Resources Rising Stars: Lion’s Hedley Widdup says the mining cycle is at 4 o’clock – here’s what he means

4 o'clock, what does that mean for junior miners? Pic: Getty Images

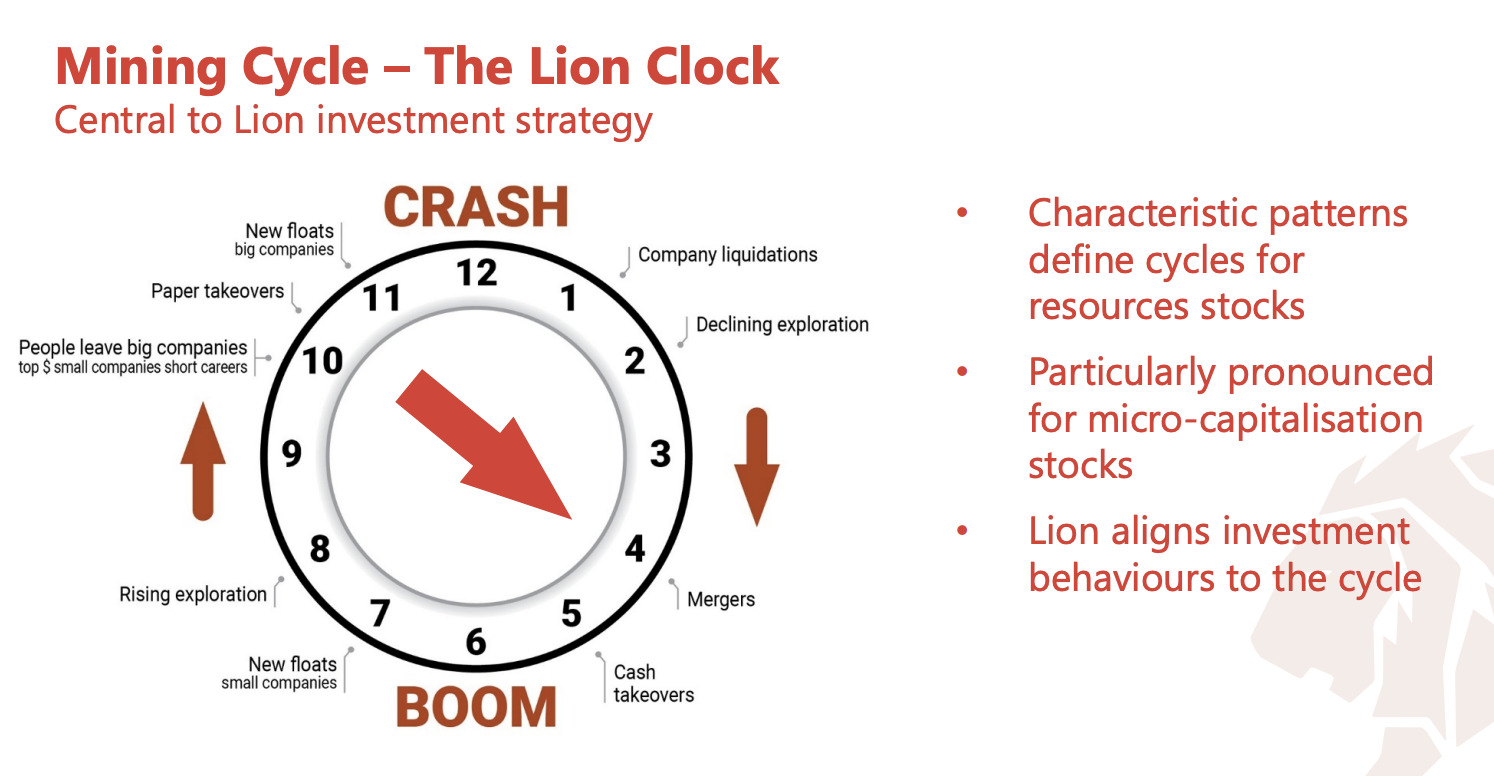

- Hedley Widdup’s famous mining clock has been turned to 4 o’clock

- We’re now a couple years into the downturn, a time Widdup and his Lion Selection Group looks to find value in the unloved junior resources sector

- Lion is deploying capital into gold explorers ahead of the impending bottom of the cycle

Lion Selection Group’s CEO Hedley Widdup has, for years, been famous for charting the moments of the mining cycle on his mining clock.

From midnight the boom has hit and the next downturn is on its way, fast forward to 6 o’clock and the bottom is in, the way is up.

Sounds simple, right? But how does the Melbourne-based investor, fund manager, geologist and stock picker use it to direct the listed small cap mining fund’s investment strategy?

“In setting the time on the clock, there’s always a benefit of retrospect and looking back. In May last year, we were saying it was around 12,” Widdup told Stockhead on the sidelines of the Resources Rising Stars conference in the Gold Coast on Tuesday.

“I think in retrospect, 12 o’clock was maybe 12 months or so earlier. It doesn’t matter, but that puts us two and a half years beyond the peak of the cycle – peak share prices, commodities and things like that.

“We’ve seen the most damage done to the ultra micro-caps, the explorers, that’s where a lot of the liquidity has leaked from. The large companies, their balance sheets are in a good state. So there’s not a lot of leverage on share prices from financial stress for a lot of the big majors. So how far we are from the bottom is anyone’s guess.

