R8R gears up for busy year with Cobar Basin critical minerals exposure

Regener8 Resources plans to get boots on the ground at its East Ponton project this current quarter. Pic: Getty Images

- R8R snaps up a new tenement in one of Australia’s exploration hotspots

- The tenement abuts market darling AGC and their Achilles discovery

- R8R hopes to get boots on the ground at East Ponton this quarter

Special Report: NSW’s Cobar Basin has long been considered one of Australia’s major copper producing regions, dotted with operations such as the CSA copper mine with a history stretching as far back as the 1870s.

Now run by Metals Acquisition Corporation (ASX:MAC) – one of the most notable IPOs of the year so far following an oversubscribed $325m raise – the CSA copper mine is regarded as the highest-grade operating copper mine outside the Democratic Republic of the Congo (DRC), backed by 314,000t of copper reserves within 7.9Mt of ore at a grade of 4%.

But it’s not just copper that the Cobar Basin is known for. The region is host to high-grade precious and base metals described by geologists in the field as ‘Cobar-style’ deposits, characterised by plunging ‘pipelike’ geometry with short strike-lengths and persistent depth extent.

Small cap junior plays such as Australian Gold & Copper (ASX:AGC) have recently put the region – and its 150 year mining history – back on the map for investors, with drilling results including 5m at 16.9 g/t gold, 1,667 silver, 0.4% copper and 15% lead-zinc from 112m unearthing the ‘Achilles’ discovery.

While those gold results are impressive on their own, the silver grades add another value driver with AGC being the first company to come across this type of mineralisation in the southern part of the Cobar Basin.

R8R enters the Cobar Basin

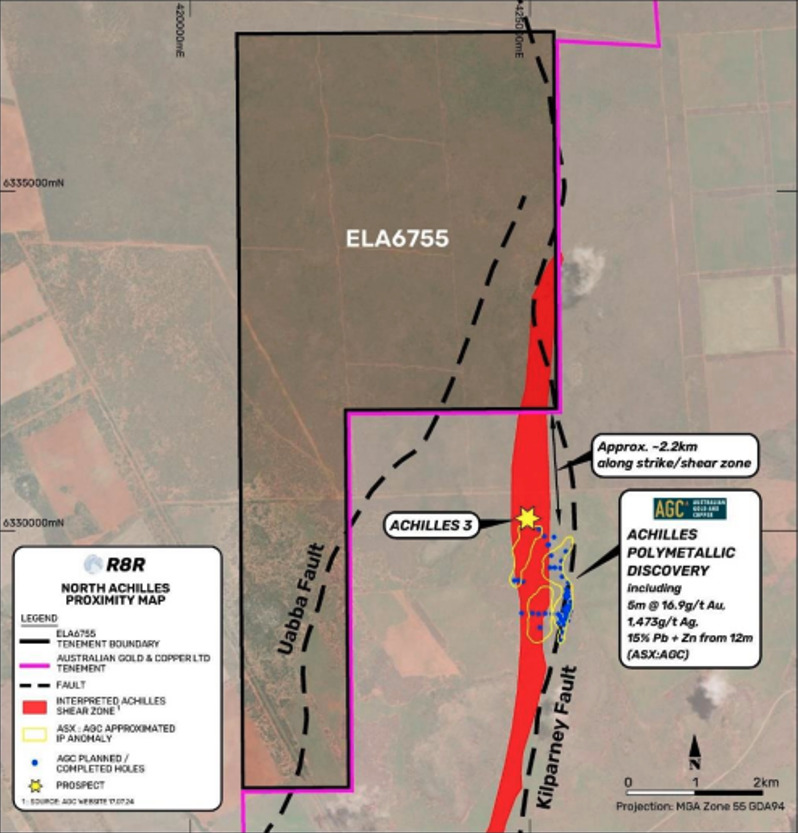

But other explorers have also recently swept into the area with one of the most recent, Regener8 Resources (ASX:R8R), announcing its acquisition of a tenement earlier this week immediately adjacent and abutting AGC whose Achilles discovery is only ~2km to the south along strike.

