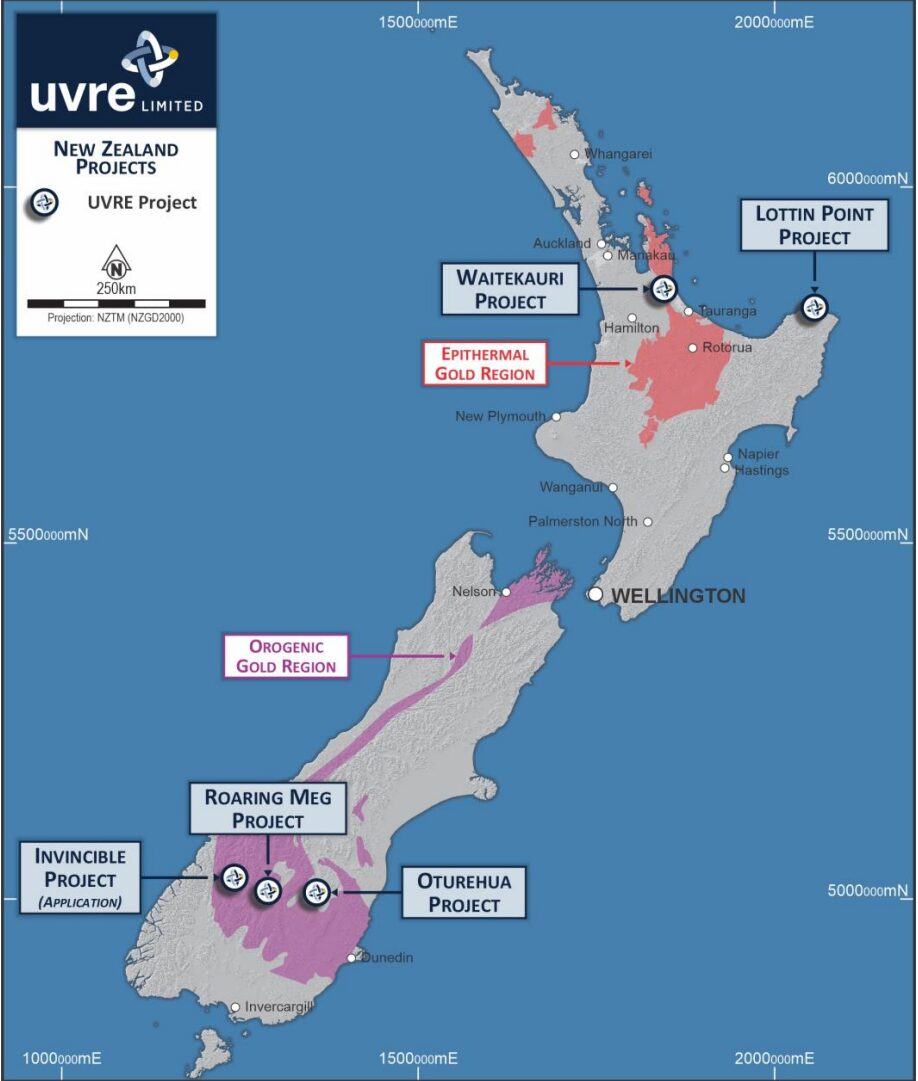

Uvre is operating in the same Central Otago gold belt with its Roaring Meg and Oturehua projects. But its flagship project is Waitekauri on the North Island, which sits in the shadows of the 12Moz Waihi gold mine. UVA also boasts the Lottin Point project on the North Island’s eastern tip.

Uvre’s project locations within New Zealand. Pic: supplied, UVA.

“With every small company, the team is incredibly important,” Uvre advisor and managing director of Prospech (ASX:PRS) Jason Beckton said at the Resources Rising Stars Conference.

“The main two people I’ve known for many years are Norm Seckold and Peter Nightingale, who I’ve worked with for 21 years since Mexico, and we have a habit of leaving the high risk, greenfields exploration to larger groups.

