Resolution Minerals uplists to OTCQB market in US under ticker RLMLF

RML’s dual listing to the OTCQB marketplace will offer greater visibility, liquidity and accessibility for North American investors. Pic: Getty Images

- RML upgrades from OTCID to OTCQB under symbol RLMLF

- Increases visibility and exposure to US investors and capital markets

- Enables broker-dealer support and ‘Blue Sky’ compliance

Special Report: A listing to the US OTCQB market has opened the door to the world’s largest source of capital for Resolution Minerals.

Resolution Minerals (ASX:RML) is also preparing to list on major US stock exchange the NASDAQ, which is focused on established companies and offers even higher levels of visibility and liquidity.

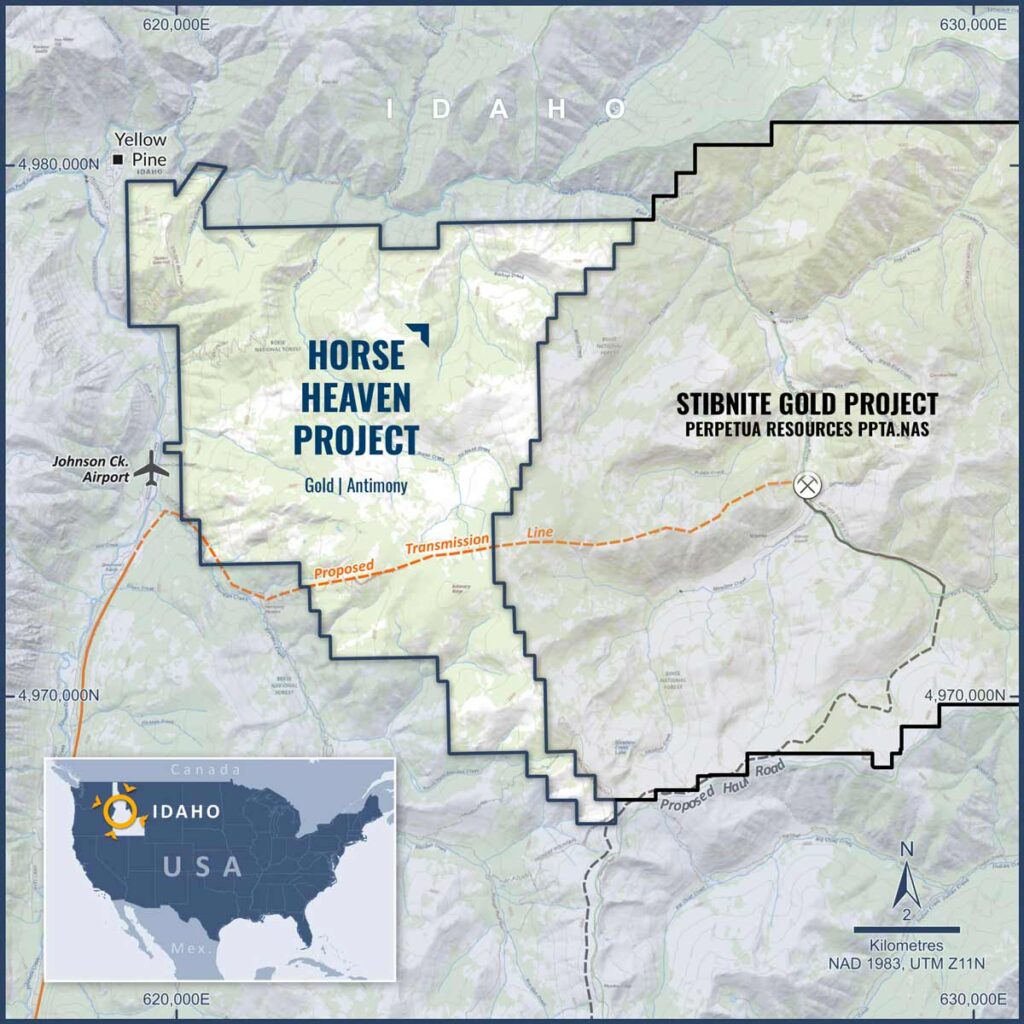

The U.S. listing will help RML gain additional exposure and awareness from US investors (as well as U.S. government bodies) in the interest of developing its Horse Heaven antimony-gold-tungsten project in Valley County, Idaho.

The listing also provides greater access to broker-dealer support and enables ‘Blue Sky’ compliance, making RML shares legally eligible to be offered and recommended to investors across the US.

RML sees its US listing as an opportunity to access US Department of Defense (DoD) funding opportunities, potential inclusion in fast-track permitting initiatives, and as a platform for US corporate opportunities, including acquisitions, mergers and joint ventures.

Antimony has been a hot topic in the US of late, after China cut exports of the defence-critical mineral last year.

The DoD has since made several strategic investments in US-based companies with antimony projects in an effort to secure domestic supply.

Mirroring early success

One such company is Perpetua Resources, which holds the Stibnite antimony-gold project right next door to RML’s Horse Heaven.

The two operations share a boundary and are host to similar geology and mineral prospectivity with strong potential for gold, antimony and silver mineralisation in the Antimony Ridge Fault Zone (ARFZ) and the Golden Gate Fault Zone (GGFZ).

Perpetua’s Stibnite project holds a resource estimate of 4.8Moz gold and 148Mlb antimony, a sizeable bounty Resolution will seek to emulate.

Earlier this month, Resolution Minerals kicked off a 3,000m diamond drilling program at Horse Heaven, targeting the Golden Gate prospect and confirming historical drilling results.

The drill bit will test for mineralisation at depth, laterally and along strike in order to sketch out the boundaries of the potential system.

This article was developed in collaboration with Resolution Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.