Resources Top 5: A fascinating zinc-lead spin out, gold explorer teams up with Newcrest in $25m deal

Pic: Via Getty

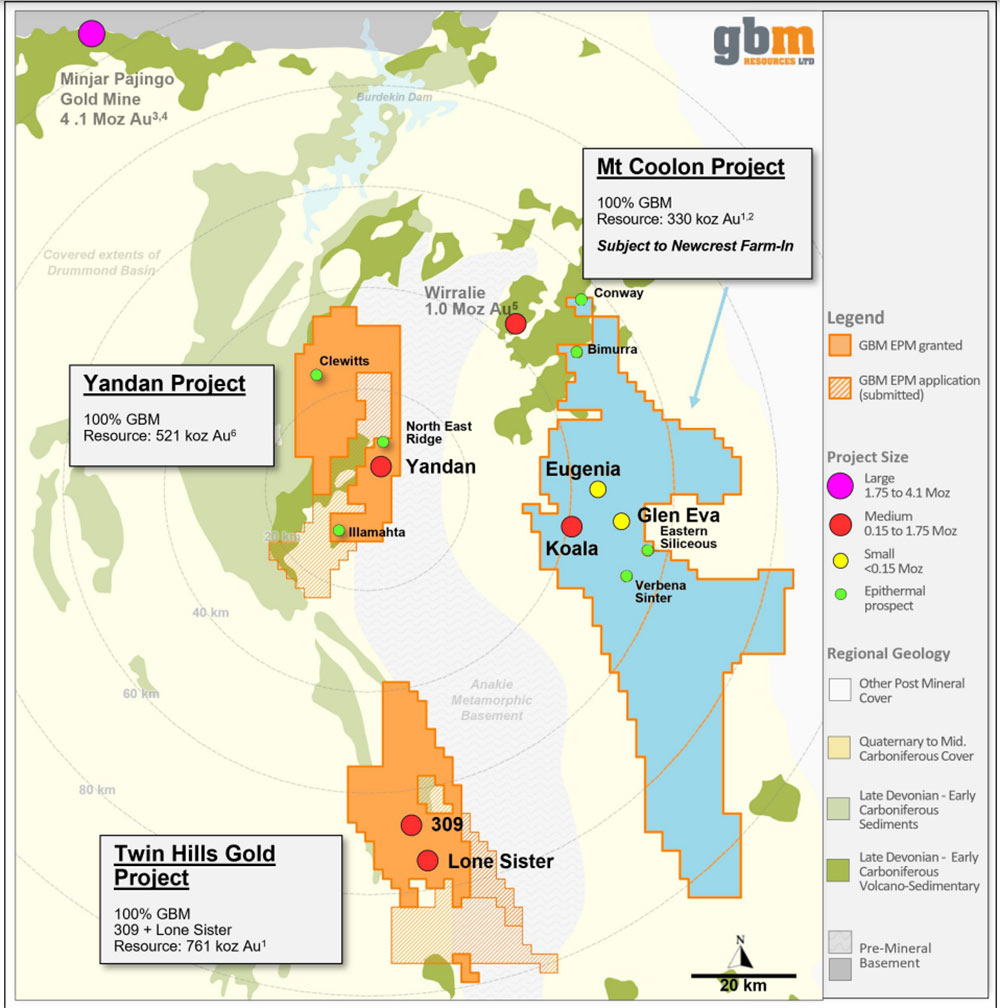

- GBM Resources inks $25m farm in agreement with Newcrest over 330,000oz Mount Coolon project

- Strickland to spin out its Iroquois zinc-lead, Bryah Basin copper-gold projects into a new ASX company

- Resource update for Podium’s 3Moz Parkes Reef deposit due out this month

Here are the biggest small cap resources winners in early trade, Friday October 21.

CARBINE RESOURCES (ASX:CRB)

(Up on no news)

This former shell relisted with a silica sand focus in July last year.

While most demand comes from the booming construction sector, high-quality silica sand can also be used in glass, electric vehicles, and big batteries.

CRB’s flagship is ‘Muchea West’ is directly adjacent to $80m market cap VRX Silica’s (ASX:VRX) ‘Muchea’ project in Perth.

A maiden mineral resource estimate of 93Mt at 99.71% SiO2 was released in July, but it has been fairly quiet since then.

At the time, the company said that “early rains means that Carbine cannot access the Muchea West Project during the 2022 winter to avoid the spread of jarrah dieback and comply with tenement conditions”.

Meanwhile, CRB has been working on a Scoping Study – the first or look at the economics of building a project – and various other license applications.

The $3.5m market cap minnow is down 50% year-to-date.

GBM RESOURCES (ASX:GBZ)

Junior explorer GBM Resources has inked a $25m farm in agreement with gold giant Newcrest (ASX:NCM) over GBZ’s 330,000oz Mount Coolon project in the Drummond Basin of QLD.

NCM can acquire up to 75% of Mount Coolon by spending up to $25m and completing a series of exploration milestones – including 23,000m of drilling – over six years.

The deal frees up GBZ to focus its efforts (and money) on the nearby Twin Hills and Yandan gold projects, which have a combined resource of ~1.38Moz.