“We prefer brownfields things that have already been de-risked to some extent on previous operators.”

Apart from its Central Otago expertise, UVA’s team also boasts epithermal gold veterans in Beckton and Peter Zitnan, the latter of which is preparing for a fresh drilling program on UVA’s projects.

“We’ve planned out the drilling already, the drilling pads, predecessors already built and put in, so we don’t have to do any significant earthworks,” Beckton explained.

“We should be drilling by the end of this month.”

Gorilla Gold (ASX:GG8)

Gorilla Gold is headed by CEO Charles Hughes, a geologist with experience across some of Australia’s top gold and lithium miners including Saracen, Northern Star, Bellevue Gold (ASX:BGL) and Delta Lithium (ASX:DLI).

The company’s assets sit predominantly in Western Australia, with an eye to underdeveloped projects close to established infrastructure.

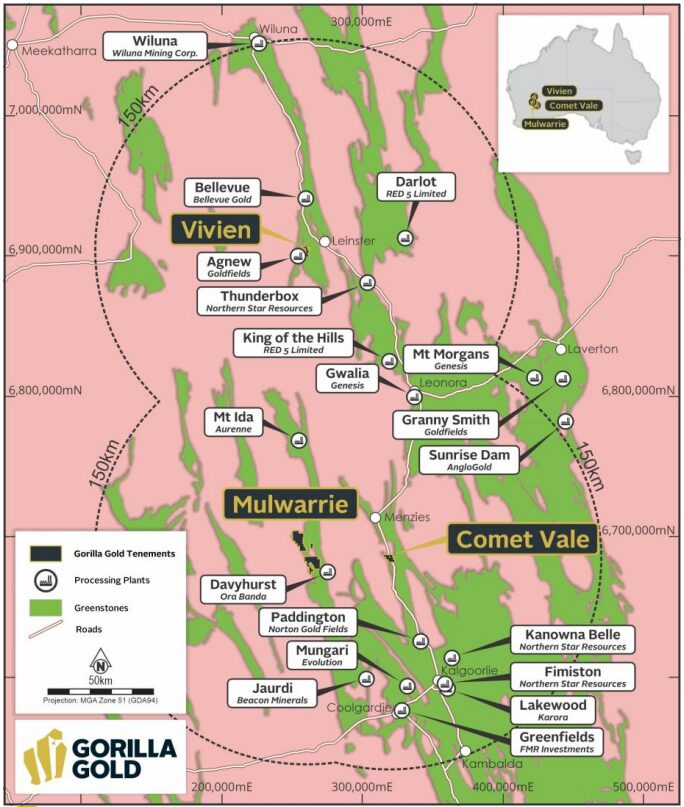

GG8 has snapped up a smorgasbord of tenements in the Kalgoorlie region within a premier gold mining jurisdiction host to some of the largest deposits in WA.

Gorilla Gold WA project locations. Pic: Supplied, GG8.

“High grade gold projects all on granted mining leases. This is a key tenant for us,” Hughes told the Resources Rising Stars conference in his presentation.

“These projects are all surrounded by existing infrastructure – the combination of high gold grades and established infrastructure builds optionality into our business.

“We’ve drilled more than 80,000m so far this year, and we have added nearly 650,000oz of gold resources to our books through exploration.”

Hughes is supported by non-executive director Simon Lawson, fresh off the former Northern Star geologist’s successful run with Spartan Resources.

Lawson led a once penniless Spartan Resources to the Never Never and Pepper gold discoveries and a takeover by Ramelius Resources valuing the company at $2.4 billion, after which he was welcomed onto the Ramelius board as a non-executive director and deputy chair.

“When it comes to making serious strategic decisions, we’ve done it before and can make the right decisions at the right time and make sure shareholders benefit the most out of it,” Gorilla Gold CEO Charles Hughes told Stockhead on the conference floor.

“We’re confident we can execute effectively, making the right decisions from the early stages that allow us to get it right all the way through the project execution stages.”

At Stockhead, we tell it like it is. While Uvre is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.