QX Resources dives into uranium with Tanzanian project

QX Resources is embarking on a new adventure with the move to acquire the Madaba uranium project. Pic: Getty Images

- QX Resources acquires 613km2 Madaba uranium project in Tanzania

- Madaba appears to be an analogue of the 125Mlbs Nyota uranium deposit

- Madaba has more than a dozen high-priority, near-surface targets

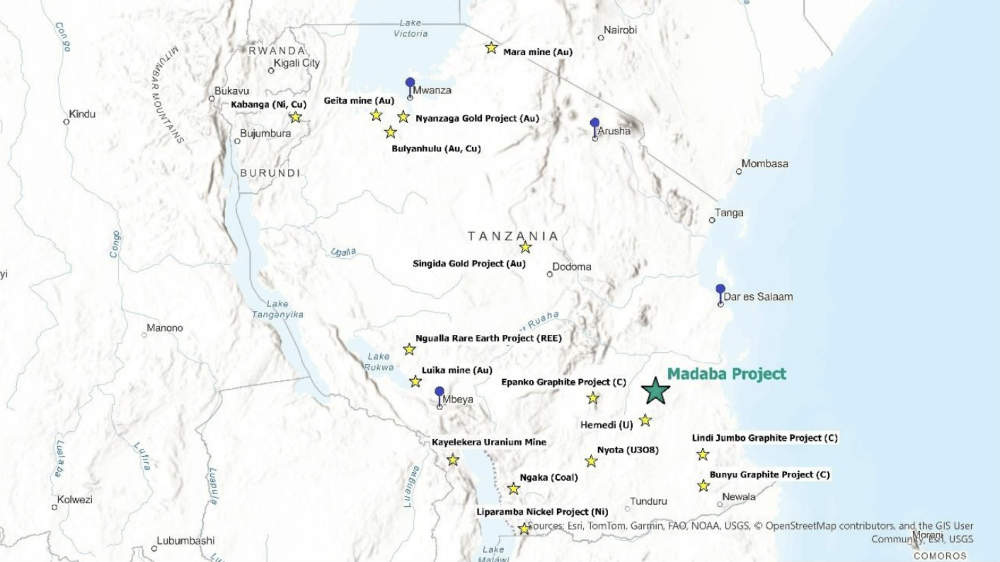

Special Report: QX Resources is expanding its horizons on signing binding agreements to acquire the Madaba uranium project in the highly prospective Luwegu Basin of southern Tanzania.

The 613km2 project is ~250km southwest of Dar es Salaam and is believed to host a geological deposit analogous to the world-class Nyota uranium deposit that contains 125Mlbs U3O8 about 300km to the southwest.

It was first discovered in 1979-82 by Germany’s Uranerzbergbau, which followed up on several strong airborne anomalies with geological mapping, ground radiometrics, trenching, sampling and reconnaissance drilling.

This historical drilling returned numerous standout results including 3m grading 1082ppm U3O8 from a down-hole depth of 8m, 7m at 890ppm U3O8 from 30m and 7m at 693ppm U3O8 from 9m.

QX Resources (ASX:QXR) notes the historical results indicate significant potential for the stacking and coalescing of individual uranium seams to form substantial targets for detailed follow-up drilling.

