Research house flags Loyal Metals as undervalued copper-gold opportunity

An East Coast Research report notes that drilling at the Highway Reward mine is the primary catalyst for a re-rate for LLM. Pic: Getty Images

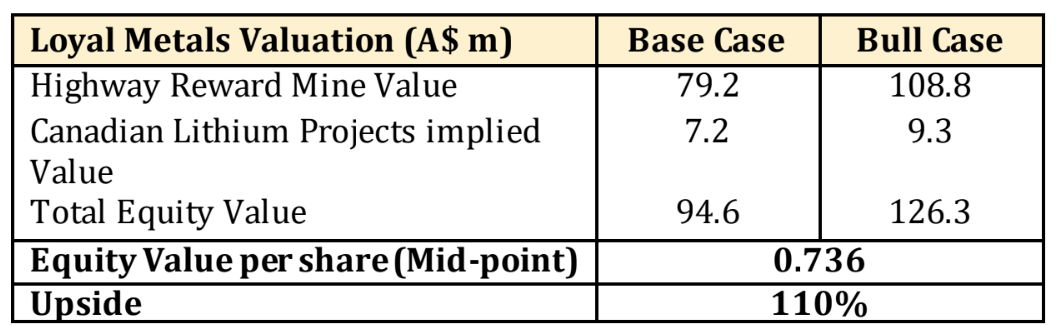

- Loyal Metals welcomes research report with price target of 73c, a 110pc increase

- The report notes Highway Reward could host more copper-gold discoveries

- East Coast Research also points to potential value of Canadian lithium plays

Special Report: Loyal Metals has welcomed a report from East Coast Research detailing the company’s Highway Reward mine as an undervalued copper-gold opportunity.

The Queensland mine produced 3.65Mt at 5.7% copper and 260,000oz at 4.5g/t gold when it operated from 1987 to 2005 before being mothballed for about 20 years.

This is despite the potential for substantial unmined mineralisation being present near open pit and underground workings with historical drilling returning assays such as 33m at 5% Cu, 30m at 5.1% Cu, 2m at 105.4g/t Au and 10m at 17.7g/t Au.

The project is also just 37km from Charters Towers in Queensland’s Mount Windsor Volcanic Belt, an historical copper-gold mining region home to operations like Newmont’s 3.2Moz Mt Leyshon mine and Yuxin Holding’s 3.4Moz Pajingo mine.

East Coast Research’s report flags a 12-month target price of A$0.736 for Loyal Metals (ASX:LLM), representing a 110% upside from the current share price of A$0.350.

“The Highway Reward copper-gold project is the primary value driver for Loyal Metals, supported by exceptional grades, proven past production, and recent exploration breakthroughs,” the report said.

“This project forms the core of our near-term valuation. We see a strategic opportunity from the unmined resource potential in and around the existing mine, as well as the possibility of new discoveries at depth and across the broader Highway Reward property, which has been dormant for over 20 years.

“The system remains open along strike and at depth, indicating that large portions are yet to be fully explored.”

Drilling could drive a re-rate

East Coast Research notes that drilling is the primary catalyst for a re-rate at the project, which has historically produced and has seen extensive historical drill coverage exceeding 122,000m.

“As drilling, resource definition, and technical milestones are delivered at Highway Reward, we expect potential for a meaningful re-rating,” the report said.

Recent positive drilling results, including a standout intercept of 132.5m of near-surface massive sulphides, highlight the significant unmined resource potential close to surface.

Loyal Metals plans to leverage advanced drill targeting methodologies and deploy modern geophysical technologies to enhance its already substantial geological dataset, uncover new discoveries, and accelerate resource growth.

The report said that a successful maiden JORC-compliant unmined resource definition, followed by ongoing resource expansion, would materially strengthen project economics, establish sector recognition, and drive valuation alignment with leading ASX copper-gold peers.

“Copper and gold prices have increased dramatically since 1997, with copper up about 680% and gold over 1,250%, creating a robust tailwind that materially strengthens the Highway Reward project’s economics and investment appeal,” it said.

“This long-term price uplift supports Loyal Metals’ strategic positioning in the global resources market.”

Watch: Loyal Metals harnessing AI for drilling

Canadian lithium projects a bonus

East Coast Research also noted that the company’s Canadian lithium projects provide value optionality, particularly at a time when the lithium market looks prime for an upswing, with demand surging.

By 2030, the global lithium market is projected to reach between US$74.81 billion and US$96.5 billion, up from US$28.08 billion– US$37.4 billion in 2024, reflecting robust compound annual growth rates (CAGRs) of 17.5%–18.2%.

Volume demand is expected to more than double, rising from 0.85 million to 2.08 million lithium carbonate equivalent tonnes at a CAGR of 19.6%, driven primarily by battery applications.

Plus, based on comparative valuation metrics derived from Winsome Resources’ Adina lithium project, East Coast Research says the implied market capitalisation for Loyal Metals’ Trieste asset can be benchmarked using land-area ratios and sector multiples at US$4.8 million (base case) and US$6.1 million (bull case).

“The Trieste Project offers complementary exposure to the high-growth lithium sector, located within the globally recognized James Bay lithium district,” the report added.

“The project lies in proximity to major deposits owned by Patriot Battery Metals, Allkem, and Winsome Resources, enhancing its strategic relevance. Early-stage mapping and sampling indicate fertile pegmatite trends consistent with regional spodumene-bearing systems.”

This article was developed in collaboration with Loyal Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.