Recharge Metals joins the uranium game with acquisition of new Athabasca Basin project

Recharge Metals is acquiring a uranium project in one of the world’s premier uranium hot spots. Pic via Getty Images

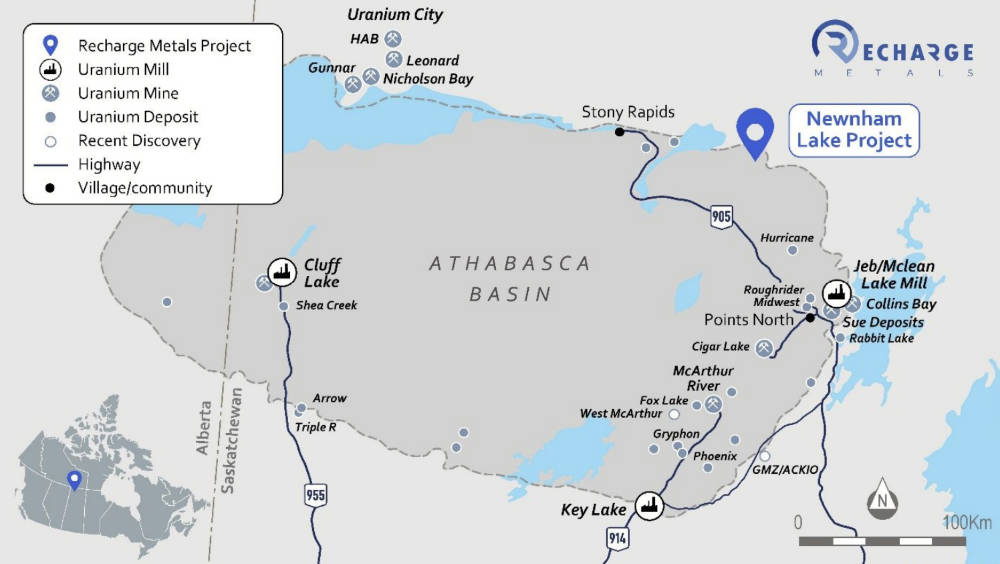

- Recharge Metals is acquiring the Newnham Lake uranium project in Canada’s Athabasca Basin

- The Canadian region supplies 20% of the world’s yellowcake and is known for hosting several high-grade uranium deposits

- Newnham Lake comes with limited historical drilling which intersected uranium in the target basement area

Special Report: With the uranium market still buoyant, Recharge Metals has pulled off a coup with a binding agreement to acquire the Newnham Lake project in Canada.

With a land area of 15.84km2, Newnham Lake is near the northeast margin of the Athabasca Basin, one of the world’s premier uranium districts which produces about 20% of the world’s current supply and hosts the largest deposit – McArthur River.

It is also just 56km northwest of IsoEnergy’s Hurricane deposit which hosts a high confidence indicated resource of 63,800t grading an eye-watering 34.5% U3O8 for 48.6Mlb of contained U3O8.

Notably for Recharge Metals (ASX:REC), modern uranium discoveries in the Athabasca have highlighted the potential for ‘basement-hosted’ mineralisation, where large, high-grade deposits occur below the unconformity, such NexGen’s Arrow Deposit (337.4Mlbs @ 1.8% U3O8).

This is the same style of mineralisation believed to be present at Newnham Lake.

Priority targets identified

REC has already identified priority targets based on:

- Significant alteration identified in basement rocks in recent drilling;

- Strong, wide conductive zone trending east-west across the entirety of the project with coincident low resistivity and anomalous radon; and

- Shallow historical drilling that demonstrated anomalous uranium at the unconformity, with very limited testing of underlying basement rocks.

Two deeper drill holes completed by ALX Uranium Corp in 2018 confirmed the presence of uranium mineralisation over significant widths, as well as visible pitchblende, intense faulting and strong hydrothermal alteration deep in the basement.

Newnham Lake also allows REC to leverage its established Canadian footprint, in-country relationships, and focus on green energy.

“The ongoing collaboration between Recharge and DGRM, which vended our Express lithium project, has forged a strong working relationship over the last year, resulting in the valuable opportunity for Recharge to successfully bid for the highly sought after Newnham Lake uranium project in the Athabasca Basin,” REC managing director Felicity Repacholi said.

“Historical drilling at Newnham Lake has confirmed the presence of uranium in the system. However, drilling has only focused on the shallow Athabasca Basin unconformity, with minimal drilling done in the underlying basement rocks.

“Advancements in the understanding of basement-hosted mineralisation has helped uncover some spectacular deposits, such as NexGen’s Arrow Deposit.

“This basement-hosted geological model adds weight to the prospectivity of Newnham Lake, as does the scale of the coincident low resistivity anomaly which is analogous to Arrow, and will be Recharge’s primary target”.

Acquisition terms and share placement

REC is acquiring Newnham Lake from DGRM (DG Resource Management) and Kalt Industries for a consideration of C$300,000 ($339,000) in cash and C$200,000 worth of REC shares priced at 6c each, as well as a 1% gross overriding return royalty for both vendors.

It has already completed legal, technical and geological due diligence on the project to its sole satisfaction, as well as securing all necessary shareholder, third-party and regulatory approvals.

Fulfilling another condition of the acquisition, REC has received firm commitments from sophisticated and professional investors to subscribe for more than 24 million shares priced at 6c each to raise $1.44 million.

Directors of the company also plan to subscribe for up to $50,000 worth of shares under the placement, subject to shareholder approval.

Forward activity

REC is working with Dahrouge Geological Consulting to complete the compilation, interpretation and 3D modelling of all historical data from Newnham Lake.

Final drill planning will follow the results of the historical data review.

Negotiation of land access agreements will be done concurrently with the data review to ensure all required permits are in place prior to drill testing.

This article was developed in collaboration with Recharge Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.