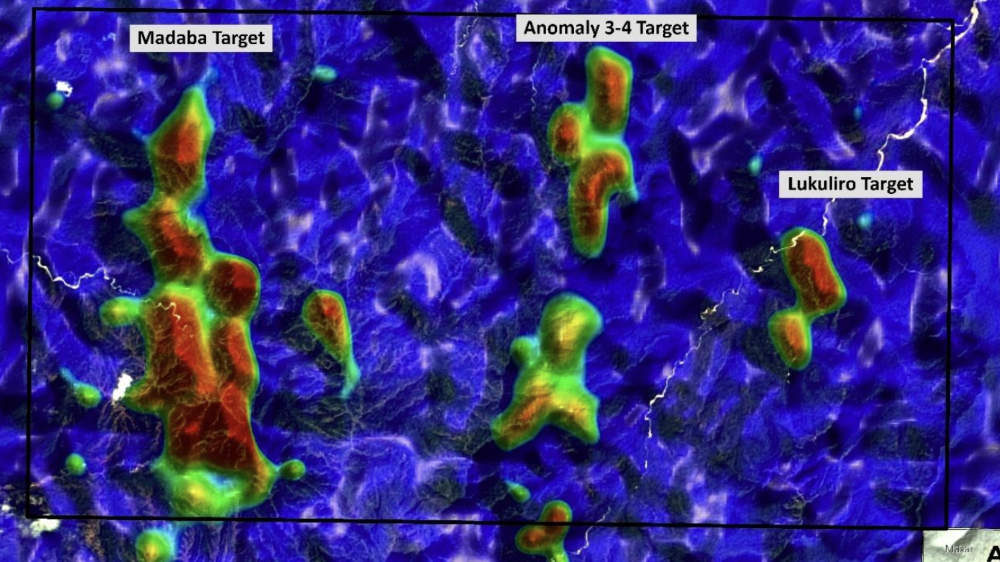

Madaba contains more than a dozen high-priority targets delineated through radiometrics or sporadic drilling and trenching.

In conjunction with the acquisition, the company has also appointed former Mantra Resources general manager project development Russell Bradford as a non-executive director to boost its African and uranium expertise.

Mantra, which was acquired by Uranium One in 2011 as part of a $1.2Bn transaction, owned the Nyota project that is now the subject of a development collaboration between the Tanzanian Government and Russia’s Rosatom.

Bradford is a metallurgist with more than 35 years of project management and operational experience in the mining sector.

This includes more than 20 years in executive operational roles within Africa, North America and Australia.

He has extensive, hands-on experience at an executive level in operations and project development for top-tier miners such as Anglo American, LionOre, Mantra Resources and Asanko Gold.

This experience extends from grassroots to advanced exploration and the development of projects across a wide range of commodities and countries.

Madaba project

Madaba is an Upper Karoo sandstone type uranium prospect of early Jurassic age.

Uranium mineralisation is hosted in the lower parts of the Hanging Wall Series and the upper 60m of the Coloured Series within the Madaba Formation.

The mineralised channel sandstone units’ outcrop in numerous localities and the gentle dips mean that the mineralised layers remain at shallow depths for several hundred metres.

Surface uranium is strongly oxidised and has been remobilised by rainwater vertically and laterally forming high-grade secondary uranium deposits within the top 5m or so of weathered rock. These represent an immediate target for shallow auger drilling.

The mineralised channel sands represent at least 16 targets for shallow aircore drilling to define near-surface uranium resources.

Notable targets include Anza at Madaba South where work returned grades of up to 1.2% U3O8 that indicates near-surface mineralisation and the Uno target at Madaba South where trenching returned up to 0.87% U3O8.

“The acquisition of the Madaba uranium project is a fantastic outcome for QXR shareholders,” executive chairman Maurice Feilich said.

“We believe the project has the potential to be analogous to the world-class Nyota uranium deposit, which contains a resource of 125Mlbs contained U3O8 at a grade of 300ppm U3O8.

“With the appointment of Russell Bradford to the board, we believe we have the skills and expertise to quickly move the project forward.

“It is great to see the recent joint announcement by the government of the Republic of Tanzania and Russia’s Rosatom in relation to the construction of a $400 million uranium processing plant at the Nyota Project, with plans to produce up to 3,000 tonnes of yellowcake annually.”

Capital raising and future plans

To help fund development of Madaba and ongoing exploration at its other projects, QXR has received firm commitments from new and existing sophisticated and professional investors for a $1.5m placement.

This is priced at 0.4c, a 4% discount to the 15-day volume weighted average price. It includes one free-attaching option exercisable at 1c and expiring on December 23, 2027, for every two shares subscribed for.

While the bulk of the placement will be conducted under ASX Listing Rules 7.1 and 7.1A, shareholder approval will be sought for the $200,000 worth of shares that will be placed with company directors.

Looking ahead, QXR intends to carry out a series of low-cost exploration programs to refine initial drill targets at Madaba.

This includes field reconnaissance such as mapping, rock-chip sampling and radiometric surveying.

It will also carry out infill airborne/ground-based detailed radiometric surveys along with confirmatory trenching, auger and aircore – or reverse circulation drilling.

This article was developed in collaboration with QX Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.