Queensland cash boost to accelerate Ark Mines’ Sandy Mitchell REE project development

Ark Mines has received a $4.5m investment from the Queensland Government’s critical minerals fund. Pic: Getty Images

- Queensland Government invests $4.5m in Ark Mines to accelerate Sandy Mitchell development

- Funds will help fund Phase 3 drilling and metallurgical testwork

- Work will feed into pre-feasibility study that is due in early 2026

Special Report: The potential of Ark Mines’ Sandy Mitchell rare earths and heavy mineral sands project to strengthen critical mineral supply chains has been recognised with a $4.5m investment from the Queensland Government.

The funds were provided by the QIC Critical Minerals and Battery Technology Fund (QCMBTF), which is intended to support businesses across the critical minerals supply chain in Queensland.

It is managed by state government-owned corporation QIC which has $131.2bn in funds under management.

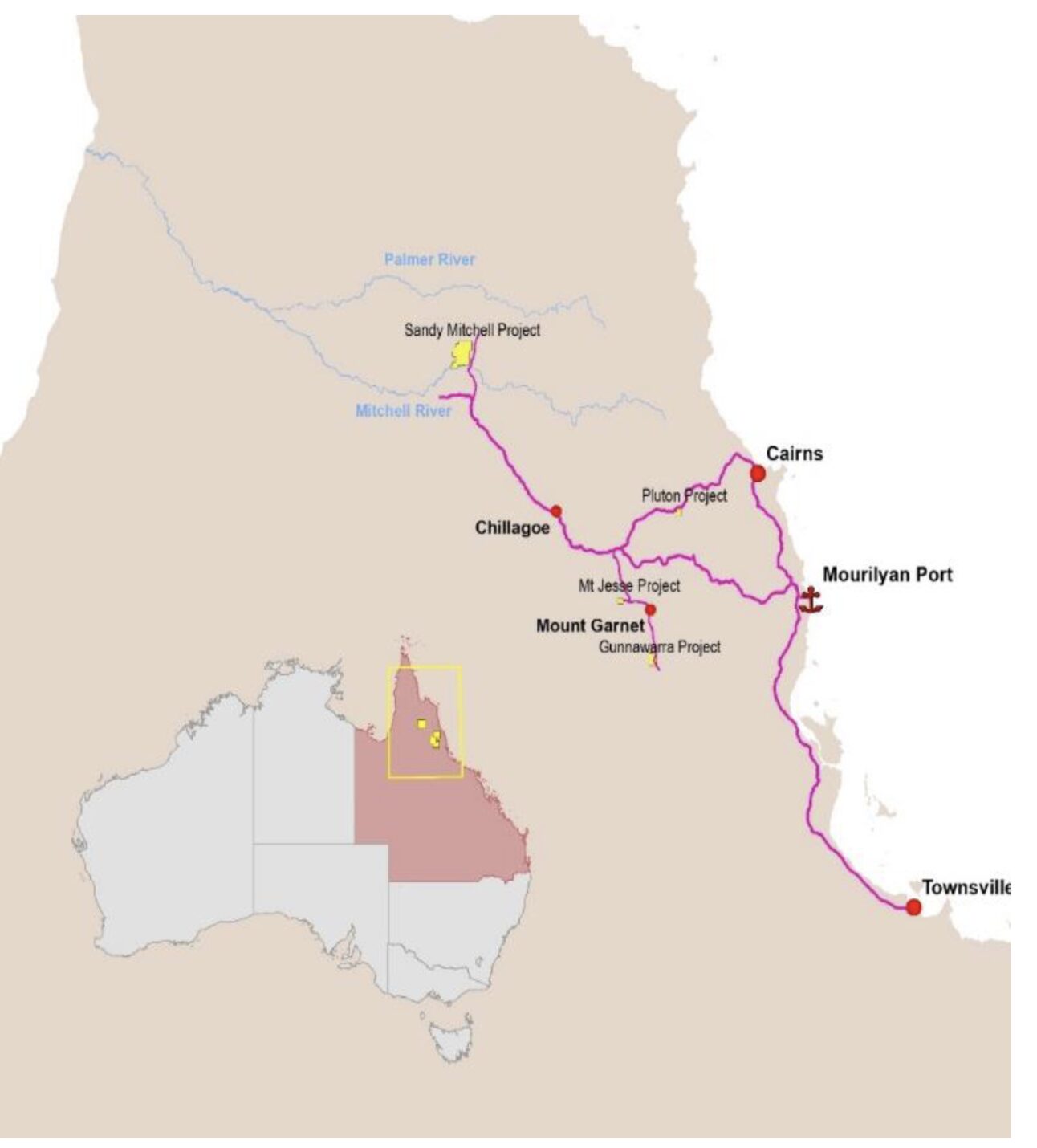

Ark Mines (ASX:AHK) will use the funds, which comprises $4m in upfront funding tied to royalties based on future product sales from Sandy Mitchell and a $500,000 equity investment, to accelerate development at its Sandy Mitchell project about 230km northwest of Cairns.

This follows a collaborative due diligence process between the parties and reflects the Queensland Government’s commitment to providing support for Queensland-based resources projects which meet strict criteria for government investment.

The funding is in line with the Queensland Government’s strategy to strengthen domestic supply chains for critical minerals, with expectations for ~80 local jobs to be created when production at Sandy Mitchell commences.

“We are pleased to announce this funding agreement with the QCMBTF, which follows an extensive period of engagement with the fund and marks a significant step forward in our strategy to develop Sandy Mitchell through to production,” AHK managing director Ben Emery said.

“With a busy works program scheduled for the second half of 2025, this investment provides Ark with an effective non-dilutive source of funding to accelerate development.

“Strategically, it also delivers long-term alignment with the state government’s policy objective to position the North Queensland region as a key supplier of the critical minerals used in global clean energy supply chains.”

