QX Resources is going to drill a lithium brine project twice the size of Sydney harbour

The 1,000m program is expected to commence shortly. Pic: via Getty Images.

- QXR is going to drill an initial two diamond holes at its new Liberty Lithium brine project in the coming days

- The company is earning up to 75% of the large 102km2 project in the USA

- Drilling is targeting the potential for lithium brines at depth

- Samples will be sent to direct lithium extraction providers for testwork

QX Resources is gearing up to commence a 1,000m drilling program at the Liberty Lithium brine project in California, USA in the coming days.

The company recently inked a deal to earn-in 75% of the 102sqkm project, which is one of the largest single lithium brine projects in the US. Its stature is equivalent to roughly twice the size of the Sydney Harbour.

Notably, Liberty has a geological setting which mirrors Albemarle’s nearby producing Silver Peak lithium brine deposit in Clayton Valley and major Argentinian brine projects.

It hosts an extensive lithium brine surface anomaly with elevated results up to 215mg/Li extending over 10km, according to QX Resources management.

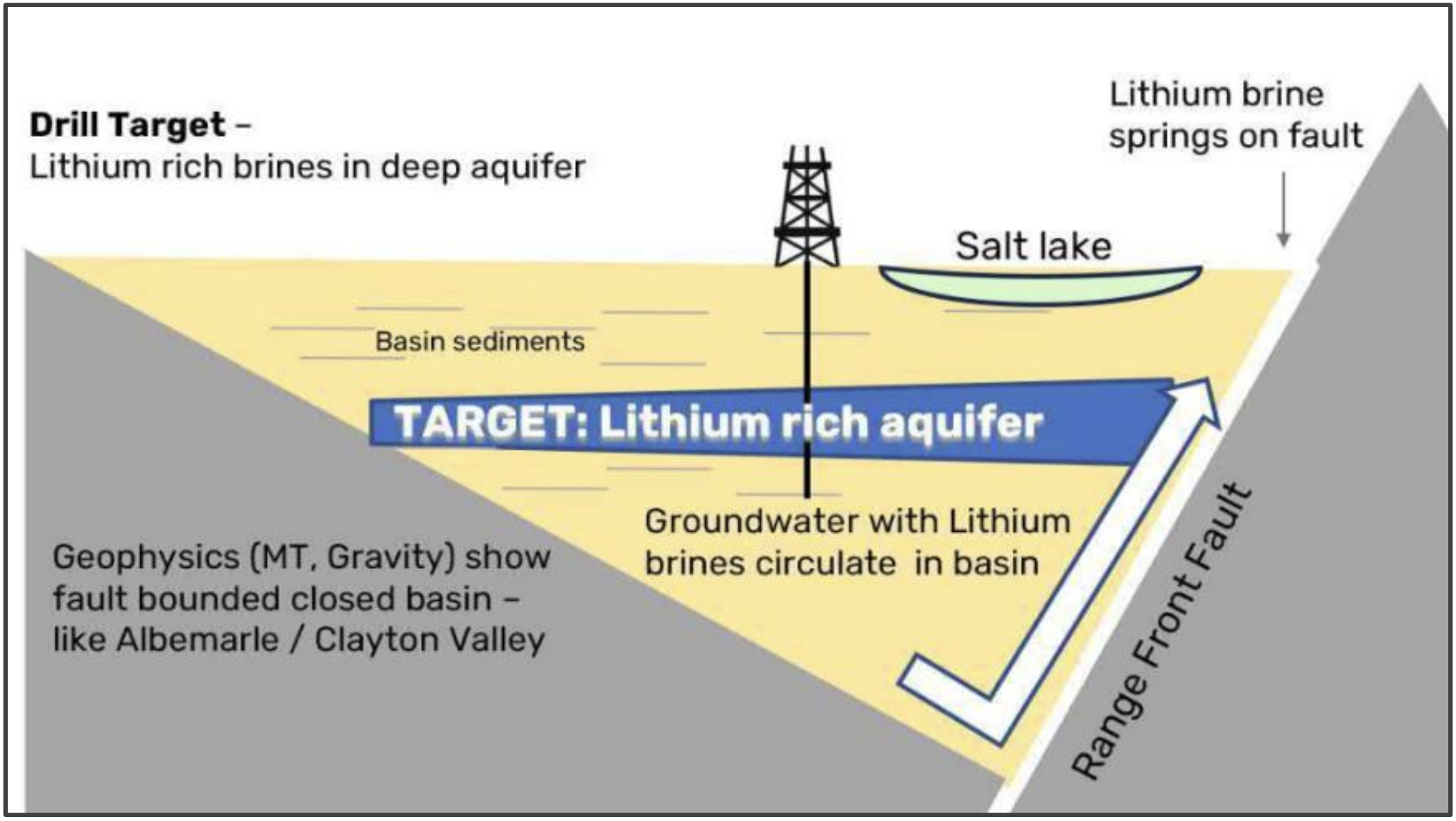

Geophysical analysis suggests there are brine aquifer targets at depth in a large basin over 1,000m deep.

The drilling program will test the potential for aquifers at depth hosting lithium bearing brines, which will be submitted for analysis and also test work with various direct lithium extraction (DLE) providers.

“This is potentially a new large-scale lithium brine project – in the heartland of a rapidly growing battery supply chain in the USA,” says QX Resources (ASX:QXR) MD Steve Promnitz, who previously grew Lake Resources (ASX:LKE) from a $9.5m brines explorer into an advanced project developer with a $256m market cap today.

“Participants in the USA are aggressively seeking to secure domestic battery minerals supply to balance potential supply side risks to the energy transition.”

How do lithium brines differ to other deposits?

Promnitz recently sat down with Stockhead’s Sarah Hughan to explain the difference between brines and hard rock lithium deposits, how they are extracted, and why the battery makers are looking to secure their slice of the pie.

Targeting lithium in brines at depth

At Liberty, two large diameter (PQ) deep diamond drillholes (500m each) have been approved.

The targets are centred over an extensive lithium brine surface anomaly over 10km, as well as large geophysical anomalies that indicate conductive brine aquifer targets in a deep closed basin.

Promnitz said the targets have been modelled from geochemistry, geophysics and the geological setting, based on past successes.

“End-users, DLE technology providers, project developers and battery makers have intimated interest in participating with us once we identify lithium brines in drillholes,” he said.

“The project is located near to long life salt evaporation operations, and is well-serviced by roads and power in an industrial region keen to be part of the energy transition.”

Earning up to 75% in Liberty Lithium

Once samples have been submitted for test work, the explorer will make staged option payments to vendor IGL totalling US$2 million over the next 27 months to earn 75% of the project and sole fund activities through to the Definitive Feasibility Study (DFS) stage.

Drilling is planned to assess the project before the bulk of the payments are due.

QXR is cashed up for exploration following a $3.5m placement to professional and sophisticated investors.

Promnitz pointed out that despite the capital markets being tight at present, investors taking part in the raising included a US-based operator in the battery supply chain, underscoring the anticipation surrounding Liberty Lithium.

Directors in the company have also emphasised their faith in Liberty Lithium by committing to subscribe for $128,700 worth of shares under the placement subject to shareholder approval.

This article was developed in collaboration with QX Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.