Report says Orion’s copper-zinc project is primed and ready

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Special Report: A new research report has flagged Orion Minerals’ (ASX:ORN) Prieska copper-zinc project in South Africa as a low risk, build-ready development.

And with copper prices testing eight-year highs due to falling stockpiles, strong long-term demand and optimism about stimulus-fuelled post-COVID economic recovery, the timing seems to be right for the company to start project construction in 2021 with production beginning in 2023.

Influential global investment bank Goldman Sachs last week described the recent price strength in copper as the first leg of a “structural bull market”, predicting that the price could hit US$10,000 per tonne next year.

“This current price strength is not an irrational aberration, rather we view it as the first leg of a structural bull market in copper,” the bank said.

All of which means that Orion’s timing could not be better, as it works to complete financing for the brownfields Prieska development and start construction next year.

The dual-listed company has spent the past five years bringing the globally significant Prieska deposit, which was mined successfully for two decades in the 1970s and 80s, to the brink of development.

An updated Bankable Feasibility Study completed in May 2020 outlined an initial 12-year, 2.4Mtpa operation producing 22ktpa of copper and 70ktpa of zinc, based on a reserve of 14.5Mt at 1.1% Cu and 3.2% Zn.

The BFS outlined strong operating margins and financials for the project including pre-tax cash-flow of $1.6 billion, a pre-tax NPV of $779m using an 8% discount rate and a payback period of 2.4 years based on a peak-funding requirement of $413m.

In his report, independent mining analyst Simon Hudson-Peacock noted that Orion, with a current ASX market capitalisation of $95m, had a valuation ranging from a base case of $448m to an upside of $639m.

This is based on his assumption that long-term prices for copper and zinc will be about $US3.10 per pound and $US1.15/lb respectively, which translates to estimated post-tax net present value of $605m and internal rate of return of 28 per cent.

Prieska adds about $427m to the company’s valuation with a further $191m from mine extension and other operational efficacy improvements. Orion’s other ventures, including significant tenement holdings adjacent to Prieska and a joint venture with IGO Limited (IGO: ASX) in Australia, are worth a further $21m.

Hudson-Peacock says the Prieska project is a low-risk option on delivering copper and zinc concentrate to market by mid-2023.

“Most of the infrastructure is in place, mining and processing technologies are conventional, the lead and payback periods are short, and valuation is robust,” he added.

While initial life-of-mine is expected to be 12 years, there are several opportunities to extend this through orebody extensions and remnant pillar mining.

Underground ground conditions are expected to be excellent based on historical experience backed up by recent drilling studies while the proposed plant is expected to match past good recoveries to produce copper and zinc concentrate relatively clean of deleterious materials and desirable in the international market.

All-in-sustaining costs of US16c/lb copper and US$18c/lb zinc nett of co-product credits, places the project in the lowest cost quartile thanks to the bulk mechanised nature of the mining methods employed on a relatively large, continuous and wide orebody.

Maximum cash drawdown to construct the mine is estimated at $436m after including a 10 per cent contingency.

Prieska copper-zinc project

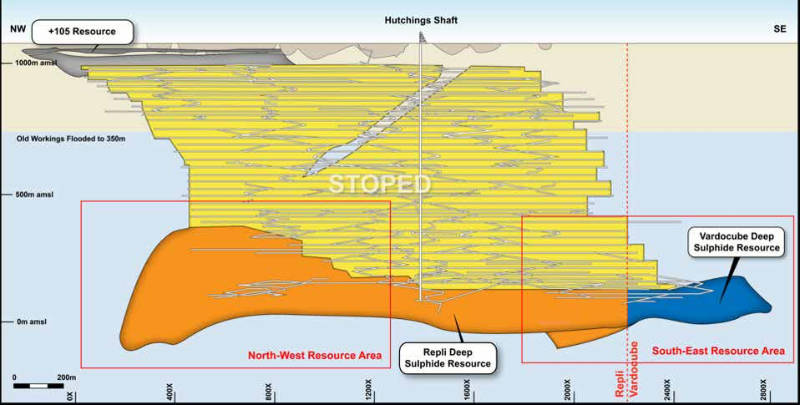

Prieska is a volcanogenic massive sulphide deposit that had previously been mined to a depth of about 900m with shaft infrastructure extending down to 1,250m, which facilitates access to targeted depth extensions.

Over the course of its previous mining life, it processed 46 million tonnes of ore to produce 430,000t of copper and just over 1Mt of zinc.

The orebody stretches out over 2.6km on strike and remains open at depth and along strike.

Orion has defined a contained ore reserve of 153,000t of copper and 462,000t of zinc along with a contained resource of 361,000t of copper and 1.1Mt of zinc.

Notably, the mineralisation is remarkable in its uninterrupted continuity, meaning that there are very few or no unpayable mining blocks within the mining footprint, which simplifies mining and reduces costs.

There are also several opportunities to further increase reserves and resources.

These include:

- Potential lateral and depth extensions both to the north-west and south east of the orebody;

- A possible orebody extension along the unexplored western limb as it up-dips towards surface;

- A newly discovered, high grade parallel orebody is open in all dimensions and presents important upside;

- The ground adjacent to and immediately below the existing central mine infrastructure and primary development could not be drilled for fear of intersecting the old workings;

- Several known satellite orebodies within 15km of the planned mill; and

- The possibility of reclaiming support pillars left behind in the original mine workings through the use of backfill.

One of the few new copper projects in the global pipeline

Prieska is one of only a few new fully-permitted copper-zinc projects globally slated for development in the next few years, reflecting a structurally challenged supply pipeline due to declining mine grades and falling discovery rates.

Orion completed permitting for the project this year in record time – securing a 12-year Mining Right renewable for a further 30 years, alongside all other required permits.

The Company has also completed a landmark black economic empowerment (BEE) agreement and is compliant with the South African Mining Charter.

The project involves re-opening, dewatering and re-establishing mining operations.

Notably, critical infrastructure is already in place, which serves to make capital costs and time to market favourable for project economics.

This article was developed in collaboration with Orion Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.