QIC senior investment director Jonathan Crombie said the project has the potential to be a strategically significant, long-life asset producing essential rare earth elements outside of Asia.

Securing sustainable supplies of REEs is a strategic priority for governments and industries globally due to the accelerating transition to net zero – this is especially urgent due to recent export restrictions.

“Projects like Sandy Mitchell represent a strategic opportunity for Australia, and particularly Queensland, to help rebalance global supply chains and secure long-term economic, environmental and geopolitical advantages,” Crombie added.

Watch: Ark Mines puts pen to paper for drilling campaign

Sandy Mitchell project

The Sandy Mitchell project has a high confidence measured resource of 71.8Mt at 1732.7ppm monazite – a mineral containing REEs – equivalent.

There is potential for exploration to deliver scale that could place it in a similar ballpark as Red Metal’s (ASX:RDM) Sybella project in northwest Queensland, given the exploration target of 1.3 billion-1.5 billion tonnes at 1,286-1,903ppm MzEq.

A scoping study released in December has placed a $120-150m cost on a development underpinned by the current measured resource.

This is expected to generate annual EBITDA of $45m-$53m and annual post-tax-free cash flow totalling ~$25m-30m while payback is expected within 3-4 years from first rare earth mineral concentrate production.

It benefits from having near-surface mineralisation which Emery said would enable the project to be quickly developed.

“Most of the processing has already been done by mother nature, so to produce a monazite concentrate, simple low-cost gravity separation is all that is required, reducing our environmental footprint,” he added.

AHK is already fully funded to advance its near-term works program over the remainder of CY2025.

This will be led by the start of Stage 3 infill drilling with the company targeting a significant increase to the existing measured resource.

A detailed metallurgical testing program to improve both the beneficiation process and mineral separation process for rare earths and heavy minerals at Sandy Mitchell will also be carried out.

This work will be incorporated into a comprehensive pre-feasibility study scheduled for early 2026 that is expected to deliver significantly improved economics across all key project metrics.

This article was developed in collaboration with Ark Mines, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.