“Having gone 2 to 2.5 years in a down cycle is a reasonably long one. I don’t think there’s a great argument in saying it’s been long enough or it’s about time.

“But there is a good argument in saying a lot of the behaviours which happen as the world is collapsing have happened, and the behaviours we’re now seeing like major miners looking for consolidation opportunities, paper mergers, things like that, tend to be symptomatic of the, you know, the two or so hours that are leading up to six o’clock.”

A question of liquidity

The kinds of events Widdup says we are seeing now that are symptomatic of 4 o’clock in the cycle are paper mergers, where big companies try to grow by leveraging the damage done to smaller producers and developers.

BHP’s (ASX:BHP) failed bid for Anglo American is a prominent example. Pilbara Minerals (ASX:PLS) has also taken the plunge with a $560 million agreed scrip takeover of Brazilian lithium developer Latin Resources (ASX:LRS)

In the WA gold space, Westgold Resources (ASX:WGX) did the same with its merger with TSX-listed gold miner Karora Resources, the steward of the unique Beta Hunt gold mine near Kambalda.

Those are just the crumbs that have fallen off the plates of investment bankers, in Widdup’s opinion.

“It’s a bit like icebergs. For every M&A deal that you see getting rumoured or announced, there’s probably 20 more which are in discussion in backrooms,” he said.

“There’s all sorts of innuendo that swirls around but when you start seeing those leaks happen and deals take place – so BHP’s deal in South America for copper (with Filo Corp and Lundin Mining), for example – it just shows they’ve been very, very active.

“And I don’t think there’s ever been a case where BHP has been active and nobody else has.

“You’d have to think that most of the majors, all of the majors, would be active on the M&A front assessing things, and either they’ve got them ready to go and waiting for something that takes them over the line, or are still working through their processes.

“Talking to a lot of companies who have strategic-sized projects, there doesn’t seem to be any lack of interest from those big companies in having discussions around what might take place down the track.”

That scrip mergers are a major focus right now is one hint of the liquidity that has come out of the industry. Another is a drop in IPOs.

“In the years where you get 120 IPOs, you also get larger IPOs. So we saw a couple of larger sized deals coming to market (in 2021),” Widdup noted.

“29Metals (ASX:29M) was one of the largest IPOs that we’d seen for a decade or more.

“To obtain that liquidity for a company which has no reporting history is also an indicator that the market is running hot. You can’t get those away in sh*t markets. That was another indicator that time that we were close to the top of the cycle in our minds.”

In the past couple years resources IPOs have been in the ~20s, though they’ve been stronger than they were at the lowest point of the mid-2010s downturn, when in 2014 only one explorer – Stavely Minerals (ASX:SVY) – managed to get a float away.

Countering the cycle

Having sold out of an Indonesian gold project, Lion has viewed this moment in the cycle as an opportunity to deploy the capital it accrued in the last.

“The pitfall is the risk that until you’re at the bottom, you’re not,” he cautioned.

“A market crash can be fast or slow, or a long, prolonged bust in mining. So until you’ve rounded the bottom on those, you can always keep moving down.”

But he thinks the majority of the collapse in explorers has probably been seen.

“Lion’s invested $25 million I think in the last two years, $14m of that’s been in the last quarter,” Widdup said.

“So we’ve been deploying across a sector that we feel is ripe for investment now. And that’s the junior sector.

“We’re very driven by our assessment of the cycle and the mining clock. That’s wound by liquidity, so the clock moves according to money moving in or moving out of the sector.

“We assess a number of indicators that help us to understand how that’s moving, but it goes with that, that there are very strong buying or selling signals that come with that clock assessment. So that’s what we react to.”

It enables funds like Lion to be counter-cyclical versus often pro-cyclical producers, who are susceptible to expectations from investors to expand capacity when times are good.

“We’re fortunate that, as a company which is focused on investment, we can pick equity in companies that it makes sense to to find at the bottom of the cycle and then ride them up through the next leg of the cycle,” Widdup said.

Multiple exit points

As previously stated in our columns, Widdup likes the look of explorers and developers with multiple exit points and different paths to create value.

Two at this week’s Resources Rising Stars Conference who he likes are Brightstar Resources (ASX:BTR) and Warriedar Resources (ASX:WA8).

Brightstar has announced a scrip merger with Sandstone-focused Alto Metals (ASX:AME), which will give it 3Moz of gold across three historic WA gold fields in Menzies, Laverton and Sandstone.

Warriedar meanwhile controls more than 1.8Moz of gold, including 1.01Moz at the Big Springs project in Nevada, USA, and 816,000oz at the Golden Range and Fields Find projects in WA’s Murchison.

“Brightstar (are) one of the only companies which has the ability to access, I think, pretty reasonable production of gold for a low level of capex, and then they have a genuine case to say that they can reinvest the cash that they generate to make their business bigger,” Widdup said.

“So that’s exciting, because there’s a lot of stories even here with large resource positions, but there’s high capex to be able to unlock that.

“I look at other gold stories which are close to producing facilities that could be M&A candidates. Something like a Warriedar is surrounded by producing facilities, and they have a pretty sizeable inventory.

“So the second exit for a company like Warriedar could very well be you don’t build it yourself, you get taken over.”

Widdup favours gold, but says he would love “a couple of good base metals” and Australian silver projects. While lithium is down, he says it’s hard to see prices getting punished further from here.

At Stockhead, we tell it like it is. While Brightstar Resources was a Stockhead advertiser at the time of writing, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.