RareX re-assays elevate gallium to ‘core value stream’ of Cummins Range

Gallium has reached new heights at RareX’s Cummins Range project after re-assaying established the consistency of mineralisation. Pic: Getty Images

- RareX’s re-assaying of 2020 infill drilling at Cummins Range returns wide, high-grade gallium intersections

- Notable results such as 115m at 146g/t gallium elevate the critical mineral to being a “core value stream”

- Re-assaying is continuing with another 26 holes to go

Special Report: RareX now considers gallium to be a core value stream for its Cummins Range project in the East Kimberley region of WA after re-assaying of previous drilling returned wide, high-grade intersections of the critical mineral.

The role of gallium in Cummins Range has risen quickly since the company first found it unexpectedly in historical data in April 2025.

Back then, the data confirmed values of up to 6826g/t Ga2O3, raising the likelihood that the project could have yet another valuable product in addition to rare earths, phosphate and scandium.

This led RareX (ASX:REE) to kick off a program of re-assaying drill holes from its 2020 infill drill program with the first 15 holes yielding hits such as 99m at 106g/t gallium and 74m at 123g/t gallium.

The results placed Cummins Range amongst the highest grade gallium projects in Australia, adding to its position as one of the country’s most significant undeveloped REE deposits.

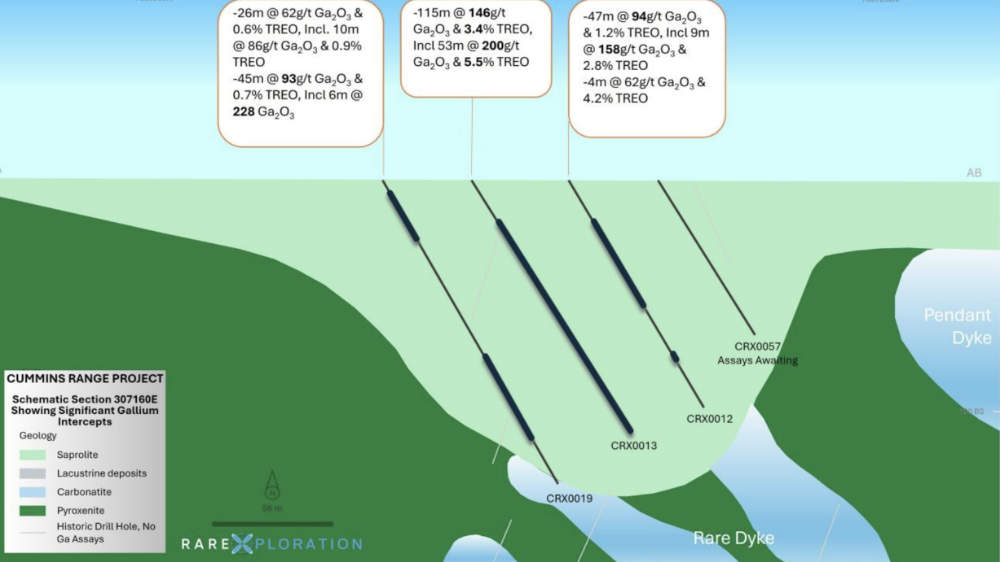

REE has now received a further 970 gallium re-assays from 16 holes that continued this trend of wide, high-grade gallium results including a top hit of 115m at 146g/t Ga2O3, 3.4% total rare earth oxides and 369g/t Sc2O3 from a down-hole depth of 22m.

Managing director James Durrant said the results confirmed Cummins Range as one of Australia’s most advanced and highest-grade gallium deposits.

“The consistency of high-grade results across multiple holes and long intercepts removes any remaining doubt. Gallium is now a core value stream,” he added.

“We are advancing both conventional and alternative processing pathways with Gega Elements, SGS Lakefield and others to unlock the full value of the contained metals — rare earths, gallium, scandium and phosphate.”

This is hugely significant as gallium is used in semiconductors, LEDs and solar tech, leading to its place on the critical minerals lists for Europe, North America and Australia.

Cummins Range project

The carbonatite at Cummins Range hosts a resource of 524Mt at 0.31% TREO, 4.6% phosphate and 70g/t Sc2O3.

Despite historical RC drilling, conducted between 2007 and 2012 by Navigator Resources and Kimberley Rare Earths being mostly assayed for gallium, the 30,000m of drilling completed by the company since acquiring the project in 2019 has not been assayed for gallium.

This led to the company’s decision to re-assay the 2020 infill drill program that had been designed to upgrade the inferred REE resource to the higher confidence indicated category.

A total of 2,080 assays from 29 drill holes have now been received and results have confirmed high-grade gallium over wide intervals.

The most elevated results are coincident with high-grade rare earth and scandium content that have been upgraded due to a combination of residual or eluvial and chemical weathering.

Gallium is dominated by China, which controls 98% of global production, meaning that any alternative sources will likely be viewed favourably by countries looking to build alternative supply chains.

Demand for the critical mineral has expanded dramatically across numerous high-tech sectors, contributing significantly to the upward pressure on prices.

The global gallium market is projected to grow from $2.32 billion in 2024 to $2.91 billion in 2025, representing a compound annual growth rate CAGR of 25.4%.

Upward price pressure is likely to persist as demand continues to expand across the semiconductor, telecommunications, defence and renewable energy sectors.

REE continues re-assaying its infill drilling results with 26 holes remaining.

This article was developed in collaboration with RareX, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.