Rare slice of iron ore pie just the start for Pantera IPO

Pic: Schroptschop / E+ via Getty Images

Iron ore is the lifeblood of the Australian economy, so it’s curious that relatively few companies are listed with the commodity on their books.

This is particularly true of companies listing in WA’s north – truly Australia’s pumping iron heart, but at times a difficult place for younger, smaller companies to get a foothold.

“Most of the large and prospective areas for iron ore are locked up with the majors,” Pantera Minerals chief executive officer Matthew Hansen told Stockhead.

“A number of other iron ore projects are stranded due to their location, with no access to rail, or may not have sufficient scale to support a standalone operation.”

Pantera (proposed ASX:PFE) is a company bucking the trend and will go to IPO with its cornerstone asset the Yampi iron ore project just off the WA coast in the Kimberley, some 150km north of Derby.

The company’s prospectus was recently released, highlighting its plans to list with an immediate focus on Yampi and a suite of prospective mineral plays to follow up on.

In its iron ore project, Pantera has a truly unique proposition for those seeking exposure to the commodity.

“Location, location, location… that’s what sets Yampi apart from other projects,” Hansen said.

“The project is uniquely located, being right on the coast and less than 5km from a potential deep-water port location.”

The region is not exactly untapped – the Buccaneer Archipelago which Yampi’s coastal locale straddles is home to both Mt Gibson Iron’s significant Koolan Island project and Pluton Resources’ Cockatoo Island project.

In the case of Mt Gibson, you’re talking a 30 million tonne iron ore reserve at 64% iron and resources of 68Mt at 63% iron, with 70Mt already mined. Prolific is one way of putting it.

Iron ore is an industry where grade counts for a lot, and the standard measures for fines on the international market are at 58% and 62% respectively. Allowing for greater efficiencies, higher grade material tends to achieve price premiums.

At Yampi, initial grab and rock chip samples have graded up to 68% iron. It’s enough to excite those in the know in the region, who are keen to get the drill rigs turning.

“Pantera has hired ex-Mount Gibson exploration geologist Nick Payne as our head of exploration,” Hansen said.

“Nick had walked our ground when he was at Mount Gibson and always loved it, and was extremely excited to join us with a view to getting a rig out to Yampi.”

First thing on the agenda once listed is the execution of a five-hole drill program at the project. A custom-built rig by local contractor Harrington Drilling has been designed to carry out the job.

Hansen said he expected the region’s majors to be keeping a close eye on the results of early drilling.

“If we have success at Yampi this year, what does that mean for a company like Pantera with an EV of $6.3 million at IPO?” he said.

“It would only be natural that our neighbours and some much larger companies would be watching what’s happening at Yampi very closely.”

Ace in a compelling deck

Pantera may be listing with an iron ore project as its immediate priority, but it is far from a one-trick pony when it comes to exploration plays.

Among the projects on its books are the Yampi copper project, just 8km southeast of its namesake iron ore project, as well as the Weelaranna manganese project, and the Frederick polymetallic project which tested for high grades of lead-zinc.

The Yampi copper project hosts a large iron ore-copper-gold-looking electromagnetic target – a fascinating proposition with such strong long-term forecasts for the red metal.

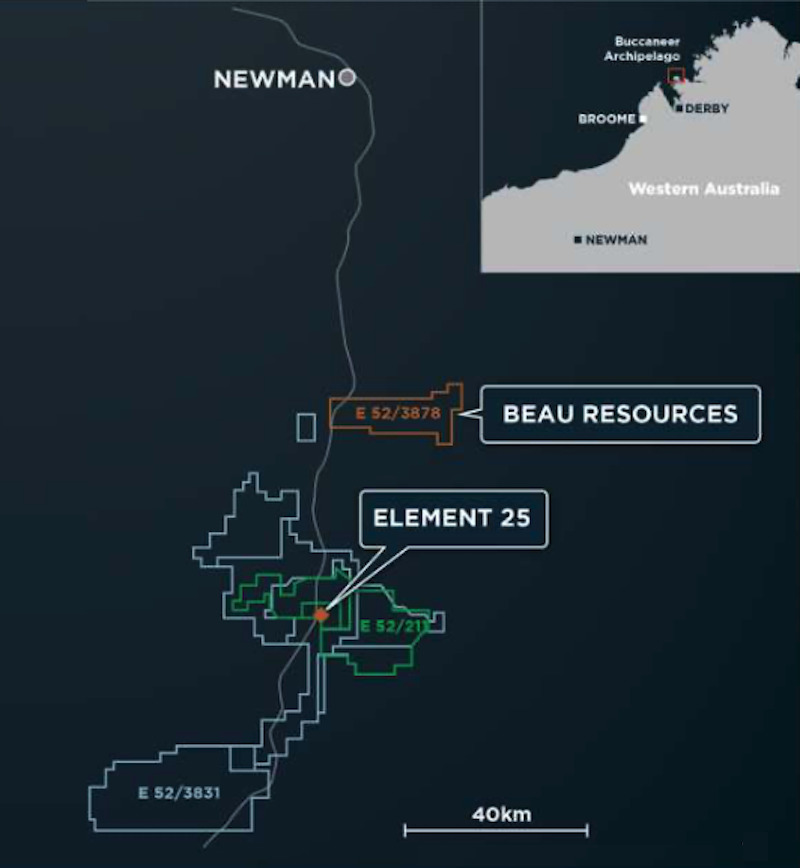

At Weelaranna, Pantera holds a manganese project to the north of Element 25’s (ASX:E25) Butcherbird project (+260Mt of manganese ore in measured, indicated and inferred JORC resources) where x-ray fluorescence results of grab samples have averaged 37% and gone as high as 42% manganese.

Frederick sits around 170km west-northwest of Galena Mining’s Abra project, which is poised to be a high-grade lead producer.

Rock chip sampling here has tested for high grades of lead/zinc – recording 1.7% lead, 1.03% zinc, 13 grams per tonne silver and 0.17% copper.

Hansen said the projects in combination presented an exciting proposition for potential shareholders in the company.

“All of the projects on the Pantera books are highly prospective and we are extremely excited to get out and start exploring them,” he said.

All of Pantera’s projects are located in WA’s north, the state’s mineral heartland, and their positioning means the company will be able to carry out year-round exploration activity.

The region has seen its fair share of controversy in recent years relating to Native Title and the protection of significant sites, with the most obvious the Juukan Gorge disaster which eventually caused serious turnover at the top of Rio Tinto.

Potentially a first for an Australian iron ore company is Hansen’s heritage. He’s a proud Noongar man with a background working for a number of mining majors before moving into the legal field as an advisor to mining companies.

Yampi sits within the Native Title of the Dambimangari People, and Hansen said the Pantera team would be extremely inclusive and focused on culture.

“As a Noongar man running Pantera, it’s in our DNA to engage the Traditional Owners of all our projects to work together,” he said.

“Our aim is to build mutually beneficial relationships based on honest engagement.”

This article was developed in collaboration with Pantera Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.