Queen Alexandra to pay golden dividends for Redcastle Resources

Queen Alexandra could deliver early cashflow of up to $15m from gold production for Redcastle. Pic: Getty Images

- Redcastle’s Queen Alexandra project targets 13,700oz gold production to generate $65.6m revenue over 10 months

- Total funding requirement estimated at $21-22m with pre-tax cash flow of $14-15m

- Scoping study highlights potential for further expansion that will add another 1700oz

Special Report: Redcastle Resources has pulled the covers off an independent scoping study that highlights the potential of its Queen Alexandra gold project in WA’s Eastern Goldfields to deliver strong returns.

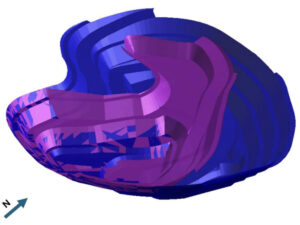

The study found that at current commodity prices, a two stage open pit development would be able to produce 13,700oz of gold by processing 181,000t of ore at an average head grade of 2.56g/t over a 10 month period.

Using a gold price of $4800/oz, this is expected to generate revenue of $65.6m and undiscounted pre-tax cash flow of between $14m and $15m.

Total funding costs for Redcastle Resources (ASX:RC1) are estimated at $21-22m with pre-mining capital and start-up costs of about $6m.

“2025 remains a breakout year for Redcastle. The release of our initial scoping study for Queen Alexandra (QA) further reinforces this significance,” non-executive chairman Raymond Shaw said.

“This opportunity is supported by modest capital requirements and compelling economics at current gold prices.

“With strong grades, straightforward metallurgy, and close proximity to existing processing infrastructure, the low-risk development outlined for the initial shallow pit design confirms the potential for near-term production.”

Scoping study

The scoping study found that about 73,000t of higher grade material (3.83g/t gold) would be available for milling at the end of the fifth month, which exceeds the assumed minimum parcel size of 50,000t for toll treatment.

This will produce about 8300oz of gold, which is a little less than two thirds of the overall production target of 13,700oz.

RC1 also has a great deal of confidence in meeting these numbers as a hefty 91% of the production target comes out of Queen Alexandra’s indicated resources with only 9% drawn from inferred resources.

There is also potential for further upside by carrying out a third stage pit expansion to a depth of about 70m, which will allow access to a further 1700oz of gold depending on the gold price, final pit design and successful application of grade control procedures.

Additional work will be required to expand the pit or consider underground mining opportunities to access the deeper Kestrel, Hawk and Eagle lodes which have high grade intersections and visible gold.

The company add the study found that Queen Alexandra has a breakeven price of ~$3700/oz and that every $100 increase in the gold price above $4800/oz results in extra revenue of about $1.4m.

Queen Alexandra currently has an indicated resource of 167,000t grading 2.9g/t, or 16,000oz of contained gold, and an inferred resource of 98,000t at 4.1g/t, or 13,000oz of contained gold.

Next steps

RC1 has begun discussions and is evaluating options for a toll milling agreement whilst also assessing a Joint Venture proposal relating to production and milling operations.

The company is actively planning a Phase 2 scoping study that will investigate the concurrent mining of the nearby Redcastle Reef project, which has an indicated resource of 146,000t at 1.9g/t, or 9000oz of contained gold.

It will also carry out all essential geotechnical and sterilisation drilling later in 2025 along with hydrology and ground water studies.

Additionally, work will be carried out on final pit design, , equipment optimisation and site layout.

Looking further ahead, the company will define an ore reserve, complete a feasibility study and finalise environmental studies.

This will enable the compilation and submission of a mining plan during the first half of 2026.

This article was developed in collaboration with Redcastle Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.