Renascor puts more milestones in rear view for Australia first graphite demonstration plant

Renascor is accelerating its ambitions, with more material needed to alleviate future graphite shortages. Pic: Getty Images

- Renascor ticks off site, bulk sample and engineering milestones for its spherical graphite demonstration plant

- Plant to use feedstock from the company’s own massive graphite reserves

- Combined assets would become the first integrated anode operation outside of China

Special Report: Renascor has passed more milestones as it heads towards the construction of a government co-funded purified spherical graphite demonstration plant in South Australia.

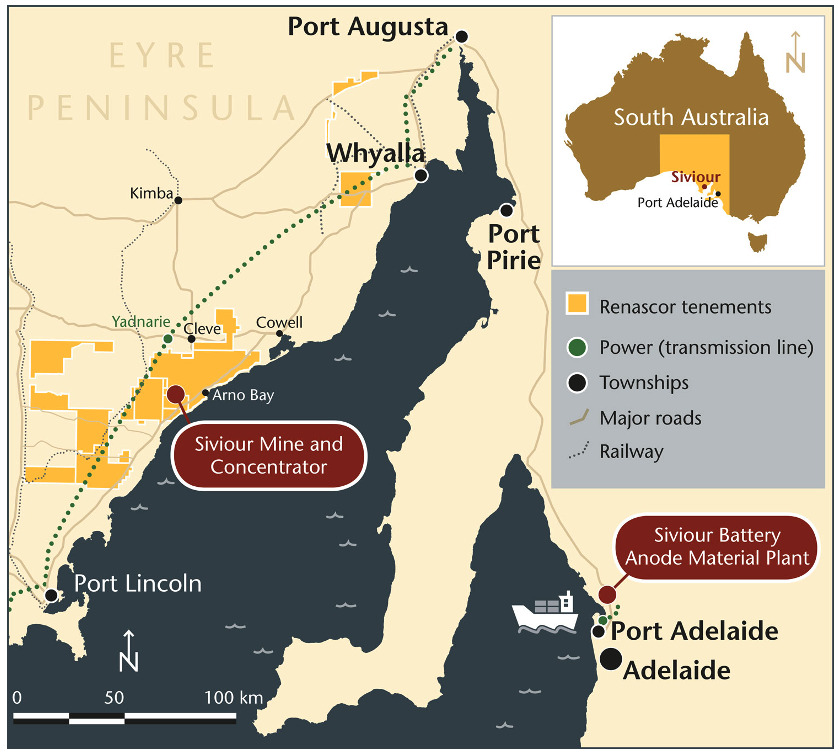

With a $5m government grant supporting the project, Renascor Resources (ASX:RNU) has secured a site north of Adelaide where, pending arrival of equipment, it can begin commissioning as soon as Q3 this year.

The site holds a large industrial warehouse next to an operating commercial lab and analytical services facility and is also the place where RNU intends on building a full-scale facility.

A first concentrate run from the bulk sample at its own Siviour graphite project exceeded expectations, with 97.1% total carbon and 96% graphite recovery, a product now set for use as a feedstock for demonstration.

Engineering design for the plant is also well-advanced, and a first federal funding payment of $750,000 is in the RNU accounts.

“Our technical team continues to make excellent progress in advancing our ecofriendly, hydrofluoric acid-free purification technology,” Renascor managing director David Christensen said.

“We look forward now to moving through procurement, construction and commissioning of our PSG demonstration facility later this year, as we seek to deliver a globally competitive Australian alternative to China’s current monopoly on PSG production.”

Full stream ahead

While a dive in the lithium price cast a pall over the wider battery metals industry, Stockhead contributor Kristie Batten notes graphite could be the first of the bunch to bounce back.

Batten noted Renascor, holding Australia’s second-largest graphite resource and the largest reserve outside of Africa, was shovel-ready at its Siviour project, and that the company believes it’s at the front end of a global graphite queue.

Between the plant and manufacturing facility, it would become the first integrated anode material operation outside of the Chinese borders which control around 98% of the global market.

Christensen told Batten the company has largely achieved the technical and regulatory factors of a final investment decision over the mine and was close to finishing off the financials.

Renascor intends on accelerating development of its upstream operations to get to production in tune with projected shortages, an ambition also backed by Canberra in the form of a $185m loan facility from Australia’s Critical Minerals Facility scheme.

This article was developed in collaboration with Renascor Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.