GBZ purchased Mount Coolon in February 2015 from DGO (recently acquired by Gold Road Resources) for $850,000 cash and 50m shares.

It has done some drilling since then but believes “a well-credentialed partner in Newcrest” is required to give the project a red-hot go.

“The results of the 2021 and 2020 drill programs have demonstrated a substantial multi-stage hydrothermal system is present at GEES [Glen Eva and Eastern Siliceous zone],” GBZ says.

“GBM believes that the Glen Eva epithermal veining, the pyrite halo, and CBM veining may be part of a large mineral system that zones outward from a base metal bearing core to a low sulfidation precious metal system to the northwest at Glen Eva and potentially also to the southeast at Eastern Siliceous.

“This is a preliminary interpretation and requires additional drill testing over 1.5 km of intervening untested strike projection of the vein corridor back to Glen Eva and over 2 km of intervening untested strike towards Eastern Siliceous.”

The $25m market cap stock is down 54% year-to-date.

READ: The Small Cap +1Moz Gold Club: A Guide, Part 2

STRICKLAND METALS (ASX:STK)

This explorer has enjoyed a 30% bump to its share price over the past two days thanks to some strong news flow.

Yesterday it was strong gold drilling results at the new Wanamaker discovery, part of the Millrose project in WA.

New oxide gold results include 5m @ 14.5g/t from 67m and 5m @ 6.6g/t Au from 83m, in two separate holes.

The first of these is ~200m away from the hit of 7m at 22.2g/t announced earlier this week.

Today, STK announced plans to spin out its Iroquois zinc-lead (80% Strickland; 20% Gibb River Diamonds (ASX:GIB)) and Bryah Basin copper-gold projects into a new ASX company.

STK’s focus is Milrose, but Iroquois and Bryah are still projects of significance, CEO Andrew Bray says.

“ The Iroquois Zn-Pb project lies directly along strike from Rumble Resources’ (ASX:RTR) world-class Earaheedy project, and has shown tremendous potential for additional Zn-Pb discoveries,” he says.

“After the initial discovery hole at Iroquois (23m @ 5.5% Zn + Pb1 ) Strickland has steadily advanced Iroquois throughout 2022 via soil and rock-chip geochemical sampling and various geophysics surveys.

“This work has yielded several additional targets, with preparation now underway for a larger drilling campaign to commence in early 2023.”

The work completed to date has shown that Iroquois warrants development in a standalone ASX-listed base metals company, Bray says.

“Should the spin out proceed as proposed, Iroquois will be front-and-centre of the new company. This allows for much more dedicated and focused exploration programs,” he says.

“With the addition of the Bryah Basin project, the new company will also have a largely greenfield project in a highly prospective area to begin advancing.”

The $64m market cap stock is down 35% year-to-date.

PODIUM MINERALS (ASX:POD)

POD wants to be Australia’s first platinum group metals producer at Parkes Reef, a 15km long deposit in WA which also contains gold and base metal (Cu + Ni) mineralisation.

The orebody commences near surface and to date has been proven to continue to ~500m vertical depth, the company says. It remains open.

POD says the latest batch of high-grade drilling results – including a highlight 2m at 12.90g/t 5E PGM (1.03g/t Rh and 0.39g/t Ir) from 88m – will help inform a resource update for the 3Moz deposit due out this month.

““With these results Podium has completed a crucial step in our path towards growth and development of Parks Reef,” boss Sam Rodda says.

“The presence of high-grade zones and confirmation of rhodium and iridium throughout the orebody will allow us to optimize our resource modelling and studies to consider these areas.”

“Our workstreams remain focused on growing and understanding the orebody and testing our metallurgy for a preferred processing path as part of refining our path to production.”

The $47m market cap stock is down 61% year-to-date.

LITHIUM PLUS MINERALS (ASX:LPM)

(Up on no news)

This red-hot explorer is now up 128% on its April listing price of 25c per share.

10,000m of drilling is now underway to unlock rock at LPM’s flagship ‘Bynroe’ lithium project, which shares a border with Core Lithium’s (ASX:CXO) ‘Finniss’ mine development.

The focus is ‘Lei’ and ‘Cai’ prospects where there is “strong potential to delineate a maiden high-grade resource”, the company says.

Best assays so far include hits like 11.0m @ 1.48% Li2O from 196m and 17.8m @ 1.40% Li2O from 217m.

“It is extremely encouraging to have confirmed a significant strongly mineralised pegmatite system at Lei, located only 1.5 km from Core Lithium’s development centred on the Grants pegmatite,” LPM exec chair Bin Guo said October 18.

“We are keen to extend our diamond drilling program to chase the mineralised system down-plunge and will be back diamond drilling at Lei in the coming weeks.

“Armed with this additional proof of regional high grade spodumene-bearing pegmatites, we are excited to extend the program to our targets at the Jenny’s and Perseverance Prospects. With the progress to date, we remain excited about the potential to delineate a maiden lithium resource by Q1 2023.”

At Stockhead we tell it like it is. While Strickland Metals, GBM Resources and Podium Minerals are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.