RareX acquires district-scale niobium project with near-term drill targets

The new niobium targets includes two identified targets. Pic: Getty Images

- RareX (ASX:REE) acquires district-scale niobium project in WA

- Initial exploration will focus on the identified Luchini and Niobe targets

- Desktop studies will begin imminently with work aimed at starting drilling within months

Special Report: RareX has acquired a district-scale project in WA where historical drilling had returned elevated levels of niobium.

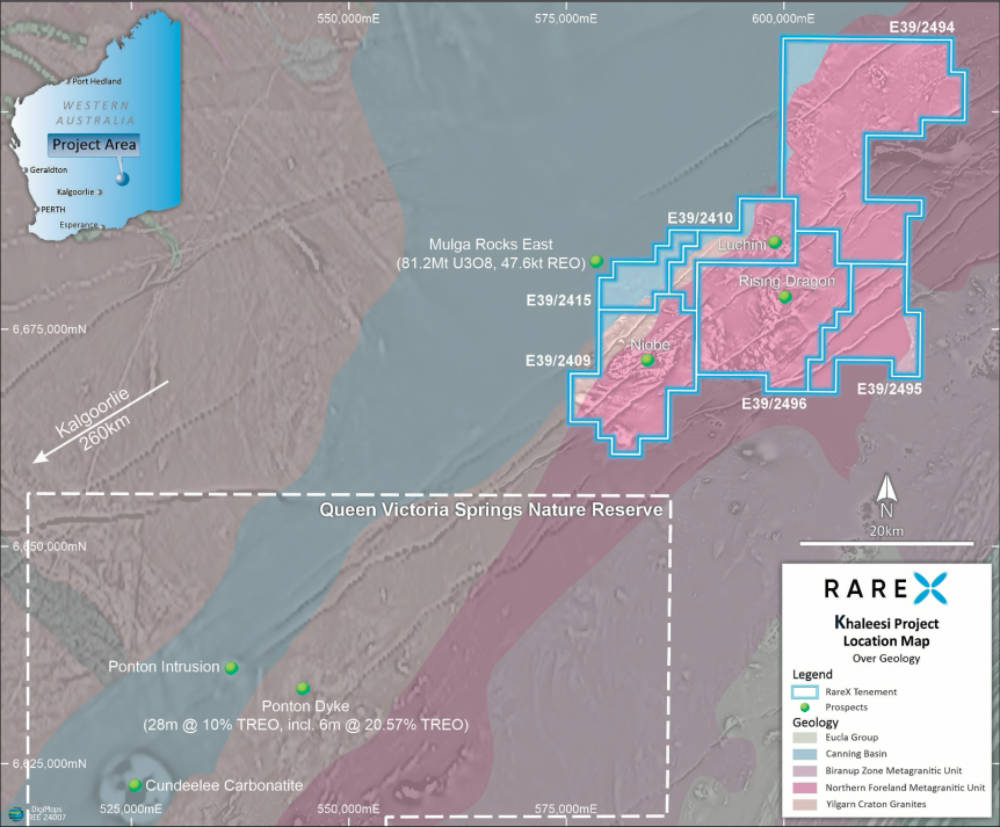

The new Khaleesi project is about 290km east-northeast of Kalgoorlie by road and consists of six tenements (one granted and five pending) that cover a total area of 966km2 over the Albany-Fraser Orogen in the Eastern Yilgarn region.

The project area is favourable for niobium-rare earth-carbonatite intrusions under little to no cover.

It is along strike from the highly-endowned Ponton Dyke, which hosts some of Australia’s best rare earth intersections such as 28m at 10% total rare earth oxides (TREO) including 6m at 20.57% TREO, the Cundeelee carbonatite, and Tropicana gold mine.

It is also adjacent to the Mulga Rocks sedimentary uranium deposit that also contains copper, nickel, cobalt, zinc and rare earth oxides, and is proximal to RareX’s (ASX:REE) Red Dragon project about 50km to the north.

Historical drilling was focused on gold and only half of the holes were assayed for niobium and rare earths.

However, data from this drilling has suggested the potential for niobium-enriched carbonatites at the project with elevated niobium values of up to >1000ppm niobium.

Due diligence carried out on existing detailed gravity and magnetic data sets identified a large 20km diameter alkaline intrusive complex within the project that has the same age profile as Mt Weld and the Ponton Dyke.

The acquisition supports the company’s’ goal of becoming a leading critical metals company with the future development of its Cummins Range rare earths and phosphate project and a strong focus on continuing to discover major new carbonatite-hosted mineral deposits utilising internally-fostered expertise.

“This acquisition is tremendously exciting for us. The new Khaleesi project is well endowed with geological data from large-company programmes that were mainly gold-focused and never properly tested or evaluated the extensive niobium anomalies and rare earth potential,” chief executive officer James Durrant said.

“Through our due diligence we’ve identified the opportunity for a district-scale niobium project and will immediately commence a highly targeted exploration program.”

Niobium, a transition metal, is used to strengthen steel alloys, although it is also gaining traction as a cobalt substitute in lithium batteries that charge faster, last longer and reduce fire risks.

Seven countries – including Australia and Canada – and the European Union classify niobium on their critical minerals list due to both the importance of the metal in modern manufacturing and electronics as well as the supply chain being dominated by two companies in Brazil with significant Chinese control.

Targets for exploration

The alkaline intrusive complex identified by REE is 20km in diameter.

Geophysics consultant Resource Potentials – who are credited with locating WA1 Resources’ (ASX:WA1) Luni geophysics that become a significant niobium discovery in the West Arunta region – identified possible ring dyke structures on the north-eastern edge of the complex and multiple circular bodies within the complex that may represent various fractionated melts.

Additionally, geochemistry provides conclusive evidence of the presence of the alkaline intrusion.

REE has already identified two obvious targets – Luchini and Niobe – for initial exploration.

Luchni on tenement E39/2410 was subject to a 10,000m gold-focussed exploration drilling program by Anglo Gold Ashanti between 2006-2014.

Many of the drill holes in the southern portion of this prospect returned highly elevated niobium through the regolith and into the fresh rock that is coincident with uranium radiometrics.

The Niobe target on tenement E39/2409 is composed of two drill lines about 2km apart on either side of a magnetic low that is coincident with a 4km by 0.5km vegetation and thorium radiometric anomaly.

These drill holes were assayed with 4-acid digest and showed elevated niobium-rare earth results in the regolith and into the fresh rock.

Exploration plans

During the June 2024 quarter, REE plans to sign access agreements, carry out full-scale desktop data analysis along with field survey, mapping and sampling.

It will then move to carry out detail geophysics, drill target generation and drill program preparation such as camp preparation and permitting in the September 2024 quarter.

In FY2024 Q2 – the December 2024 quarter – the company plans to carry out a 10,000m drill program, assay the results and carry out geological modelling.

RareX has also raised $1.5m through an oversubscribed self managed capital raising of shares to existing shareholders and directors at parity with the previous market close.

This article was developed in collaboration with RareX, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.