Redcastle bags a ride to gold production under transformational JV

Redcastle will have all Queen Alexandra/Redcastle Reef mining and working capital costs to first gold revenue paid for by BML Ventures. Pic: Getty Images

- Redcastle reaches strategic Queen Alexandra/Redcastle Reef JV with BML Ventures

- BML to fund 100% of mining and working capital costs until first gold revenue

- Company has also increased its Eastern Goldfields landholding by 600% to ~85km2

Special Report: With the execution of a strategic joint venture to fast-track gold production from its Eastern Goldfields projects amongst other moves, 2025 continues to be a breakout year for Redcastle Resources.

The joint venture with BML Ventures – a leading gold mining contractor based in Kalgoorlie – will realise the company’s vision of delivering cashflow and shareholder value from its Queen Alexandra and Redcastle Reef projects within the prolific gold province in WA.

It will achieve this by virtue of BML funding 100% of the mining and working capital required to deliver first revenue estimated to be approximately $20million in a recently completed scoping study.

This includes all permitting related to mining activities except native vegetation clearance, the mobilisation of mining fleet and equipment, site establishment, mining operations, and haulage of ore to third-party processing facilities.

BML will also arrange and fund processing and related costs until first revenue, manage all day-to-day mining operations and arrange toll milling agreements.

Redcastle Resources (ASX:RC1) will be responsible for just native title, heritage surveys and native vegetation and other environmental approvals along with providing site access and tenure management.

In return, BML will receive 50% of surplus gold sales proceeds after recovering its costs with the JV agreement including provision for interim profit distributions possible after the starter pit is mined.

The proposed production strategy is predicated on the maiden resource of 13,000oz for Redcastle Reef and the updated resource of 29,000oz contained gold at Queen Alexandra combining to reach a total of at least 42,000oz announced 30 June 2025.

RC1 has completed a scoping study which estimates that a 10-month toll treatment pathway for Queen Alexandra could produce ~13,700oz of gold and generate gross revenue of ~$65.6m and an undiscounted, pre-tax cash surplus of between $14m and $15m.

Other transactions

While the JV with BML is undoubtedly the most significant, it is not the only agreement the company has just concluded.

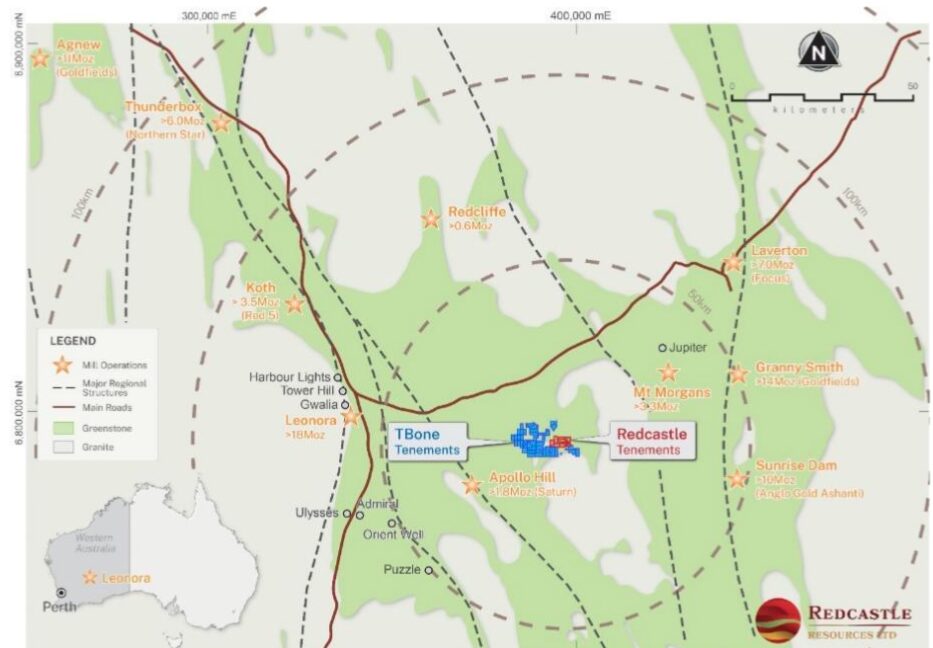

RC1 has also made a binding agreement to acquire a package of tenements the highly prospective TBone Belt, covering ~72km2, directly adjacent to its existing tenements.

Redcastle’s portfolio now consists of four granted mining leases, five mining lease applications, 51 prospecting licences and three pending prospecting licences that increase its total landholding by ~600% to about 85km2.

Notably for the company, the new tenements host multiple historical gold workings with evidence of significant alluvial gold recovery which the company interprets as having sources within the tenement package.

They are expected to deliver immediate growth potential and synergies with the company’s existing landholding.

Separately, RC1 has secured firm commitments for a $4m placement priced at 0.9c per share that will be completed in two tranches. Strong support from the outset led the company to accept oversubscription of $1million to reach $4million.

This is priced at a 15% premium to the 15-day volume weighted average price – a rarity with capital raisings – and includes one free attaching option exercisable at 1.5c and expiring in three years for every three shares subscribed for.

Proceeds will be used for the acquisition and exploration of the TBone tenement package that will generate robust prospects for proof-of-concept drilling, further exploration and delineation drilling at Redcastle to support and grow ongoing production by the BML JV possibly including Morgan’s Castle East.

“2025 is truly shaping up as a breakout year for Redcastle,” chairman Dr Ray Shaw said.

“The Joint Venture with BML provides a disciplined, capital-efficient pathway for first gold production, while the TBone acquisition delivers a unique opportunity to apply first mover systematic exploration across 48 concessions previously held by six separate entities adjacent to the tenements where our technical team have already demonstrated success with the QA and RR projects.

“The strong support for our capital raising reflects confidence in our now funded strategy.

“Taken together, this announcement highlights three major milestones for the company, and over the coming weeks and months we will progressively release further technical information on the TBone concessions as our work is advanced, ensuring the market is kept fully and transparently informed.”

Next steps

RC1 will now finalise the pre-final investment decision work program and budget under the BML JV.

This will include grade control, geotech/hydro, environmental baseline, pit designs, tolling and mine scheduling for the two projects.

Additionally, the company will progress shareholder documentation for the approval of the shares to be issued under the second tranche of the placement.

Other work includes the preparation and evaluation of infill drilling and the drilling of other potential targets at Queen Alexandra and Redcastle Reef, and refining target ranking and reconnaissance programs at TBone.

This article was developed in collaboration with Redcastle Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.