Red Metal amongst rare earth plays to benefit from neodymium magnet demand growth

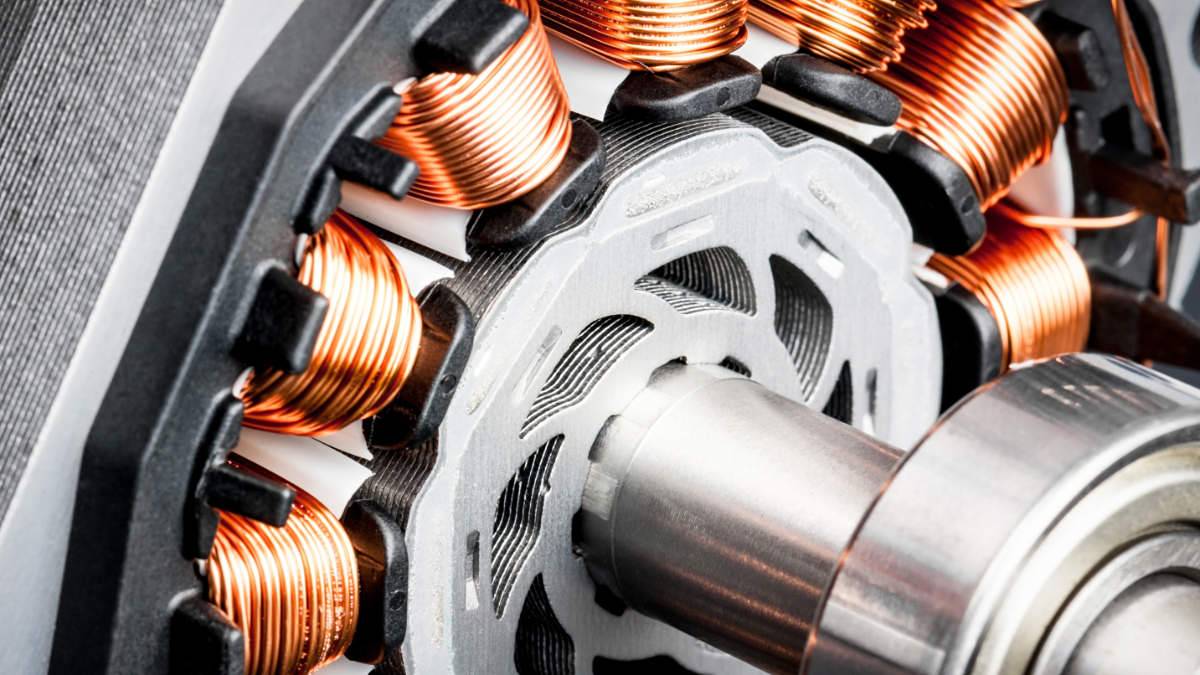

Demand for neodymium magnets will outstrip rare earths supply. Pic: Getty Images

- Adamas Intelligence forecasts that demand for neodymium magnets will increase at a CAGR of 8.7% from 2024 through 2040

- This outstrips projected supply growth of 5.1% during the same period

- Companies such as Red Metal have the opportunity to capitalise on this gap

Special Report: Strong demand for electric vehicle traction motors, wind power generators, and automotive micromotors, sensors and speakers drove a 13.3% increase in the global consumption of permanent rare earths magnets in 2023.

And this trend is likely to continue with Adamas Intelligence forecasting in its latest Rare Earth Magnet Market Outlook to 2040 annual report that from 2024 through 2040, global demand for neodymium magnets will increase at a compound annual growth rate (CAGR) of 8.7%.

It credited this to double-digit growth for the robotics, advanced air mobility and electric vehicle sectors, adding that the demand growth for magnets translates directly into increased demand for critical REEs such as neodymium, praesodymium, dysprosium and terbium.

Adamas also forecast that total magnet rare earth oxide (MREO) consumption will increase five-fold by 2040 at a CAGR of 5.4% while prices are projected to increase at CAGRs of 4.3-5.2% over the same period.

While electric vehicle motors and wind turbines are currently credited with driving magnet demand, the research and advisory firm believes that industrial and consumer service robots will become the single largest demand driver by 2040 with further growth from greater use of drones for the transportation and delivery sectors.

It also sees potential for supply shortages of neodymium magnets due to the increasingly tight availability of upstream REE feedstocks – with CAGR estimated at 5.1% – and that aggressive supply increases would be needed past 2030 to keep up with demand.

This will require either China to increase annual production at Bayan Obo in Inner Mongolia nearly five-fold, which would also massively deplete its reserves, or for non-Chinese suppliers to develop 20-30 modest-scale mines by 2040 over and above those already expected to be developed.

Positive headwinds for explorers

The report is hugely positive for REE explorers such as Red Metal (ASX:RDM) as it indicates that the supply and demand dynamics are skewed very much in favour of those bringing new resources and production online.

It certainly means that resources as large as RDM’s Sybella project in Queensland, which has an easily accessible resource of 4.8Bt grading 302 parts per million NdPr and 28ppm DyTb that starts from surface and remains open below 100m depth, will have little difficulty finding buyers for their products.

Early mining opportunities are presented by the significant at surface resource of 788Mt at 297ppm NdPr and 28ppm DyTb contained within weathered granite.

Early-stage drilling, metallurgical and comminution studies have indicated that a low-cost, low-capital, heap leach processing option may prove feasible while work has already produced a mixed rare earth concentrate with 48.7% total rare earth oxides and MREOs making up 39.5% of this product.

The rich potential of this project provided investors with enough confidence to heavily oversubscribe for a share purchase plan priced at 10c per share RDM launched in late September.

While this was originally intended to raise $2m, the strong response led the company to increase the SPP up to $6m.

Proceeds from this raising will be used to accelerate the company’s pre-development geological, mining, metallurgy and infrastructure studies at Sybella as well as drill testing of high priority copper-gold targets at the Gulf, Corkwood, Three Ways and Pernatty Lagoon, and Hemi-style gold targets at Pardoo in WA.

This article was developed in collaboration with Red Metal, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.