The Achilles prospect is hosted in the Achilles Shear within the Rast Trough of the southern Cobar Basin.

Its potential for polymetallic, Cobar-style mineralisation was first identified by Santa Fe Mining in the late 1990s; the Achilles Shear is a 15 km long structure which controls the distribution of the central Cobar district polymetallic deposits.

Exploration by various companies defined three main prospects areas – Achilles, 1, 2 and 3 with AGC exploring the Achilles 3 prospect area since listing on the ASX in 2021.

In an interview with Stockhead, R8R managing director Stephen Foley said the explorer hopes to replicate the success of AGC and follow a similar process to discovery.

“We think this is a fantastic opportunity in a great location, it’s essentially a greenfields exploration site because no previous work has been undertaken on this tenement in the past,” Foley said.

“From information available, we can see interpretations of the Achilles trend going into our tenement, appearing to continue to the north from AGC’s discovery into our ground.

The company plans to prepare a staged and systematic exploration strategy incorporating learnings from AGC and others in the area.

“The Achilles discovery by AGC is exciting with outstanding gold, silver, lead and zinc results,” Foley said.

“Ongoing exploration from AGC and Strategic Energy Resources – another explorer nearby – indicates the potential for discoveries in the area has just begun to be realised.”

Not just a one trick pony

While the North Achilles project tenement boasts exciting potential in one of the country’s exploration hotspots, R8R’s project portfolio is one filled with optionality and diversity.

The company’s East Ponton project along the Trans Australia railway line is a multi-commodity play on a large-scale package in WA’s Eastern Goldfields region.

It comprises the historical Grasshopper and Seven Sisters prospects, which sit a mere 40km south-east of known rare-earth bearing carbonatites such as the Cundeelee Intrusion.

“What attracted us was the proximity the project has to carbonatite and rare earth potential, including the Cundeelee Intrustion which BHP previously described as the largest, untested carbonatite in the world,” Foley said.

“Just nearby to that is the Ponton Dyke, another intrusion that has had some of the highest rare-earth intercepts ever found in Australia, previously held by Galaxy Metals.

“We’re talking results upwards of 14% TREO over 16m intersections, but both of those discoveries – Cundeelee and Ponton Dyke – sit within a Class A nature reserve, essentially ruling out exploration or development.

“The good thing for us is that we have very similar geophysics characteristics to what they have displayed and we are sitting outside the nature reserve, plus we’ve got anomalous rare earth assays from historical drilling by Anglo Gold that weren’t follow up on.

“We are really looking forward to getting boots on the ground there and testing them but also taking a closer look at some of the interesting things we have found during the due diligence process on the nickel and cobalt side of things.”

Work in the pipeline

During further diligence, the explorer found historical drilling results carried out on R8R’s Hatlifter prospect which encountered 3m at 1.3% nickel and 0.6% cobalt, showcasing the potential for paleochannel hosted settings similar to Deep Yellow’s (ASX:DYL) Mulga Rock, 80km to the north.

“What’s really exciting about that, is it was only a 3m composite that was undertaken with those grades and while another 17m of that unit was recorded in the geological logs, they were never sampled or tested above the 3m composite,” Foley said.

“Each step out hole either side where that 3m composite was found also encountered the same unit again, which is suggesting to us there’s some pretty interesting things happening there in the Paleo channel setting.

“We’re seeing a lot of similarities to Deep Yellow’s Mulga-Rock geological model, which means the potential for thick, shallow and high-grade nickel, cobalt and base metal enrichment throughout the paleo channels and that could potentially lead to a significant resource.”

R8R is currently working through the heritage aspects and survey requirements with the intention to get out there as soon as possible to test the Hatlifter nickel-cobalt targets as well as the Grasshopper rare earth targets.

Foley said the company is aiming to get boots on the ground this current quarter.

This article was developed in collaboration with Regener8 Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.